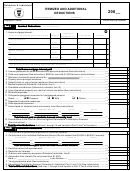

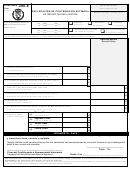

Form 482.0 R - Individual Income Tax Return - 2001 Page 15

ADVERTISEMENT

Part III

Special Partnerships Profits

40

Total Profits

Part IV

Profits from Subchapter N Corporations of Individuals

Total Profits

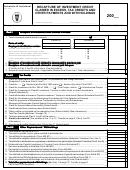

Part V

Miscellaneous Income

Column A

Column B

Column C

Column D

Tax on IRA distributions of income from sources within Puerto Rico

Tax Withheld

Option

Total miscellaneous income

NOTE: If you elected to include the IRA distributions of income from sources within Puerto Rico as ordinary income, do no consider line 3

and enter on line 6 the sum of lines 2 and 5. Transfer the total of line 6 to Part 2, line 2G of the return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28