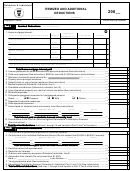

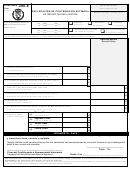

Form 482.0 R - Individual Income Tax Return - 2001 Page 4

ADVERTISEMENT

Social Security Number

Taxpayer's name

Part I

Part I

Recapture of Investment Credit Claimed in Excess

Recapture of Investment Credit Claimed in Excess

Part I

Part I

Part I

Recapture of Investment Credit Claimed in Excess

Recapture of Investment Credit Claimed in Excess

Recapture of Investment Credit Claimed in Excess

1.

Total investment credit claimed in excess ...............................................................................................

20

20

20

20

20

(01)

Column A

Column B

Name of entity:

Name of entity:

Name of entity:

Name of entity:

Name of entity:

Employer's identification number:

Employer's identification number:

Employer's identification number:

Employer's identification number:

Employer's identification number:

(02)

(03)

G

G

(04)

(05)

1

1

G

G

2

2

G

G

3

3

G

G

4

4

G

G

5

5

2.

Recapture of investment credit claimed in excess paid in previous year

Recapture of investment credit claimed in excess paid in previous year

Recapture of investment credit claimed in excess paid in previous year ....................................

Recapture of investment credit claimed in excess paid in previous year

Recapture of investment credit claimed in excess paid in previous year

(07)

3.

Recapture of investment credit claimed in excess paid this year

Recapture of investment credit claimed in excess paid this year

Recapture of investment credit claimed in excess paid this year

Recapture of investment credit claimed in excess paid this year

Recapture of investment credit claimed in excess paid this year

(Transfer to Part 4, line 24 of the return. See instructions) ....................................................................

(08)

4.

Excess of credit due to next year, if applicable (Subtract line 3 from line 1. See instructions) ...............

(10)

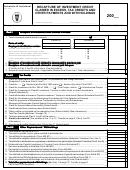

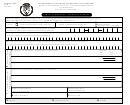

Part II

Part II

Part II

Tax Credits

Tax Credits

Tax Credits

Part II

Part II

Tax Credits

Tax Credits

(Do not include estimated tax payments. Include such payments in Part III of this Schedule)

1.

(11)

G

G

2.

(13)

G

G

3.

(15)

4.

(16)

5.

(17)

6.

(18)

7.

(19)

8.

(20)

9.

(21)

10.

(22)

11.

(23)

12.

(24)

13.

(25)

14.

(30)

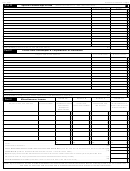

Part III

Part III

Part III

Other Payments and Withholdings

Other Payments and Withholdings

Other Payments and Withholdings

Part III

Part III

Other Payments and Withholdings

Other Payments and Withholdings

1.

Estimated tax payments for 2001 ..........................................................................................................

(31)

2.

Tax paid in excess in prior years credited to estimated tax ...................................................................

(32)

3.

Tax withheld to nonresidents (Form 480.6C) ........................................................................................

(33)

4.

Tax withheld on eligible interest and interest from financial institutions (Schedule F Individual, Part I, line 7) ....

(34)

5.

Tax withheld on dividends from corporations or distributions from partnerships (Schedule F Individual, Part II, line 3A)

(35)

6.

Dividends from Capital Investment or Tourism Funds (Submit Schedule Q1) .......................................

(36)

7.

Services rendered by individuals (Form 480.6B) ...................................................................................

(37)

8.

Payments for judicial or extrajudicial indemnification (Form 480.6B).....................................................

(38)

9.

Tax withheld on distributable share of net profits to stockholders of corporations of individuals (Form 480.6CI)

(39)

10.

Tax withheld on distributable share of net profits to partners of special partnerships (Form 480.6 SE) ......

(40)

11.

Tax withheld on IRA distributions of income from sources within Puerto Rico (Form 480.7) ......................

(41)

12.

Other payments and withholdings not included on the preceding lines (Submit detail) .........................

(42)

13.

Total other payments and withholdings

Total other payments and withholdings

Total other payments and withholdings

Total other payments and withholdings

Total other payments and withholdings (Add lines 1 through 12. Transfer to page 2,

Part 4, line 27C of the return) .........................................................................................................................

(50)

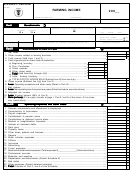

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28