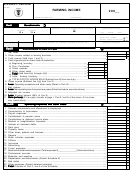

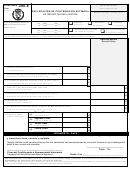

Form 482.0 R - Individual Income Tax Return - 2001 Page 5

ADVERTISEMENT

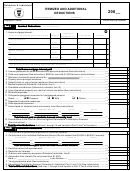

Schedule A 1 Individual

DEPENDENTS AND BENEFICIARIES

Rev. 05.01

200__

OF EDUCATIONAL CONTRIBUTION

ACCOUNTS

Taxable year beginning on ____________ , _____ and ending on ___________ , _____

Taxpayer’s name

Social Security Number

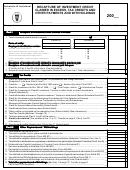

Part I

Part I

Part I

Dependents Information

Dependents Information

Dependents Information

Part I

Part I

Dependents Information

Dependents Information

(See instructions)

55

55

55

55

55

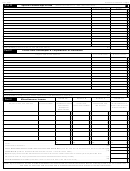

First Name, Initial

Last Name

Second Last Name

Date of Birth

Category

Social Security Number

Head of

Head of

Head of

Head of

Head of

Relationship

(01)

J J J J J

Household

Household

Household

Household

Household

NOT THE

NOT THE

NOT THE

NOT THE

NOT THE

TAXPAYER / NOT THE

TAXPAYER / NOT THE

TAXPAYER / NOT THE

TAXPAYER / NOT THE

TAXPAYER / NOT THE

SPOUSE

SPOUSE

SPOUSE

SPOUSE

SPOUSE

First Name, Initial

Date of Birth

Relationship

(N) (U) (I)

(N) (U) (I)

(N) (U) (I)

Social Security Number

Last

Second Last

Category

(N) (U) (I)

(N) (U) (I)

Name

Name

Day / Month / Year

See instructions

(02)

(03)

(04)

(05)

(06)

(07)

(08)

(09)

(10)

IMPORTANT INFORMATION PART I

IMPORTANT INFORMATION PART I

IMPORTANT INFORMATION PART I

IMPORTANT INFORMATION PART I

IMPORTANT INFORMATION PART I

,

Do not include the spouse in this schedule

Do not include the spouse in this schedule

Do not include the spouse in this schedule

Do not include the spouse in this schedule

Do not include the spouse in this schedule. A married individual who lives with his spouse is not a head of household

A married individual who lives with his spouse is not a head of household

A married individual who lives with his spouse is not a head of household

A married individual who lives with his spouse is not a head of household

A married individual who lives with his spouse is not a head of household

for tax purposes, therefore, you should not include the wife’s name on the box for head of household (line 01).

for tax purposes, therefore, you should not include the

for tax purposes, therefore, you should not include the

name on the box for head of household (line 01).

name on the box for head of household (line 01).

name on the box for head of household (line 01).

for tax purposes, therefore, you should not include the

for tax purposes, therefore, you should not include the

name on the box for head of household (line 01).

,

If a dependent entitles you the head of household filing status, do not claim him/her as a dependent

If a dependent entitles you the head of household filing status, do not claim him/her as a dependent

If a dependent entitles you the head of household filing status, do not claim him/her as a dependent.

If a dependent entitles you the head of household filing status, do not claim him/her as a dependent

If a dependent entitles you the head of household filing status, do not claim him/her as a dependent

,

In order to consider the exemption for dependents you must include this schedule with your return.

In order to consider the exemption for dependents you must include this schedule with your return.

In order to consider the exemption for dependents you must include this schedule with your return.

In order to consider the exemption for dependents you must include this schedule with your return.

In order to consider the exemption for dependents you must include this schedule with your return.

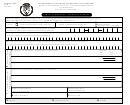

Part II

Part II

Part II

Beneficiaries of Educational Contribution Accounts

Beneficiaries of Educational Contribution Accounts

Beneficiaries of Educational Contribution Accounts

Part II

Part II

Beneficiaries of Educational Contribution Accounts

Beneficiaries of Educational Contribution Accounts

57

57

57

(See instructions)

57

57

Relationship

Contributed Amount

Name, Initial

Last

Second Last

Date of Birth

Social Security

Number

Name

Name

Day / Month / Year

(01)

(02)

(03)

(04)

(05)

Total contributions

Total contributions

Total contributions

Total contributions (Add lines (01) through (05) and transfer to Part 3, line 7H of the Short Form

Total contributions

(10)

or to Schedule A Individual, Part II, line 8 of the Long Form) ....................................................

IMPORTANT INFORMATION PART II

IMPORTANT INFORMATION PART II

IMPORTANT INFORMATION PART II

IMPORTANT INFORMATION PART II

IMPORTANT INFORMATION PART II

,

These beneficiaries must not be considered to determine the exemption for dependents. However, if any of these beneficiaries

These beneficiaries must not be considered to determine the exemption for dependents. However, if any of these beneficiaries

These beneficiaries must not be considered to determine the exemption for dependents. However, if any of these beneficiaries

These beneficiaries must not be considered to determine the exemption for dependents. However, if any of these beneficiaries

These beneficiaries must not be considered to determine the exemption for dependents. However, if any of these beneficiaries

qualifies as your dependent, you must include him/her in Part I of this Schedule.

qualifies as your dependent, you must include him/her in Part I of this Schedule.

qualifies as your dependent, you must include him/her in Part I of this Schedule.

qualifies as your dependent, you must include him/her in Part I of this Schedule.

qualifies as your dependent, you must include him/her in Part I of this Schedule.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28