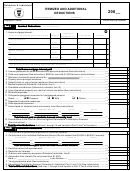

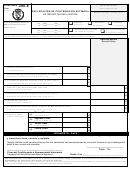

Form 482.0 R - Individual Income Tax Return - 2001 Page 2

ADVERTISEMENT

Form 482.0 - Page 2

Rev. 05.01

Adjusted Gross Income

Adjusted Gross Income

Adjusted Gross Income

Adjusted Gross Income

Adjusted Gross Income (From line 5, page 1) ..........................................................................................................................................

5.

02

02

02

02

02

(01)

6.

STANDARD DEDUCTION:

STANDARD DEDUCTION:

STANDARD DEDUCTION:

STANDARD DEDUCTION:

STANDARD DEDUCTION: If you checked box 1 in Part 1 enter $3,000, box 2 enter $2,000, box 3 enter $2,600, box 4 enter $2,000. If you

checked box 5 and your spouse claimed itemized deductions enter zero. If your spouse did not itemize enter $1,500 ....

(02)

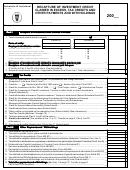

Total itemized deductions (Schedule A Individual, Part I, line 16)......................................................................

7.

(03)

8.

Standard or itemized deductions (Enter the larger of line 6 or 7)...................................................................................................................

(04)

Total additional deductions (Schedule A Individual, Part II, line 9) ...............................................................................................................

9.

(05)

Total deductions (Add lines 8 and 9)..........................................................................................................................................................

10.

(06)

PERSONAL EXEMPTION:

PERSONAL EXEMPTION:

PERSONAL EXEMPTION:

PERSONAL EXEMPTION:

PERSONAL EXEMPTION:

If you checked box 1 enter $3,000, box 2 enter $1,300, box 3 enter $3,000, box 4 enter $1,300, box 5 enter $1,500 ..

11.

(07)

EXEMPTION FOR DEPENDENTS (Complete Schedule A1 Individual, see instructions)

EXEMPTION FOR DEPENDENTS (Complete Schedule A1 Individual, see instructions)

EXEMPTION FOR DEPENDENTS (Complete Schedule A1 Individual, see instructions)

EXEMPTION FOR DEPENDENTS (Complete Schedule A1 Individual, see instructions)

EXEMPTION FOR DEPENDENTS (Complete Schedule A1 Individual, see instructions)

12.

Category (N)

Category (N)

A) Non university: Category (N)

Category (N)

Category (N) ...........................................................

_______x $1,300 ........................

(10)

(11)

B) University student: Category (U)

Category (U)

Category (U)

Category (U)

Category (U) ....................................................

_______x $1,600 ........................

(14)

(15)

C) Disabled, blind or age 65 or older: Category (I)

Category (I)

Category (I)

Category (I) ..............................

_______ x $1,300 .........................

Category (I)

(18)

(19)

(20)

D) Total Exemption for Dependents

Total Exemption for Dependents

Total Exemption for Dependents

Total Exemption for Dependents (Add lines 12A, 12B and 12C)..........................................................................................................

Total Exemption for Dependents

13.

Total Deductions and Exemptions

Total Deductions and Exemptions

Total Deductions and Exemptions (Add lines 10, 11 and 12D).................................................................................................................

Total Deductions and Exemptions

Total Deductions and Exemptions

(21)

14.

NET TAXABLE INCOME

NET TAXABLE INCOME

NET TAXABLE INCOME

NET TAXABLE INCOME (Subtract line 13 from line 5. If line 13 is larger than line 5, enter zero)..............................................................

NET TAXABLE INCOME

(30)

G

G

G

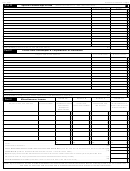

15.

TAX AS PER:

TAX AS PER:

TAX AS PER:

TAX AS PER:

TAX AS PER:

Tax Table

Special tax on capital gains

3 3 3 3 3

Nonresident alien....................

(01)

1 1 1 1 1

2 2 2 2 2

(02)

16.

Gradual Adjustment Amount (Schedule P Individual, line 7).......................................................................................................................

(03)

03

03

03

03

03

17.

Excess of Alternate Basic Tax over Regular Tax (Schedule O Individual, line 6)........................................................................................

(04)

18.

Tax on eligible interest and interest from financial institutions subject to withholding (Schedule F Individual, Part I, line 5A and 5B)...........

(05)

19.

Special tax on corporate dividends and partnerships distributions subject to withholding (Schedule F Individual, Part II, line 2A)............

(06)

20.

Tax on dividends from Capital Investment or Tourism Fund (Submit Schedule Q1)................................................................................

(07)

21.

Tax on IRA distributions of income from sources within Puerto Rico (Schedule F Individual, Part V, line 3D) ...........................................

(08)

22.

Special tax on net income from Film or Infrastructure Projects, and from businesses with tax exemption decree under Act 135 of 1997

(Schedule K Individual, Part II, line 10 or Schedule N Individual, Part II, line 8) ...........................................................................................

(09)

23.

TOTAL TAX DETERMINED

TOTAL TAX DETERMINED

TOTAL TAX DETERMINED

TOTAL TAX DETERMINED (Add lines 15 through 22)............................................................................................................................

TOTAL TAX DETERMINED

(10)

24.

Recapture of investment credit claimed in excess (Schedule B Individual, Part I, line 3)..........................................................................

(11)

25.

Tax credits (Schedule B Individual, Part II, line 13).........................................................................

.....................................

.................

(12)

26.

TAX LIABILITY

TAX LIABILITY

TAX LIABILITY

(Add lines 23 and 24 and subtract line 25. If it is less than zero, enter zero)......................................................................

(13)

TAX LIABILITY

TAX LIABILITY

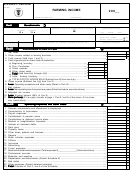

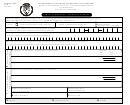

27.

TAX WITHHELD OR PAID:

TAX WITHHELD OR PAID:

TAX WITHHELD OR PAID:

TAX WITHHELD OR PAID:

TAX WITHHELD OR PAID:

(14)

A) Tax withheld on wages (Add lines 1A and 1C of Part 2)................................................................................

B) Tax withheld on annuities and pensions (Schedule H Individual, Part II, line 13) ..........................................

(15)

C) Other payments and withholdings (Schedule B Individual, Part III, line 13)..................................................

(16)

(17)

D) Total Tax Withheld or Paid (Add lines 27A through 27C)...................................................................................................................

(18)

28.

(If line 26 is larger than line 27D, enter the difference here, otherwise, enter on line 33)...........................................

AMOUNT OF TAX DUE

AMOUNT OF TAX DUE

AMOUNT OF TAX DUE

AMOUNT OF TAX DUE

AMOUNT OF TAX DUE

(19)

29.

Less:

Less:

Less:

Less: Amount paid with automatic extension of time..............................................................................................................................

Less:

(20)

30.

(If line 28 is larger than line 29, enter the difference here, otherwise, enter on line 33)............................................

BALANCE OF TAX DUE

BALANCE OF TAX DUE

BALANCE OF TAX DUE

BALANCE OF TAX DUE

BALANCE OF TAX DUE

(21)

31.

Less:

Less: Amount paid

Less:

With Return

With Return.........................................................................................................................................................

With Return

Less:

Less:

(a)

With Return

With Return

(22)

Through Electronic Transfer

Through Electronic Transfer

Through Electronic Transfer

Through Electronic Transfer

Through Electronic Transfer (Transaction No. ____________________________________) .......................

(b)

Interest

Interest

Interest

Interest

Interest ............................................................................................................................

(23)

(c)

Surcharges

Surcharges

Surcharges __________ and Penalties

Surcharges

Surcharges

and Penalties

and Penalties

and Penalties

and Penalties __________...................................................

(24)

(d)

32.

BALANCE OF TAX DUE

BALANCE OF TAX DUE

BALANCE OF TAX DUE (Subtract lines 31(a) and 31(b) from line 30)...................................................................................................

BALANCE OF TAX DUE

BALANCE OF TAX DUE

(25)

33.

Amount overpaid

Amount overpaid (Subtract lines 27D and 29 from line 26. Indicate distribution on line A or B) ...............................................................

Amount overpaid

Amount overpaid

Amount overpaid

(26)

A) To be credited to estimated tax for 2002 ............................................................................................................................................

(27)

B) TO BE REFUNDED (If you want your refund to be deposited directly in an account, complete Part 5)

TO BE REFUNDED (If you want your refund to be deposited directly in an account, complete Part 5)

TO BE REFUNDED (If you want your refund to be deposited directly in an account, complete Part 5)

TO BE REFUNDED (If you want your refund to be deposited directly in an account, complete Part 5)

TO BE REFUNDED (If you want your refund to be deposited directly in an account, complete Part 5) .............................................

(40)

AUTHORIZATION FOR THE DIRECT DEPOSIT OF THE REFUND

AUTHORIZATION FOR THE DIRECT DEPOSIT OF THE REFUND

AUTHORIZATION FOR THE DIRECT DEPOSIT OF THE REFUND

AUTHORIZATION FOR THE DIRECT DEPOSIT OF THE REFUND

AUTHORIZATION FOR THE DIRECT DEPOSIT OF THE REFUND

Route/Transit number

Route/Transit number

Route/Transit number

Route/Transit number

Route/Transit number

Account number

Account number

Account number

Account number

Account number

Type of account:

Type of account:

Type of account:

Type of account:

Type of account:

222222222

22222222222222222

G

G

Checks

Savings

Account in the name of: _________________________________________________

Account in the name of: _________________________________________________

Account in the name of: _________________________________________________ and _________________________________________________

_________________________________________________

_________________________________________________

_________________________________________________

Account in the name of: _________________________________________________

Account in the name of: _________________________________________________

_________________________________________________

(Complete name in print letter as it appears on your account. If married and filing jointly, include your spouse name)

I hereby declare under the penalty of perjury that this return (including the statements, schedules and other documents attached) has been examined by

I hereby declare under the penalty of perjury that this return (including the statements, schedules and other documents attached) has been examined by

I hereby declare under the penalty of perjury that this return (including the statements, schedules and other documents attached) has been examined by

I hereby declare under the penalty of perjury that this return (including the statements, schedules and other documents attached) has been examined by

I hereby declare under the penalty of perjury that this return (including the statements, schedules and other documents attached) has been examined by

me and to the best of my knowledge and belief is a true, correct and complete return. I also declare that I have provided more than 50% of the support

me and to the best of my knowledge and belief is a true, correct and complete return. I also declare that I have provided more than 50% of the support

me and to the best of my knowledge and belief is a true, correct and complete return. I also declare that I have provided more than 50% of the support

me and to the best of my knowledge and belief is a true, correct and complete return. I also declare that I have provided more than 50% of the support

me and to the best of my knowledge and belief is a true, correct and complete return. I also declare that I have provided more than 50% of the support

for all dependents claimed. The declaration of the person that prepares this return (except the taxpayer) is with respect to the information received, and

for all dependents claimed. The declaration of the person that prepares this return (except the taxpayer) is with respect to the information received, and

for all dependents claimed. The declaration of the person that prepares this return (except the taxpayer) is with respect to the information received, and

for all dependents claimed. The declaration of the person that prepares this return (except the taxpayer) is with respect to the information received, and

for all dependents claimed. The declaration of the person that prepares this return (except the taxpayer) is with respect to the information received, and

this information has been verified.

this information has been verified.

this information has been verified.

this information has been verified.

this information has been verified.

Date

Taxpayer's signature

Taxpayer's signature

Taxpayer's signature

Taxpayer's signature

Taxpayer's signature

N

NOTE TO TAXPAYER

NOTE TO TAXPAYER

NOTE TO TAXPAYER

NOTE TO TAXPAYER

NOTE TO TAXPAYER

If you paid a Specialist to prepare your return, he (she) must sign

Date

Spouse's signature

Spouse's signature

Spouse's signature

Spouse's signature

Spouse's signature

N

and write his (her) registration number in the space provided.

Specialist's Name (Print letter)

Specialist's Signature

Name of the Firm or Business

04

04

04

04

04

Specialist's Social Security Number

Address

Date

Register Number

Employer's Identification Number

G

Self - employed

(Check here)

Zip Code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28