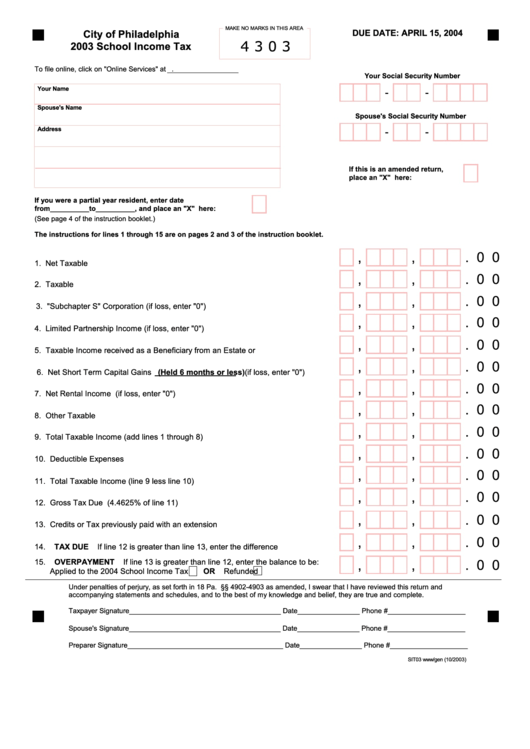

School Income Tax - City Of Philadelphia - 2003

ADVERTISEMENT

MAKE NO MARKS IN THIS AREA

City of Philadelphia

DUE DATE: APRIL 15, 2004

4 3 0 3

2003 School Income Tax

To file online, click on "Online Services" at

Your Social Security Number

Your Name

-

-

Spouse's Name

Spouse's Social Security Number

Address

-

-

If this is an amended return,

place an "X" here:.........................

If you were a partial year resident, enter date

from__________to__________, and place an "X" here:................

(See page 4 of the instruction booklet.)

The instructions for lines 1 through 15 are on pages 2 and 3 of the instruction booklet.

,

,

. 0 0

1. Net Taxable Dividends..............................................................................................1.

,

,

. 0 0

2. Taxable Interest........................................................................................................2.

,

,

. 0 0

3. "Subchapter S" Corporation (if loss, enter "0").........................................................3.

,

,

. 0 0

4. Limited Partnership Income (if loss, enter "0").........................................................4.

,

,

. 0 0

5. Taxable Income received as a Beneficiary from an Estate or Trust.........................5.

,

,

. 0 0

6. Net Short Term Capital Gains (Held 6 months or less) (if loss, enter "0").............6.

,

,

. 0 0

7. Net Rental Income (if loss, enter "0")......................................................................7.

,

,

. 0 0

8. Other Taxable Income..............................................................................................8.

,

,

. 0 0

9. Total Taxable Income (add lines 1 through 8)..........................................................9.

,

,

. 0 0

10. Deductible Expenses ............................................................................................10.

,

,

. 0 0

11. Total Taxable Income (line 9 less line 10).............................................................11.

,

,

. 0 0

12. Gross Tax Due (4.4625% of line 11)....................................................................12.

,

,

. 0 0

13. Credits or Tax previously paid with an extension coupon.....................................13.

,

,

. 0 0

14. TAX DUE If line 12 is greater than line 13, enter the difference here..................14.

,

,

. 0 0

15. OVERPAYMENT If line 13 is greater than line 12, enter the balance to be:

Applied to the 2004 School Income Tax

OR Refunded

...........................15.

Under penalties of perjury, as set forth in 18 Pa. C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature_______________________________________ Date________________ Phone #____________________

Spouse's Signature_______________________________________ Date________________ Phone #____________________

Preparer Signature________________________________________ Date________________ Phone #____________________

SIT03 www/gen (10/2003)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1