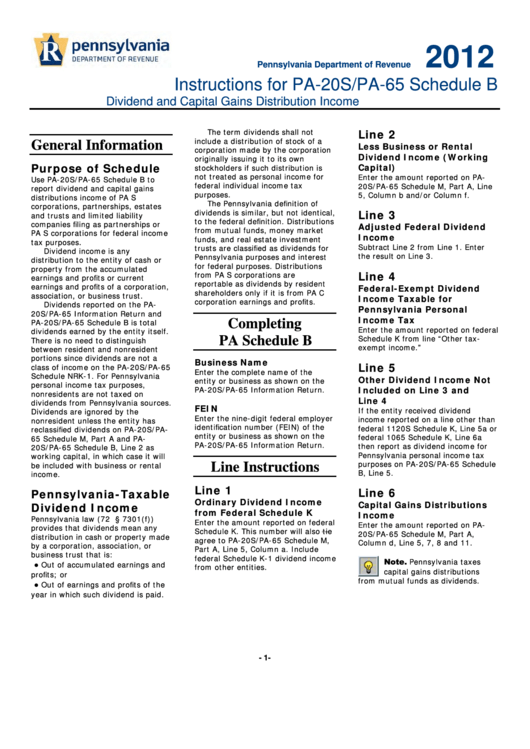

Instructions For Pa-20s/pa-65 Schedule B - Pennsylvania Department Of Revenue - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule B

Dividend and Capital Gains Distribution Income

The term dividends shall not

Line 2

include a distribution of stock of a

General Information

Less Business or Rental

corporation made by the corporation

Dividend Income (Working

originally issuing it to its own

Purpose of Schedule

Capital)

stockholders if such distribution is

not treated as personal income for

Enter the amount reported on PA-

Use PA-20S/PA-65 Schedule B to

federal individual income tax

20S/PA-65 Schedule M, Part A, Line

report dividend and capital gains

purposes.

5, Column b and/or Column f.

distributions income of PA S

The Pennsylvania definition of

corporations, partnerships, estates

dividends is similar, but not identical,

Line 3

and trusts and limited liability

to the federal definition. Distributions

companies filing as partnerships or

Adjusted Federal Dividend

from mutual funds, money market

PA S corporations for federal income

Income

funds, and real estate investment

tax purposes.

Subtract Line 2 from Line 1. Enter

trusts are classified as dividends for

Dividend income is any

the result on Line 3.

Pennsylvania purposes and interest

distribution to the entity of cash or

for federal purposes. Distributions

property from the accumulated

Line 4

from PA S corporations are

earnings and profits or current

reportable as dividends by resident

earnings and profits of a corporation,

Federal-Exempt Dividend

shareholders only if it is from PA C

association, or business trust.

Income Taxable for

corporation earnings and profits.

Dividends reported on the PA-

Pennsylvania Personal

20S/PA-65 Information Return and

Income Tax

PA-20S/PA-65 Schedule B is total

Completing

Enter the amount reported on federal

dividends earned by the entity itself.

Schedule K from line “Other tax-

PA Schedule B

There is no need to distinguish

exempt income.”

between resident and nonresident

portions since dividends are not a

Business Name

Line 5

class of income on the PA-20S/PA-65

Enter the complete name of the

Schedule NRK-1. For Pennsylvania

Other Dividend Income Not

entity or business as shown on the

personal income tax purposes,

Included on Line 3 and

PA-20S/PA-65 Information Return.

nonresidents are not taxed on

Line 4

dividends from Pennsylvania sources.

FEIN

If the entity received dividend

Dividends are ignored by the

Enter the nine-digit federal employer

income reported on a line other than

nonresident unless the entity has

identification number (FEIN) of the

federal 1120S Schedule K, Line 5a or

reclassified dividends on PA-20S/PA-

entity or business as shown on the

federal 1065 Schedule K, Line 6a

65 Schedule M, Part A and PA-

PA-20S/PA-65 Information Return.

then report as dividend income for

20S/PA-65 Schedule B, Line 2 as

Pennsylvania personal income tax

working capital, in which case it will

purposes on PA-20S/PA-65 Schedule

be included with business or rental

Line Instructions

B, Line 5.

income.

Line 1

Line 6

Pennsylvania-Taxable

Ordinary Dividend Income

Capital Gains Distributions

Dividend Income

from Federal Schedule K

Income

Pennsylvania law (72 P.S. § 7301(f))

Enter the amount reported on federal

Enter the amount reported on PA-

provides that dividends mean any

Schedule K. This number will also tie

20S/PA-65 Schedule M, Part A,

distribution in cash or property made

agree to PA-20S/PA-65 Schedule M,

Column d, Line 5, 7, 8 and 11.

by a corporation, association, or

Part A, Line 5, Column a. Include

business trust that is:

federal Schedule K-1 dividend income

Note.

Pennsylvania taxes

●

Out of accumulated earnings and

from other entities.

capital gains distributions

profits; or

from mutual funds as dividends.

●

Out of earnings and profits of the

year in which such dividend is paid.

- 1-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2