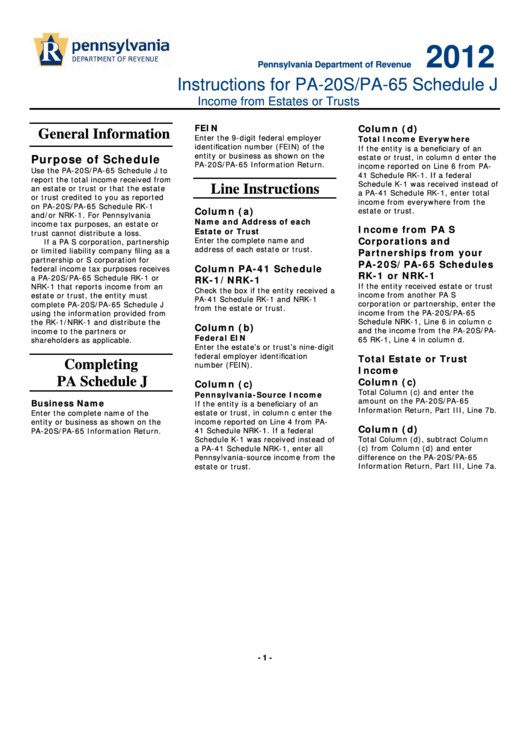

Instructions For Pa-20s/pa-65 Schedule J - Pennsylvania Department Of Revenue - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule J

Income from Estates or Trusts

FEIN

Column (d)

General Information

Enter the 9-digit federal employer

Total Income Everywhere

identification number (FEIN) of the

If the entity is a beneficiary of an

entity or business as shown on the

Purpose of Schedule

estate or trust, in column d enter the

PA-20S/PA-65 Information Return.

income reported on Line 6 from PA-

Use the PA-20S/PA-65 Schedule J to

41 Schedule RK-1. If a federal

report the total income received from

Schedule K-1 was received instead of

an estate or trust or that the estate

Line Instructions

a PA-41 Schedule RK-1, enter total

or trust credited to you as reported

income from everywhere from the

on PA-20S/PA-65 Schedule RK-1

Column (a)

estate or trust.

and/or NRK-1. For Pennsylvania

Name and Address of each

income tax purposes, an estate or

Income from PA S

Estate or Trust

trust cannot distribute a loss.

Corporations and

Enter the complete name and

If a PA S corporation, partnership

address of each estate or trust.

or limited liability company filing as a

Partnerships from your

partnership or S corporation for

PA-20S/PA-65 Schedules

Column PA-41 Schedule

federal income tax purposes receives

RK-1 or NRK-1

a PA-20S/PA-65 Schedule RK-1 or

RK-1/NRK-1

If the entity received estate or trust

NRK-1 that reports income from an

Check the box if the entity received a

income from another PA S

estate or trust, the entity must

PA-41 Schedule RK-1 and NRK-1

corporation or partnership, enter the

complete PA-20S/PA-65 Schedule J

from the estate or trust.

income from the PA-20S/PA-65

using the information provided from

Schedule NRK-1, Line 6 in column c

the RK-1/NRK-1 and distribute the

Column (b)

and the income from the PA-20S/PA-

income to the partners or

Federal EIN

65 RK-1, Line 4 in column d.

shareholders as applicable.

Enter the estate’s or trust’s nine-digit

federal employer identification

Total Estate or Trust

Completing

number (FEIN).

Income

Column (c)

PA Schedule J

Column (c)

Total Column (c) and enter the

Pennsylvania-Source Income

amount on the PA-20S/PA-65

Business Name

If the entity is a beneficiary of an

Information Return, Part III, Line 7b.

Enter the complete name of the

estate or trust, in column c enter the

income reported on Line 4 from PA-

entity or business as shown on the

Column (d)

41 Schedule NRK-1. If a federal

PA-20S/PA-65 Information Return.

Schedule K-1 was received instead of

Total Column (d), subtract Column

(c) from Column (d) and enter

a PA-41 Schedule NRK-1, enter all

difference on the PA-20S/PA-65

Pennsylvania-source income from the

Information Return, Part III, Line 7a.

estate or trust.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1