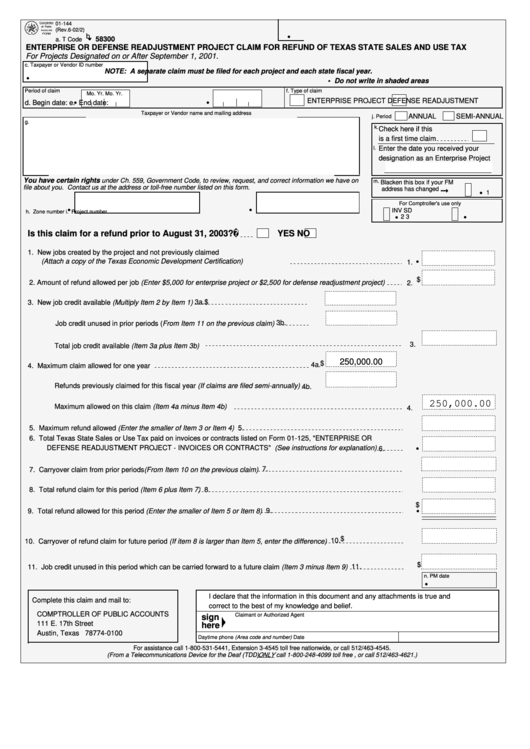

01-144

(Rev.6-02/2)

b.

58300

a. T Code

ENTERPRISE OR DEFENSE READJUSTMENT PROJECT CLAIM FOR REFUND OF TEXAS STATE SALES AND USE TAX

For Projects Designated on or After September 1, 2001.

c. Taxpayer or Vendor ID number

NOTE: A separate claim must be filed for each project and each state fiscal year.

• Do not write in shaded areas

Period of claim

f. Type of claim

Mo.

Yr.

Mo.

Yr.

ENTERPRISE PROJECT

DEFENSE READJUSTMENT

d. Begin date:

e. End date:

Taxpayer or Vendor name and mailing address

ANNUAL

SEMI-ANNUAL

j. Period

g.

k.

Check here if this

is a first time claim

l.

Enter the date you received your

designation as an Enterprise Project

You have certain rights

under Ch. 559, Government Code, to review, request, and correct information we have on

m.

Blacken this box if your

FM

.

file about you. Contact us at the address or toll-free number listed on this form

address has changed

1

For Comptroller's use only

INV

SD

h. Zone number

i. Project number

2

3

Is this claim for a refund prior to August 31, 2003?

YES

NO

1. New jobs created by the project and not previously claimed

(Attach a copy of the Texas Economic Development Certification)

1.

2. $

2. Amount of refund allowed per job (Enter $5,000 for enterprise project or $2,500 for defense readjustment project)

3a.$

3. New job credit available (Multiply Item 2 by Item 1)

3b.

Job credit unused in prior periods (From Item 11 on the previous claim)

3.

Total job credit available (Item 3a plus Item 3b)

250,000.00

$

4a.

4. Maximum claim allowed for one year

Refunds previously claimed for this fiscal year (If claims are filed semi-annually)

4b.

250,000.00

Maximum allowed on this claim (Item 4a minus Item 4b)

4.

5. Maximum refund allowed (Enter the smaller of Item 3 or Item 4)

5.

6. Total Texas State Sales or Use Tax paid on invoices or contracts listed on Form 01-125, "ENTERPRISE OR

DEFENSE READJUSTMENT PROJECT - INVOICES OR CONTRACTS" (See instructions for explanation)

6.

7.

7. Carryover claim from prior periods (From Item 10 on the previous claim)

8. Total refund claim for this period (Item 6 plus Item 7)

8.

$

9.

9. Total refund allowed for this period (Enter the smaller of Item 5 or Item 8)

10. $

10. Carryover of refund claim for future period (If item 8 is larger than Item 5, enter the difference)

$

11. Job credit unused in this period which can be carried forward to a future claim (Item 3 minus Item 9)

11.

n. PM date

I declare that the information in this document and any attachments is true and

Complete this claim and mail to:

correct to the best of my knowledge and belief.

COMPTROLLER OF PUBLIC ACCOUNTS

Claimant or Authorized Agent

sign

111 E. 17th Street

here

Austin, Texas 78774-0100

Daytime phone (Area code and number)

Date

For assistance call 1-800-531-5441, Extension 3-4545 toll free nationwide, or call 512/463-4545.

(From a Telecommunications Device for the Deaf (TDD) ONLY call 1-800-248-4099 toll free , or call 512/463-4621.)

1

1 2

2