Form 01-144 (Back)(6-02/2)

INSTRUCTIONS FOR ENTERPRISE OR DEFENSE READJUSTMENT PROJECT CLAIM FORM

This form is for all enterprise projects designated by Texas Economic Development (Agency) on or after September 1, 2001.

Please indicate on claim form if the refund is for items that qualify for a refund prior to August 31, 2003.

Taxpayer or Vendor ID Number - Use your Federal Employer

Local taxes may or may not be refundable by the local taxing

Identification Number or Social Security Number if filing as an

authority. Inquiry regarding potential refunds may be directed

individual.

to your local taxing authorities or to the Texas Economic

Development (Agency).

Period of claim/Type of claim - A project may file a claim

annually or semi-annually. The annual period referred to

Items on which a refund of tax can be claimed are:

corresponds to the State of Texas fiscal year which runs from

• Machinery or equipment used in the project;

September 1 through August 31 each year.

• Building materials used in the renovation, rehabilitation or

construction of the project;

First time claims - If this project has never before filed a claim

• Labor for remodeling, rehabilitating or constructing a struc

for a refund of tax paid, the date that you received your

ture by a project; or

designation as a project will be needed. Claims may include

• Electricity and natural gas purchased and consumed in the

taxes paid as much as 90 days prior to the date of designation

normal course of business in the project.

through the end of the designation period.

• Tangible personal property purchased and consumed in the

normal course of business in the enterprise project;

Item 1 - New jobs created - This number will be obtained from

• Taxable service.

the Texas Economic Development (Agency) and should be

verifiable on the Certification form which you should attach.

Sales tax paid to another state is not refundable and should be

omitted from the claim. Include those invoices on which a

Item 3b - Job credit unused in prior periods - If jobs created

portion of the tax was paid to the State of Texas and a portion

in previous periods result in a job credit greater than the amount

to another state, but omit the amount of tax paid to the other

of tax refund claimed in those periods, you are allowed to carry

state when calculating the total amount claimed.

forward the unused credit as it appears on Item 11 of your

previous claims.

Calculations should include only actual taxes paid and not

previously refunded or exempted under any other provisions of

Item 4b - Refunds previously claimed for this fiscal year

the Texas sales tax laws.

A maximum of $250,000 in tax credit may be claimed for each

State of Texas fiscal year. The fiscal year for the State runs from

Item 7 - Carryover claim from prior periods - This amount

September 1 through August 31 of each year. If a prior claim

would have appeared on a prior claim in Item 10. This is an

has been filed by a semi-annual filer for the same fiscal year, the

excess of tax claimed over the ceiling of $250,000 refundable

maximum amount allowed is reduced by the amount of the

for each State fiscal year.

prior claim.

Item 9 - Total refund allowed for this period - Since the refund

Item 5 - Maximum refund allowed - The maximum refund

cannot exceed the maximum allowed in Item 5, a comparison

allowed is limited to the lesser of $250,000 or the number of new

is made of Item 8 to Item 5, to determine the proper amount to

jobs created, multiplied by $5000 for an enterprise project, or

be refunded.

$2,500 for a defense readjustment project. See Item 10 for

claims in excess of maximum allowed.

Item 10 - Carryover of refund claim for future period - This

amount represents tax which you have paid and on which you

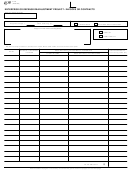

Item 6 - Total Texas state sales and use tax paid & claimed

are due a refund. However, the maximum amount which you

for refund - Supplemental Form 01-125 is a required attach

may claim for a fiscal year is limited to the number of jobs

ment, unless this entire claim is based on a carryover figure

created multiplied by $5,000 for enterprise projects ($2,500 for

from Item 10 on a prior claim. Form 01-125 should list all

defense readjustment projects), or $250,000, whichever is

invoices or contracts on which sales tax has been paid and for

less. Therefore, any claim over this ceiling must be carried over

which a refund is being claimed. In lieu of using Form 01-125,

and claimed in the next fiscal year.

you may use any spreadsheet software to copy the supplement

format and submit the required information on diskette or via

Item 11 - Job credit unused in this period - This amount

email.

represents the potential tax credit which could be claimed

based on the number of new jobs created multiplied by $5,000

Only the state portion of the sales tax is refundable on this claim

for enterprise projects ($2,500 for defense readjustment projects)

form.

and reduced by the actual amount of claims made to date. This

amount may be used on your next claim even if no new jobs are

Invoice Documentation. All invoices should indicate that items

created or it can be used in addition to any new jobs created by

were shipped to the EZ project, received by the EZ project, and

entering this total on your next claim in Item 3b.

paid by the EZ project. If a contract is referenced, please include

a copy of that contract for review

1

1 2

2