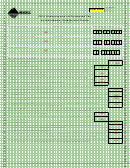

New Jersey Gross Income Tax

Instructions for Form NJ-2210

Underpayment of Estimated Tax by Individuals, Estates, or Trusts

2014

Use Form NJ-2210 to determine if you are subject to interest on the underpayment of estimated tax. Estates and trusts

are subject to interest on underpayment of estimated tax and may need to complete form NJ-2210, except estates and trusts

that meet the two year limitation and other criteria of federal Internal Revenue Code section 6654(1)(2). Complete Part I,

Figuring your Underpayment, to determine if you have not paid enough estimated tax during any of the payment periods. If

you have not, complete Part II, Exceptions, to determine if an exception applies to any of the payment periods. If no excep-

tion applies use the attached worksheet, Computing The Interest, to calculate the interest for that period.

In General - You may owe interest if you did not make estimated

Line 14 - Based on the amounts indicated on Line 6, Part I, enter

payments, including withholdings (see Line 6), equal to at least

the total amount of all estimated tax payments and taxes withheld

80% of your 2014 tax liability (Line 44, Form NJ-1040) or 100%

by each of the due dates indicated on Part II.

of your 2013 tax liability, provided your 2013 New Jersey Gross

Income Tax return covered a full 12 month period.

Exceptions 1, 2, 3 & 4 - You must complete the appropriate

worksheet for exemptions 2, 3 and 4 and attach all computations

If an underpayment does exist for any column in Part I, you

for each of the exceptions claimed. If you meet exception 1 at

should complete Part II, Exceptions and the appropriate work-

Line 15 do not file this form. These amounts will be automati-

sheet on page 2, NJ-2210 to determine if any of the exceptions on

cally verified by the Division of Taxation.

Part II may apply. You must complete the appropriate worksheet

for exceptions 2, 3 and 4 and attach all computations for each of

Exception 1 - Enter your prior year tax liability in the space pro-

the exceptions claimed.

vided at Line 15. Exception 1 only applies if your prior year tax

return covered a full twelve month period and your current tax

SPECIFIC INSTRUCTIONS

year payments (Line 14) are at least equal to your prior year tax

PART I

liability. Your prior year tax liability is zero, if a return was not

required to be filed. Enter the applicable percentage of your prior

Line 3 - If Line 3 is $400 or more, complete Lines 4 through 13.

year tax liability in each column at Line 15, as indicated.

Line 6 - For the purpose of determining your underpayment of

Exception 2 - Exception 2 is calculated by subtracting the total

estimated tax, tax withheld includes the amount of New Jersey

Tax Withheld (Line 48, Form NJ-1040), Property Tax Credit

amount of your current tax year exemptions from your prior year

(Line 49, Form NJ-1040), New Jersey Earned Income Tax Credit

Gross Income. Tax is computed using the current year tax rates.

(Line 51, Form NJ-1040), Excess NJ UI/WF/SWF Withheld

Subtract your credit for income taxes paid to other jurisdictions,

(Line 52, Form NJ-1040), Excess NJ Disability Insurance

if any. Enter the applicable percentage of Line 6 of the worksheet

Withheld (Line 53, NJ-1040) and Excess NJ Family Leave

on each column at Line 16, as indicated. Exception 2 only applies

Insurance Withheld (Line 54, NJ-1040). The total amount of tax

if your current year tax payments (Line 14) are at least equal to

withheld is considered to have been paid evenly (one-fourth of

the amounts indicated at Line 16.

total amount) on each payment due date, unless you can show oth-

erwise. Include this amount with the amount of any estimated tax

Exception 3 - Exception 3 is calculated by multiplying the actual

payments on each of the columns on Part I. The total amount of

portion of NJ Gross Income that is applicable to each period

credit, if any, from your prior year tax return should be included

shown, by the annualization amounts at Line 2 of the worksheet.

in the amount of your payment on Column A. If each column on

Subtract the total amount of exemptions from your Annualized

Line 6 is greater than the corresponding column on Line 5, do not

Income on Line 3. Compute tax on this amount. Subtract your

complete the rest of this form.

credit for income taxes paid to other jurisdictions, if any. Enter

the applicable percentage of each amount from Line 8 of the

Line 7 - Complete Lines 7 through 13 for one column before

worksheet on the corresponding column at Line 17 as indicated.

completing the next column.

Exception 3 only applies if your current year tax payments (Line

14) are at least equal to the amounts indicated at Line 17.

Line 12 - If Line 12 is zero for all payment periods, you are not

subject to the interest and therefore do not have to file Form NJ-

Exception 4 - Exception 4 is calculated by computing tax on the

2210. If you have an underpayment in any column on Line 12,

complete Part II.

actual amount of NJ Taxable Income that is applicable to each

period shown. Subtract your credit for income taxes paid to other

PART II

jurisdictions, if any. Enter 90% of each amount from Line 4 of

the worksheet on the corresponding column at Line 18.

You will not have to pay interest if, (1) you have paid your 2014

Exception 4 only applies if your current year tax payments (Line

tax payments (Line 14) on time; and (2) the amount on Line 14 is

14) are at least equal to the amounts indicated at Line 18.

equal to or more than the tax calculated under any of the four

exceptions for the same payment period.

1

1 2

2 3

3 4

4