Computing the Interest

Use the table in Option 1 to compute interest on the amount of the underpayment from page 1, NJ-2210. If your estimated tax payments

for tax year 2014 were not paid timely, interest must be computed based on the Interest Rate Schedule in Option 2.

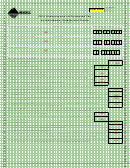

OPTION 1

Q

A

B

C

D

E

F

G

U

A

PERIOD

Amount Due

Balance Due

Total Due

Total Paid

Balance

Interest

R

(Line 5, NJ-2210)

Previous Qtr.

(Col. A + B)

(Line 6, NJ-2210)

(Col. C - D)

Multiplier

(Col. E x Col. F)

T

E

(Col. E)

R

1.

4/16 - 6/15

.010

2.

6/16 - 9/15

.015

3.

9/16 - 1/15

.021

4.

1/16 - 4/15

.015

TOTAL INTEREST

Column A

Enter the amount due per quarter (Line 5, NJ-2210).

Column B

Enter the balance due (Column E) from the previous quarter.

Column C

Enter the total of Column A plus Column B.

If Column B is negative, subtract Column B from Column A.

Column D

Enter the total estimated tax paid and withheld (Line 6, NJ-2210).

Column E

Subtract Column D from Column C.

Column F

The multiplier is based on the interest rates in effect during each quarter.

Column G

Multiply Column E by the multiplier in Column F. If Column E is negative, enter zero in Column G.

TOTAL INTEREST

Add the interest for each quarter and enter this amount in the block marked TOTAL INTEREST on Line 19,

NJ-2210 and on Line 46, NJ-1040.

OPTION 2

Compute the interest on the amount of the underpayment on Line 12 from the date the underpayment was

incurred to the date the underpayment was satisfied or the original due date of the final tax return (Form NJ-1040),

whichever is earlier. Interest is assessed at the annual rate of 3% above the average predominant prime rate and is

imposed each month or fraction thereof the underpayment exists. The interest rate will be reviewed quarterly and

will only change if there has been a cumulative change of more than one percent since it was last set.

INTEREST RATE SCHEDULE

PERIOD

INTEREST RATE

4/17/14 - 4/15/15

6.25%

1

1 2

2 3

3 4

4