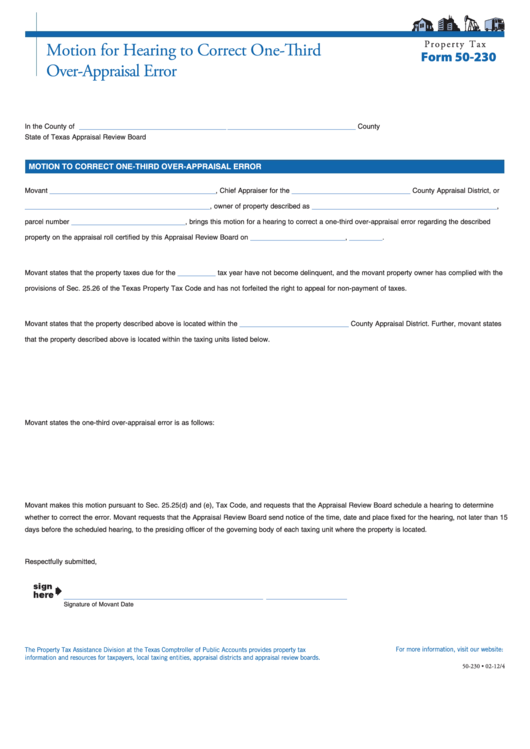

P r o p e r t y T a x

Motion for Hearing to Correct One-Third

Form 50-230

Over-Appraisal Error

_______________________________

___________________________

In the County of

County

State of Texas

Appraisal Review Board

MOTION TO CORRECT ONE-THIRD OVER-APPRAISAL ERROR

___________________________________

_________________________

Movant

, Chief Appraiser for the

County Appraisal District, or

_______________________________________

_______________________________________

, owner of property described as

,

________________________

parcel number

, brings this motion for a hearing to correct a one-third over-appraisal error regarding the described

____________________

_______

property on the appraisal roll certified by this Appraisal Review Board on

,

.

________

Movant states that the property taxes due for the

tax year have not become delinquent, and the movant property owner has complied with the

provisions of Sec. 25.26 of the Texas Property Tax Code and has not forfeited the right to appeal for non-payment of taxes.

_______________________

Movant states that the property described above is located within the

County Appraisal District. Further, movant states

that the property described above is located within the taxing units listed below.

Movant states the one-third over-appraisal error is as follows:

Movant makes this motion pursuant to Sec. 25.25(d) and (e), Tax Code, and requests that the Appraisal Review Board schedule a hearing to determine

whether to correct the error. Movant requests that the Appraisal Review Board send notice of the time, date and place fixed for the hearing, not later than 15

days before the scheduled hearing, to the presiding officer of the governing body of each taxing unit where the property is located.

Respectfully submitted,

__________________________________________

_________________

Signature of Movant

Date

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-230 • 02-12/4

1

1 2

2