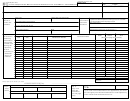

P r o p e r t y T a x

D e a l e r ’ s H e a v y E q u i p m e n t I n v e n t o r y T a x S t a t e m e n t

Form 50-266

Additional Instructions

Section 3: Information on each item of heavy equipment sold, leased or rented during the reporting month. Complete the information on

each item of heavy equipment sold, leased or rented including the date of sale, lease, or rental; item name; identification/serial number; name of

purchaser, lessee, or renter; type of sale, lease, or rental; sales price, lease or rental amount; and unit property tax. The footnotes include:

1

Type of Sale, Lease, or Rental: Place one of the following codes:

HE - Heavy equipment inventory

sales, leases and rentals of heavy equipment. Heavy equipment means self-propelled, self-

-

powered or pull-type equipment, including farm equipment or a diesel engine, which weighs at least 1,500 pounds and is intended to

be used for agricultural, construction, industrial, maritime, mining or forestry uses. The term does not include a motor vehicle that is

required to be titled under Chapter 501 or registered under Chapter 502, Transportation Code.

FL - fleet transactions

heavy equipment included in the sale of five or more items of heavy equipment from your inventory to the

-

same buyer within one calendar year.

DL - dealer sales

sales of heavy equipment to dealers.

-

SS - subsequent sales

dealer-financed sales of heavy equipment that, at the time of sale, have dealer-financing from your inventory in

-

this same calendar year. The term does not include a rental or lease with an unexercised purchase option or without a purchase option.

2

Sales Price, and Lease or Rental Amount:

Sales price is the total amount of money paid or to be paid to a dealer for the purchase of

an item of heavy equipment; or for a lease or rental, the total amount of the lease or rental payments received for an item.

3

Unit Property Tax:

To compute for sales, multiply the sales price by the unit property tax factor.

For lease or rental transaction, multiply

the monthly lease or rental payment received by the unit property tax factor. For fleet transactions, dealer sales and subsequent sales that are

not included in the net heavy equipment inventory, the unit property tax is $-0-. If no unit property tax is assigned, state the reason.

4

Total Unit Property Tax for This Month: Enter the total amount of unit property tax from the “Total for this page only” box on previous page(s).

This is the total amount of unit property tax that will be submitted with the statement to the collector.

5

Unit Property Tax Factor: Contact either the county tax assessor-collector or county appraisal district for the current unit property tax factor.

The unit property tax factor is calculated by dividing the aggregate tax rate by 12. If the county aggregate tax rate is expressed in dollars per

$100 of valuation, divide by $100 and then divide by 12. It represents one-twelfth of the preceding year’s aggregate tax rate at the location

where the heavy equipment inventory is located on January 1 of the current year.

Section 4: Definitions.

Net heavy equipment inventory - Heavy equipment that has been sold, leased, or rented less fleet transactions, dealer sales and subsequent

sales. Heavy equipment means self-propelled, self-powered, or pull-type equipment, including farm equipment or a diesel engine, that weighs

at least 1,500 pounds and is intended to be used for agricultural, construction, industrial, maritime, mining, or forestry uses. The term does not

include a motor vehicle that is required by Transportation Code Chapter 501 to be titled or by Transportation Code Chapter 502 to be registered.

transactions

Fleet

- the sale of five or more items of heavy equipment from your inventory to the same buyer within one calendar year.

Dealer sales - sales of heavy equipment to dealers.

Subsequent sales - dealer-financed sales of heavy equipment that, at the time of sale, has dealer financing from your inventory in this same

calendar year. The term does not include a rental or lease with an unexercised purchase option or without a purchase option.

For more information, visit our website:

50-266 • 04-12/8 • Page 4

1

1 2

2 3

3 4

4