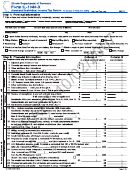

Instructions for Oregon Amended Schedule

For Amending Oregon Individual Income Tax Returns

Note: Have you received a notice from us because

I need to amend my Form 90R, Elderly Rental

we made adjustments to your return? If so and you

Assistance (ERA). Do I use this schedule?

object to the adjustments, do not respond by filing

No. Do not use this schedule to amend Form 90R. To file an

an amended return. You must follow the appeal

amended ERA claim, use Oregon Form 90R. You should:

process explained on the notice. File an amended

• Request an ERA booklet for the year you are amending.

return only if the changes you are making are

To order a booklet, go to our website or contact us.

unrelated to the adjustments on our notice.

• Write “amended” in blue or black ink at the top of Form

How do I amend my Oregon return?

90R.

• Fill out Form 90R using the correct information.

You will need the following items:

• Attach an explanation of your changes.

• The tax form and instruction booklet for the year that you

are amending. This will usually be the same form type as

How long do I have to file for a refund?

your original return, unless:

— You filed Form 40S, but can no longer use that form.

In most cases, you must file for a refund within three years

Use Form 40 instead; or

from the due date of your original return, or the date you

— You filed the incorrect form for your residency status.

filed your original return, whichever is later. If the three-year

Use the correct form type to amend.

filing period has expired, you may still file for a refund if:

• The Oregon Amended Schedule and these instructions.

• You paid tax within the past two years for the tax year

— Attach the Oregon Amended Schedule to your amended

(corrected) return.

you are amending. Your refund is generally limited to the

• A copy of the Oregon tax return that you originally filed

tax you paid in that two-year period.

for the year being amended.

• You had a net operating loss carryback. Your claim must

• A copy of any previous amended returns you filed.

be filed within three years from the due date of the return

• A copy of all notices from us, another state, or the Internal

for the tax year the loss occurred. The due date includes

Revenue Service (IRS) for the tax year being amended.

extensions.

— If we corrected your return on a notice, use the figures

• The IRS or another state adjusted your return or assessed

from that notice when amending your return.

tax for failure to file a return. You must file a copy of the

Follow these steps to amend your return:

audit report, return, or assessment and your Oregon

amended return and schedule within two years after the

1. Read through these instructions before filling out your

federal or other state correction was made.

form.

2. Check the amended box at the top of your amended

How long will it take to process my amended return?

Form 40S, 40, 40N, or 40P using blue or black ink. For tax

years 2004 and earlier write “amended” at the top of your

Processing time for amended returns varies. It may take

amended return.

six months or longer to process your amended return.

3. If we sent you a notice adjusting your return, use those

figures when making your other unrelated adjustments.

When should I file and pay if I owe additional tax?

4. Do not include any amounts received as a surplus or

kicker refund. We will recompute the correct amount and

File your amended return and schedule as soon as you

adjust your return.

know that a change needs to be made. Interest is figured

5. Fill out your entire income tax form (Form 40S, 40, 40N,

from the day after the due date of the original return up to

or 40P) using the correct information.

the date the tax is paid. Pay any tax and interest due as soon

6. Do not re-enter any refund that you already asked us to

as possible to avoid additional interest. There may also be

apply to your next year’s estimated tax.

a penalty.

7. Remember that charitable checkoffs, political party dona-

tions, and Oregon 529 college savings plan deposits can-

I was audited by the IRS (or another state). Do I

not be used on amended returns.

need to amend my Oregon return?

8. After completing your amended (corrected) return, com-

plete the amended schedule. The amended schedule

Yes, if an IRS or other state audit changed your Oregon

will figure your additional refund or tax to pay on your

taxable income. If these adjustments did not change your

amended return.

Oregon taxable income, there is no need to amend. If you

9. Attach your amended schedule to your amended return.

amend, attach a copy of the audit report to your amended

See “Finishing the amended return and schedule” at the

end of these instructions.

Oregon return.

1

150-101-061 (Rev. 12-12)

1

1 2

2 3

3 4

4 5

5 6

6