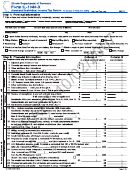

103a. Earned income credit (EIC) as amended. Tax years

107. Income tax refunds received from original return and

later. Fill in the amount of any refund you received (or

2005 and earlier, enter -0- and go to line 103b. Tax years

2006 and later, enter your corrected Oregon earned income

expect to receive) from your original Oregon return and

credit from your amended return. If your federal EIC hasn’t

any amended returns previously filed for the same year.

changed, your Oregon EIC will be the same as on your pre-

Include refunds received from the working family child

vious return.

care credit or other refundable credit or a previous adjust-

ment. Do not include interest received. Do not reduce your

103b. Working family child care credit (WFC) as amended.

refund by:

Enter your corrected working family child care credit from

your amended return. Attach your amended Schedule

• Amounts you contributed to charitable funds or political

WFC or WFC-N/P. If this credit hasn’t changed, it will be

parties claimed on the return; or

the same as on your previous return.

• Amounts you applied to the next year’s estimated tax; or

• Amounts we offset to pay money owed to the Depart-

103c. Mobile home park closure or involuntary move of a

ment of Revenue or another agency.

mobile home credit as amended.

Note: Do not include any amounts received as a kicker

• Tax years 2005 and earlier, enter -0-.

refund.

• Tax year 2006, enter your corrected refundable involun-

tary move of a mobile home credit from your amended

Any refund due from your original return may be mailed

return and attach your amended Schedule MH.

separately. By law, the Oregon Department of Revenue can-

• Tax years 2007 and later, enter your corrected mobile

not issue refunds or apply amounts less than $1.

home park closure credit from your amended return and

Example 5: Scott filed his 2010 tax return, claiming a refund

attach your amended Schedule MPC.

of $5,400 on Form 40, line 54. He asked for $200 to be applied

If your credit hasn’t changed, it will be the same as shown

as an estimated payment for tax year 2011 on line 55. He also

on your previous return.

requested that $200 be donated to various charities on lines

56 through 69. His net refund on line 72 was $5,000. When

104. Estimated tax payments. Fill in the amount of esti-

his return was processed, it took longer than expected, so

mated tax payments credited to your original return. Are

he received interest on his refund. Scott also owed money

you claiming a wolf depredation credit or claim of right

for parking tickets and the court had filed the paperwork

credit on your original and/or amended return? If so,

to offset his tax refund to pay for the tickets and court fees.

include the credit amounts here. Nonresidents: Include

His refund was reduced by $1,000 to pay off the balance

any Oregon income tax withheld for you by a pass-through

owed. He received $4,020 from the department as shown:

entity or by an agent from the proceeds of any Oregon real

estate sale.

Refund

$5,400

Less payments applied to next tax year

– 200

105. Amount of net income tax paid with original return

Less charitable checkoff donations

– 200

and later. Fill in the amount of all income tax actually paid

Net refund per return

5,000

on your original Oregon return. Include payments made

Plus interest received

+ 20

later or for any additional tax adjustments to your return.

Subtotal

5,020

Less amount paid for Scott’s debts

– 1,000

Don’t include payments for:

Scott’s check from the department

$4,020

• Penalty and interest; or

• Interest on the underpayment of estimated tax.

When Scott amends his 2010 tax return, he will enter $5,400

on line 107 of his Oregon Amended Schedule.

Example 4: When Amy filled out her original return for tax

year 2009, Form 40, line 49 showed tax to pay of $200. Since

Overpayment or balance due

the original due date had passed, she entered a 5% late pay-

ment penalty of $10 on Form 40, line 50. Her total amount

Note: Charitable checkoffs, political party donations, and

owed on Form 40, line 53 was $210. She sent a payment of

Oregon 529 college savings plan deposits cannot be used

$210 with her return. Her return was adjusted in process-

on amended returns. If you would like to donate to any of

ing to correct a math error. Her tax was increased by $150.

the charities, their addresses are available on our website.

Additional penalty and interest of $12 was added as well.

110. Amount of line 109 you want applied to another year’s

She was sent a notice explaining the adjustment, show-

estimated tax. If your overpayment on line 109 is $1 or

ing the corrected line entries on her original return. It also

more, you may apply part or all of it to your Oregon esti-

included a request to pay the additional $162 (tax, penalty,

mated tax account. Fill in the tax year and the amount you

and interest). She paid a total of $372 ($350 tax + $15 penalty

want to apply. Note: It may take six months or longer to

+ $7 interest).

process your return and apply your overpayment.

Later Amy amends her 2009 return and she enters $350

111. Refund. You must reduce your overpayment by any

on line 105 of her Oregon Amended Schedule. She will only

include the tax payments. She will not include any of the

amounts applied to your estimated tax on line 110. If you

interest and penalties she paid. Note: She will also use the

would like your remaining refund direct deposited, enter

corrected line entries from our notice when filling out her

your account information on Form 40S, 40, 40N, or 40P.

amended return.

Note: Interest on underpayment of estimated tax for a prior

3

150-101-061 (Rev. 12-12)

1

1 2

2 3

3 4

4 5

5 6

6