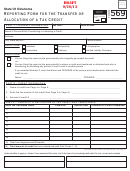

Form 569 - Page 3

Reporting Form for the Transfer or Allocation of a Tax Credit

Title 68 OS Section 2357.1A-2

Reporting Requirements

Complete Form 569 to report any tax credit, authorized to be claimed under Title 68 of the Oklahoma Statutes, that has

been transferred or allocated on or after July 1, 2011. The form shall be filed with the Tax Commission on or before the

20th day of the second month after the tax year in which an act occurs that allows the tax credit to eventually be claimed.

If a taxpayer claims a credit on any state tax return that was not previously reported on this form, such credit will be disal-

lowed. Upon the filing of the required Form(s) 569, the credit will be allowed.

Amended Report

If you are amending Form 569, place an ‘X’ in the Amended Report box. The amended report will supersede the original

report in its entirety. Please fill out the form completely, do not provide just supplemental information.

Part 1 – General Information

Tax Year:

• Enter the tax year in which the credit was generated if you are the person who originally generated the credit.

• Enter the tax year the credit was transferred or allocated to you if you transferred or allocated any portion of a credit

previously transferred or allocated to you.

Part 2 – Credit Information

(when completing Part 2, refer to credits that are allocable or

transferable listed on page 4)

1. Enter the name of the credit as shown on Page 4.

2. Enter the line number from Page 4 that corresponds to this credit.

3. Enter the amount of the credit that has been allocated and/or transferred to another person. This amount should

equal the total reported in Parts 3 and 4.

Part 3 – To be completed by a transferor who has transferred a credit

List the name, federal identification number, date of transfer and amount of credit that was transferred to each transferee.

If additional rows are needed, attach a Supplemental Schedule using the same format as Part 3 and carry the total from

the schedule to line 9.

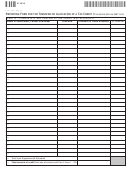

Part 4 – To be completed by a pass-through entity that has allocated a credit

List the name, federal identification number and amount of credit that was allocated to each shareholder, partner or mem-

ber. Place an ‘X’ in the column if the shareholder, partner or member is itself a pass-through entity (PTE). If additional

rows are needed, attach a Supplemental Schedule using the same format as Part 4 and carry the total from the schedule

to line 33.

Mail this form, including any Supplemental Schedules, to:

Oklahoma Tax Commission

Post Office Box 26800

Oklahoma City, OK 73126-0800

1

1 2

2 3

3 4

4