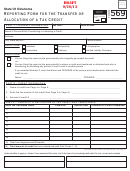

Form 569 - Page 4

Reporting Form for the Transfer or Allocation of a Tax Credit

Title 68 OS Section 2357.1A-2

Name of Credits that are Allocable or Transferable

Allocable / Transferable

1

Oklahoma Investment/New Jobs Credit

Allocable

2

Coal Credit

Allocable

Transferable

3

Credit for Investment in a Clean-Burning Motor Vehicle Fuel Property

Allocable

4

Small Business Capital Credit

Allocable

Small Business Guaranty Fee Credit (For tax years beginning before January 1, 2012.)

5

Allocable

Credit for Food Service Establishments that Pay for Hepatitis A Vaccination for their Employees

6

Allocable

7

Credit for Energy Assistance Fund Contribution

Allocable

8

Credit for Venture Capital Investment

(For tax years beginning before 1/1/09. Transferable for 3 years.)

Transferable

9

Credit for Hazardous Waste Control

Allocable

10

Credit for Employers Providing Child Care Programs

Allocable

11

Credit for Entities in the Business of Providing Child Care Services

Allocable

12

Credit for Commercial Space Industries

Allocable

13

Credit for Tourism Development or Qualified Media Production Facility

Allocable

14

Oklahoma Local Development and Enterprise Zone Incentive Leverage Act

Allocable

15

Credit for Qualified Rehabilitation Expenditures

Allocable

Transferable

16

Credit for Space Transportation Vehicle Provider

(For tax years ending before 1/1/09. Transferable for 3 years.)

Transferable

Rural Small Business Capital Credit (For tax years beginning before January 1, 2012.)

17

Allocable

18

Credit for Electricity Generated by Zero-Emission Facilities

Allocable

Transferable

19

Allocable

Credit for Financial Institutions Making Loans under the Rural Economic Development Loan Act

20

Credit for Manufacturers of Small Wind Turbines

Allocable

Transferable

21

Credit for Qualified Ethanol Facilities

Allocable

22

Poultry Litter Credit

Allocable

23

Credit for Qualified Biodiesel Facilities

Allocable

24

Film or Music Project Credit

Allocable

25

Credit for Breeders of Specially Trained Canines

Allocable

26

Credit for Wages Paid to an Injured Employee

Allocable

27

Credit for Modification Expenses Paid for an Injured Employee

Allocable

28

Dry Fire Hydrant Credit

Allocable

29

Credit for the Construction of Energy Efficient Homes

Allocable

Transferable

30

Credit for Railroad Modernization

Allocable

Transferable

31

Research and Development New Jobs Credit

Allocable

32

Credit for Stafford Loan Origination Fee

Allocable

33

Gas Used in Manufacturing Credit

Allocable

34

Credit for Biomedical Research Contribution

Allocable

35

Credit for Employers in the Aerospace Sector

Allocable

36

Wire Transfer Fee Credit

Allocable

37

Credit for Manufacturers of Electric Vehicles

Allocable

38

Credit for Cancer Research Contribution

Allocable

39

Oklahoma Capital Investment Board Tax Credit

Allocable

Transferable

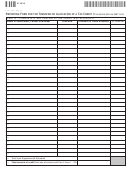

1

1 2

2 3

3 4

4