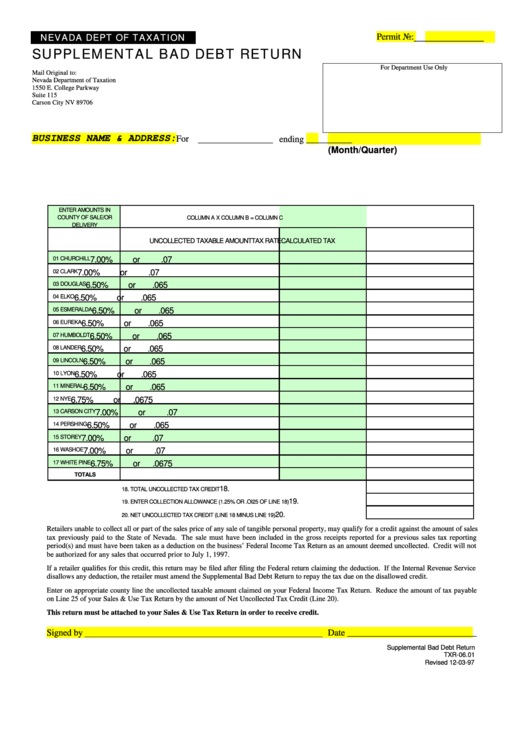

NEVADA DEPT OF TAXATION

Permit No:

______________

SUPPLEMENTAL BAD DEBT RETURN

For Department Use Only

Mail Original to:

Nevada Department of Taxation

1550 E. College Parkway

Suite 115

Carson City NV 89706

BUSINESS NAME & ADDRESS:

For

_______________

ending __________

(Month/Quarter)

ENTER AMOUNTS IN

COUNTY OF SALE/OR

COLUMN A

X COLUMN B

= COLUMN C

DELIVERY

UNCOLLECTED TAXABLE AMOUNT

TAX RATE

CALCULATED TAX

01 CHURCHILL

7.00%

or

.07

02 CLARK

7.00%

or

.07

03 DOUGLAS

6.50%

or

.065

04 ELKO

6.50%

or

.065

05 ESMERALDA

6.50%

or

.065

06 EUREKA

6.50%

or

.065

07 HUMBOLDT

6.50%

or

.065

08 LANDER

6.50%

or

.065

09 LINCOLN

6.50%

or

.065

10 LYON

6.50%

or

.065

11 MINERAL

6.50%

or

.065

12 NYE

6.75%

or

.0675

13 CARSON CITY

7.00%

or

.07

14 PERSHING

6.50%

or

.065

15 STOREY

7.00%

or

.07

16 WASHOE

7.00%

or

.07

17 WHITE PINE

6.75%

or

.0675

TOTALS

18.

18. TOTAL UNCOLLECTED TAX CREDIT

19.

19. ENTER COLLECTION ALLOWANCE (1.25% OR .OI25 OF LINE 18)

20.

20. NET UNCOLLECTED TAX CREDIT (LINE 18 MINUS LINE 19)

Retailers unable to collect all or part of the sales price of any sale of tangible personal property, may qualify for a credit against the amount of sales

tax previously paid to the State of Nevada. The sale must have been included in the gross receipts reported for a previous sales tax reporting

period(s) and must have been taken as a deduction on the business’ Federal Income Tax Return as an amount deemed uncollected. Credit will not

be authorized for any sales that occurred prior to July 1, 1997.

If a retailer qualifies for this credit, this return may be filed after filing the Federal return claiming the deduction. If the Internal Revenue Service

disallows any deduction, the retailer must amend the Supplemental Bad Debt Return to repay the tax due on the disallowed credit.

Enter on appropriate county line the uncollected taxable amount claimed on your Federal Income Tax Return. Reduce the amount of tax payable

on Line 25 of your Sales & Use Tax Return by the amount of Net Uncollected Tax Credit (Line 20).

This return must be attached to your Sales & Use Tax Return in order to receive credit.

Signed by

Date ____________________________

Supplemental Bad Debt Return

TXR-06.01

Revised 12-03-97

1

1