Pennsylvania Telefile Worksheet - 2008

ADVERTISEMENT

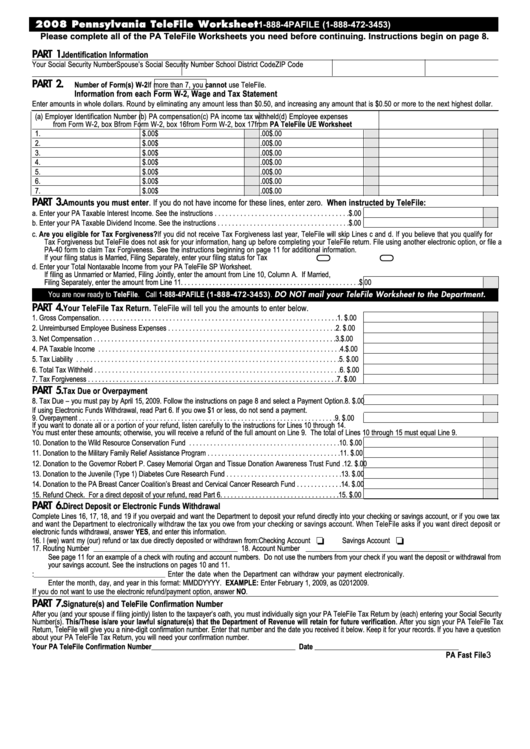

2008 Pennsylvania TeleFile Worksheet

1-888-4PAFILE (1-888-472-3453)

Please complete all of the PA TeleFile Worksheets you need before continuing. Instructions begin on page 8.

PART 1.

Identification Information

Your Social Security Number

Spouse’s Social Security Number

School District Code

ZIP Code

PART 2.

Number of Form(s) W-2

If more than 7, you cannot use TeleFile.

Information from each Form W-2, Wage and Tax Statement

Enter amounts in whole dollars. Round by eliminating any amount less than $0.50, and increasing any amount that is $0.50 or more to the next highest dollar.

(a) Employer Identification Number

(b) PA compensation

(c) PA income tax withheld

(d) Employee expenses

from Form W-2, box B

from Form W-2, box 16

from Form W-2, box 17

from PA TeleFile UE Worksheet

1.

$

.00 $

.00 $

.00

2.

$

.00 $

.00 $

.00

3.

$

.00 $

.00 $

.00

4.

$

.00 $

.00 $

.00

5.

$

.00 $

.00 $

.00

6.

$

.00 $

.00 $

.00

7.

$

.00 $

.00 $

.00

PART 3.

Amounts you must enter. If you do not have income for these lines, enter zero. When instructed by TeleFile:

a. Enter your PA Taxable Interest Income. See the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

.00

b. Enter your PA Taxable Dividend Income. See the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

.00

c. Are you eligible for Tax Forgiveness? If you did not receive Tax Forgiveness last year, TeleFile will skip Lines c and d. If you believe that you qualify for

Tax Forgiveness but TeleFile does not ask for your information, hang up before completing your TeleFile return. File using another electronic option, or file a

PA-40 form to claim Tax Forgiveness. See the instructions beginning on page 11 for additional information.

If your filing status is Married, Filing Separately, enter your filing status for Tax Forgiveness.

MARRIED

UNMARRIED

d. Enter your Total Nontaxable Income from your PA TeleFile SP Worksheet.

If filing as Unmarried or Married, Filing Jointly, enter the amount from Line 10, Column A. If Married,

Filing Separately, enter the amount from Line 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

.00

You are now ready to TeleFile. Call 1-888-4PAFILE (1-888-472-3453). DO NOT mail your TeleFile Worksheet to the Department.

PART 4.

Your TeleFile Tax Return. TeleFile will tell you the amounts to enter below.

1.

Gross Compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $

.00

2.

Unreimbursed Employee Business Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $

.00

3.

Net Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $

.00

4.

PA Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $

.00

5.

Tax Liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. $

.00

6.

Total Tax Withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. $

.00

7.

Tax Forgiveness . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. $

.00

PART 5.

Tax Due or Overpayment

8.

Tax Due – you must pay by April 15, 2009. Follow the instructions on page 8 and select a Payment Option. 8. $

.00

If using Electronic Funds Withdrawal, read Part 6. If you owe $1 or less, do not send a payment.

9.

Overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. $

.00

If you want to donate all or a portion of your refund, listen carefully to the instructions for Lines 10 through 14.

You must enter these amounts; otherwise, you will receive a refund of the full amount on Line 9. The total of Lines 10 through 15 must equal Line 9.

10. Donation to the Wild Resource Conservation Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. $

.00

11. Donation to the Military Family Relief Assistance Program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. $

.00

12. Donation to the Governor Robert P. Casey Memorial Organ and Tissue Donation Awareness Trust Fund . 12. $

.00

13. Donation to the Juvenile (Type 1) Diabetes Cure Research Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. $

.00

14. Donation to the PA Breast Cancer Coalition’s Breast and Cervical Cancer Research Fund . . . . . . . . . . . . . 14. $

.00

15. Refund Check. For a direct deposit of your refund, read Part 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15. $

.00

PART 6.

Direct Deposit or Electronic Funds Withdrawal

Complete Lines 16, 17, 18, and 19 if you overpaid and want the Department to deposit your refund directly into your checking or savings account, or if you owe tax

and want the Department to electronically withdraw the tax you owe from your checking or savings account. When TeleFile asks if you want direct deposit or

electronic funds withdrawal, answer YES, and enter this information.

J

J

16. I (we) want my (our) refund or tax due directly deposited or withdrawn from:

Checking Account

Savings Account

17. Routing Number

18. Account Number

_________________________________________________________

_________________________________________________________

See page 11 for an example of a check with routing and account numbers. Do not use the numbers from your check if you want the deposit or withdrawal from

your savings account. See the instructions on pages 10 and 11.

19. Requested Payment Date:

Enter the date when the Department can withdraw your payment electronically.

____________________________________________________

Enter the month, day, and year in this format: MMDDYYYY. EXAMPLE: Enter February 1, 2009, as 02012009.

If you do not want to use the electronic refund/payment option, answer NO.

PART 7.

Signature(s) and TeleFile Confirmation Number

After you (and your spouse if filing jointly) listen to the taxpayer’s oath, you must individually sign your PA TeleFile Tax Return by (each) entering your Social Security

Number(s). This/These is/are your lawful signature(s) that the Department of Revenue will retain for future verification. After you sign your PA TeleFile Tax

Return, TeleFile will give you a nine-digit confirmation number. Enter that number and the date you received it below. Keep it for your records. If you have a question

about your PA TeleFile Tax Return, you will need your confirmation number.

Your PA TeleFile Confirmation Number

Date

_________________________________________________________

_________________________________________________________

PA Fast File 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1