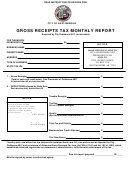

GROSS RECEIPTS TAX RATE SCHEDULE

Effective July 1, 2012 through December 31, 2012

Location

Location

Municipality or County

Rate

Municipality or County

Rate

Code

Code

RIO ARRIBA

SIERRA

Chama

17-118

8.1875%

Elephant Butte

21-319

7.5625%

Espanola (Rio Arriba)

17-215

8.1875%

Truth or Consequences

21-124

7.8750%

a

17-943

8.1875%

Truth or Consequences Airport

21-164

6.3125%

Espanola/Ohkay Owingeh Pueblo (1)

a

17-944

8.1875%

Williamsburg

21-220

7.5625%

Espanola/Ohkay Owingeh Pueblo (2)

a

17-903

8.1875%

Remainder of County

21-021

6.3125%

Espanola/Santa Clara Grant (1)

a

SOCORRO

17-904

8.1875%

Espanola/Santa Clara Grant (2)

Jicarilla Apache Nation (1)

17-931

6.5000%

Magdalena

25-221

6.8750%

17-932

Jicarilla Apache Nation (2)

6.5000%

Socorro (city)

25-125

7.0000%

Ohkay Owingeh Pueblo (1)

17-941

6.5000%

Socorro Industrial Park

25-162

5.9375%

17-942

Ohkay Owingeh Pueblo (2)

6.5000%

Remainder of County

25-025

5.9375%

Santa Clara Pueblo (1)

17-901

6.5000%

TAOS*

Santa Clara Pueblo (2)

17-902

6.5000%

El Prado Water and Sanitation District*

20-415

6.8750%

b

Remainder of County

17-017

6.5000%

7.9375%

El Prado Water and Sanitation District

*

20-425

20-419

ROOSEVELT

El Valle de Los Ranchos Water & Sanitation District*

6.8750%

b

Causey

11-408

6.6875%

7.9375%

El Valle de Los Ranchos Water & Sanitation District

20-429

*

Dora

11-310

6.9375%

Picuris Pueblo (1)*

20-917

6.6250%

Elida

11-216

7.5625%

Picuris Pueblo (2)*

20-918

6.6250%

Floyd

11-502

6.6875%

Questa*

20-222

7.6875%

Portales

11-119

7.7500%

Questa Airport*

20-160

6.6250%

Remainder of County

11-011

6.1875%

Red River*

20-317

7.9375%

SANDOVAL

Taos (city)*

20-126

7.6875%

Bernalillo (City)

29-120

7.0625%

Taos Airport*

20-163

6.6250%

Corrales

29-504

7.1875%

Taos Pueblo (1)*

20-913

6.6250%

Cuba

29-311

7.8125%

Taos Pueblo (2)*

20-914

6.6250%

a

Jemez Springs

29-217

6.9375%

20-915

7.6875%

Taos/Taos Pueblo (1)

*

a

Jicarilla Apache Nation (1)

29-931

6.2500%

20-916

7.6875%

Taos/Taos Pueblo (2)

*

Jicarilla Apache Nation (2)

29-932

6.2500%

Taos Ski Valley*

20-414

8.1875%

Laguna Pueblo (1)

29-921

6.2500%

Remainder of County*

20-020

6.6250%

Laguna Pueblo (2)

29-922

6.2500%

TORRANCE

29-971

Pueblo de Cochiti (1)

6.2500%

Encino

22-410

7.0625%

Pueblo de Cochiti (2)

29-972

6.2500%

Estancia

22-503

7.5625%

Rio Rancho (Sandoval)

29-524

7.4375%

Moriarty

22-223

7.4375%

San Ysidro

29-409

6.7500%

Mountainair

22-127

7.6875%

Sandia Pueblo (1)

29-911

6.2500%

Willard

22-314

7.3125%

Sandia Pueblo (2)

29-912

6.2500%

Remainder of County

22-022

6.5000%

Santa Ana Pueblo (1)

29-951

6.2500%

UNION

Santa Ana Pueblo (2)

29-952

6.2500%

Clayton

18-128

7.8750%

Kewa Pueblo (1) - formerly Santo Domingo Pueblo

29-973

6.2500%

Des Moines

18-224

7.5000%

Kewa Pueblo (2) - formerly Santo Domingo Pueblo

29-974

6.2500%

Folsom

18-411

7.5000%

Village at Rio Rancho TIDD

29-525

7.4375%

Grenville

18-315

7.5000%

Remainder of County

29-029

6.2500%

Remainder of County

18-018

6.0625%

SAN JUAN

VALENCIA

Aztec

16-218

7.7500%

Belen

14-129

7.8125%

Bloomfield

16-312

7.6875%

Bosque Farms

14-505

7.6875%

Farmington

16-121

7.1250%

Laguna Pueblo (1)

14-901

6.3750%

Valley Water and Sanitation District

16-321

6.5625%

Laguna Pueblo (2)

14-902

6.3750%

Remainder of County

16-016

6.3125%

Los Lunas

14-316

7.5625%

SAN MIGUEL

Peralta

14-412

7.4375%

Las Vegas

12-122

8.0625%

Remainder of County

14-014

6.3750%

Mosquero (San Miguel)

12-418

7.0625%

Pecos

12-313

7.4375%

Remainder of County

12-012

6.5000%

OTHER TAXES AND REPORTING LOCATIONS

Location

SANTA FE

Code

Edgewood

01-320

7.8750%

Leased Vehicle Gross Receipts Tax - 5.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

44-444

Espanola (Santa Fe)

01-226

8.4375%

Leased Vehicle Surcharge - $2.00/day/vehicle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

44-455

a

01-903

8.4375%

Governmental Gross Receipts Tax - 5.00%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

55-055

Espanola/Santa Clara Grant (1)

a

01-904

8.4375%

Out-of-State Business (R&D Services) - 5.125% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

77-777

Espanola/Santa Clara Grant (2)

Kewa Pueblo (1) - formerly Santo Domingo Pueblo

01-973

6.6250%

Out-of-State Business (All Other) - 5.125% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

88-888

Kewa Pueblo (2) - formerly Santo Domingo Pueblo

01-974

6.6250%

Uranium Hexafluoride GRT Deduction (7-9-90) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D0-001

Nambe Pueblo (1)

01-951

6.6250%

Electricity Conversion GRT Deduction (7-9-103.1) . . . . . . . . . . . . . . . . . . . . . .

D0-004

Nambe Pueblo (2)

01-952

6.6250%

Electricity Exchange GRT Deduction (7-9-103.2) . . . . . . . . . . . . . . . . . . . . . .

D0-005

Pojoaque Pueblo (1)

01-961

6.6250%

Pojoaque Pueblo (2)

01-962

6.6250%

01-971

Pueblo de Cochiti (1)

6.6250%

Pueblo de Cochiti (2)

01-972

6.6250%

NOTE KEY

Santa Clara Pueblo (1)

01-901

6.6250%

(1) Sales to tribal entities or members

Santa Clara Pueblo (2)

01-902

6.6250%

(2) Sales to tribal non-members by tribal non-members

a

Santa Fe (city)

01-123

8.1875%

Businesses located on Pueblo land within the city limits.

b

Businesses located within the water district and the city limits.

Santa Fe Indian School/Nineteen Pueblos of NM (1)

01-907

8.1875%

c

01-908

8.1875%

Albuquerque Indian School property owned by the 19 Pueblos of NM.

Santa Fe Indian School/Nineteen Pueblos of NM (2)

01-953

6.6250%

Pueblo of Tesuque (1)

01-954

6.6250%

Pueblo of Tesuque (2)

Remainder of County

01-001

6.6250%

* Indicates rate change due to enactment/expiration of local option taxes

and/or change in the state gross receipts tax rate.

STATE GROSS RECEIPTS TAX RATE = 5.125%

COMPENSATING TAX RATE ON PROPERTY = 5.125%

COMPENSATING TAX RATE ON SERVICES = 5%

1

1 2

2