Form Rpd-41244 - Technology Jobs Tax Credit Claim Form - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

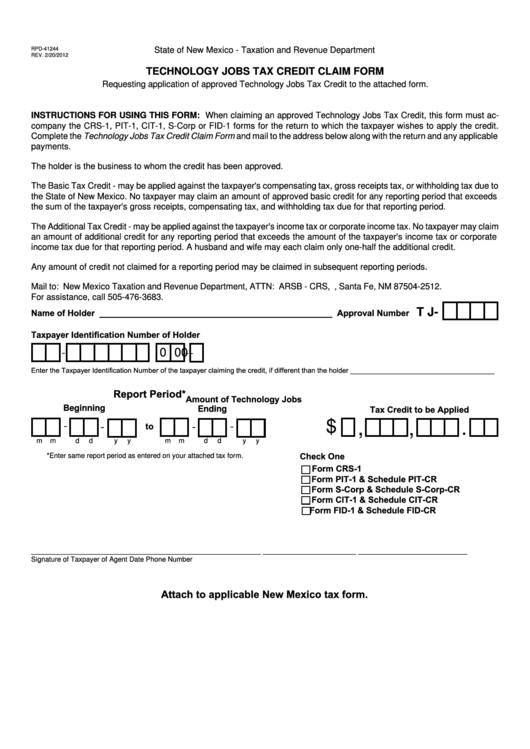

RPD-41244

State of New Mexico - Taxation and Revenue Department

REV. 2/20/2012

TECHNOLOGY JOBS TAX CREDIT CLAIM FORM

Requesting application of approved Technology Jobs Tax Credit to the attached form.

INSTRUCTIONS FOR USING THIS FORM: When claiming an approved Technology Jobs Tax Credit, this form must ac-

company the CRS-1, PIT-1, CIT-1, S-Corp or FID-1 forms for the return to which the taxpayer wishes to apply the credit.

Complete the Technology Jobs Tax Credit Claim Form and mail to the address below along with the return and any applicable

payments.

The holder is the business to whom the credit has been approved.

The Basic Tax Credit - may be applied against the taxpayer's compensating tax, gross receipts tax, or withholding tax due to

the State of New Mexico. No taxpayer may claim an amount of approved basic credit for any reporting period that exceeds

the sum of the taxpayer's gross receipts, compensating tax, and withholding tax due for that reporting period.

The Additional Tax Credit - may be applied against the taxpayer's income tax or corporate income tax. No taxpayer may claim

an amount of additional credit for any reporting period that exceeds the amount of the taxpayer's income tax or corporate

income tax due for that reporting period. A husband and wife may each claim only one-half the additional credit.

Any amount of credit not claimed for a reporting period may be claimed in subsequent reporting periods.

Mail to: New Mexico Taxation and Revenue Department, ATTN: ARSB - CRS, P.O. Box 25128, Santa Fe, NM 87504-2512.

For assistance, call 505-476-3683.

Name of Holder _________________________________________________ Approval Number

T J-

Taxpayer Identification Number of Holder

-

-

-

0

0 0

Enter the Taxpayer Identification Number of the taxpayer claiming the credit, if different than the holder _____________________________________

Report Period*

Amount of Technology Jobs

Tax Credit to be Applied

Beginning

Ending

-

-

-

-

$

to

,

.

,

m

m

d

d

y

y

m

m

d

d

y

y

Check One

*Enter same report period as entered on your attached tax form.

Form CRS-1

Form PIT-1 & Schedule PIT-CR

Form S-Corp & Schedule S-Corp-CR

Form CIT-1 & Schedule CIT-CR

Form FID-1 & Schedule FID-CR

___________________________________________________________

________________________

____________________________

Signature of Taxpayer of Agent

Date

Phone Number

Attach to applicable New Mexico tax form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1