Form Rpd-41371 - Application For Veteran Employment Tax Credit - State Of New Mexico Taxation And Revenue Department Page 2

ADVERTISEMENT

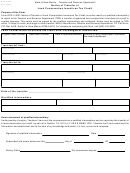

STATE OF NEW MEXICO

RPD-41371

Int. 09/04/2012

TAXATION AND REVENUE DEPARTMENT

APPLICATION FOR VETERAN EMPLOYMENT TAX CREDIT

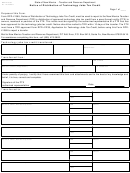

Part II - Distribution of credit to owners, members or partners, if the employer files a partnership return.

An owner, member or partner (owners) may be allocated the right to claim a veteran employment tax credit in proportion to its

ownership interest if the taxpayer owns an interest in a business entity that is taxed for federal income tax purposes as a partner-

ship. To allocate the credit to the owners of the business entity qualifying for the credit, complete the following for each owner. The

total credit that may be claimed by all members of the partnership or other business entity shall not exceed the allowable credit

approved. If additional space is needed, continue the list on a copy of this page.

Distributed to:

Name of owner, member or partner

SSN

Percent of ownership

Amount

FEIN

Name of owner, member or partner

SSN

Percent of ownership

Amount

FEIN

Name of owner, member or partner

SSN

Percent of ownership

Amount

FEIN

Name of owner, member or partner

SSN

Amount

Percent of ownership

FEIN

Name of owner, member or partner

SSN

Amount

Percent of ownership

FEIN

Name of owner, member or partner

SSN

Amount

Percent of ownership

FEIN

Name of owner, member or partner

SSN

Amount

Percent of ownership

FEIN

Name of owner, member or partner

SSN

Amount

Percent of ownership

FEIN

Name of owner, member or partner

SSN

Percent of ownership

Amount

FEIN

Name of owner, member or partner

SSN

Amount

Percent of ownership

FEIN

Name of owner, member or partner

SSN

Amount

Percent of ownership

FEIN

Name of owner, member or partner

SSN

Amount

Percent of ownership

FEIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4