Form Rpd-41371 - Application For Veteran Employment Tax Credit - State Of New Mexico Taxation And Revenue Department Page 4

ADVERTISEMENT

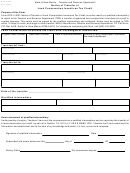

STATE OF NEW MEXICO

RPD-41371

Int. 09/04/2012

TAXATION AND REVENUE DEPARTMENT

APPLICATION FOR VETERAN EMPLOYMENT TAX CREDIT

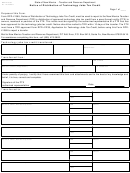

INSTRUCTIONS

Page 2 of 2

sonal or corporate income tax due by attaching Form RPD-

employed by the taxpayer prior to the individual’s deployment.

41372, Veteran Employment Tax Credit Claim Form, to the

The qualified military veteran must work or be expected to

tax return for the tax year in which you employ the veteran.

work an average of 40 hours or more per week.

Excess credit may be carried forward for three years. Mail

all forms to the address on the tax return.

DEFINITIONS:

A "qualified military veteran" means an individual who is

hired within two years of receipt of an honorable discharge

from a branch of the U.S. military, who works at least 40

hours per week during the taxable year for which the veteran

employment tax credit is claimed, and who was not previously

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4