Form Rpd-41371 - Application For Veteran Employment Tax Credit - State Of New Mexico Taxation And Revenue Department Page 3

ADVERTISEMENT

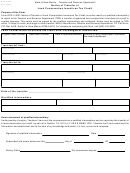

STATE OF NEW MEXICO

RPD-41371

Int. 09/04/2012

TAXATION AND REVENUE DEPARTMENT

APPLICATION FOR VETERAN EMPLOYMENT TAX CREDIT

INSTRUCTIONS

Page 1 of 2

is a qualified military veteran.

ABOUT THIS TAX CREDIT:

For tax years beginning on or after January 1, 2012, but not

after December 31, 2016, a taxpayer who employs a quali-

HOW TO COMPLETE THIS FORM:

fied military veteran, for at least 40 hours per week, in New

Complete all information requested. Enter the date using a

Mexico is eligible for a credit against the taxpayer’s personal

two-digit month and day and a four-digit year (mm/dd/yyyy).

or corporate income tax liability for up to $1,000 for wages

Enter the name, address and the New Mexico CRS identifica-

paid to each qualified military veteran. If the veteran’s quali-

tion number of the employer. The physical address should be

fied period of employment is less than a full year, the credit

the address where the business is located or based. Enter

for that year is reduced based on the ratio of the qualified

the mailing address if it is a different address.

period of employment over the full tax year of the employer.

•

An employer may not receive the credit for any individual

1.

Enter the employer's tax year in which the eligible em-

qualified military veteran for more than one calendar year

ployment took place. Enter the first and last day of the

from the date of hire.

tax year. Enter the date using a two-digit month and day

•

Multiple employers may not receive a credit for more than

and a four-digit year (mm/dd/yyyy).

one year combined for the same qualified military veteran.

•

Only one employer may receive the credit for a specific

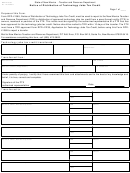

2. Enter the number of certifications (Form RPD-41370,

veteran during a tax year.

Certification of Eligibility for the Veteran Employment

•

The date of discharge may not exceed two years from

Tax Credit) attached and included in this application.

the date the employer hired the military veteran.

3. Enter the sum of the veteran employment tax credit (from

•

The veteran employment tax credit is only allowed for the

line 10 of each certification attached). A maximum of

employment of a veteran who was not previously em-

$1,000 for each qualified military veteran in tax year is

ployed by the taxpayer prior to the individual’s deployment.

allowed.

That portion of a veteran employment tax credit approved

Sign and date the application.

by Taxation and Revenue Department (TRD) that exceeds

a taxpayer’s income tax liability in the tax year in which the

Mail to:

veteran employment tax credit is claimed may not be re-

Taxation and Revenue Department

funded to the taxpayer, but may be carried forward for up to

P.O. Box 5418

three years. The veteran employment tax credit may not be

Santa Fe, NM 87502-5418.

transferred to another taxpayer.

IMPORTANT INFORMATION TO KNOW ABOUT THE

A husband and wife filing separate returns for a tax year for

APPROVAL OF THE CREDIT:

which they could have filed a joint return, each may claim

•

Failure to properly complete the application and submit any

only one-half of the veteran employment tax credit that would

required documents may result in a denial of the credit.

have been claimed on a joint return. An owner, member or

partner (owners) may be allocated the right to claim a veteran

•

Once a qualified military veteran is approved on an ap-

employment tax credit in proportion to its ownership interest

plication for a tax year, any credit requested by another

if the taxpayer owns an interest in a business entity that is

employer for the same military veteran on subsequent

taxed for federal income tax purposes as a partnership. To

applications for the same tax year will be denied.

allocate the credit to the owners of the business entity qualify-

•

Applications will be processed in the order in which they

ing for the credit, complete Part II. The total credit that may

are received.

be claimed by all members of the partnership or other busi-

ness entity shall not exceed the allowable credit approved.

•

When the period of employment, beginning from the

date of hire through the first year, crosses two tax years,

ATTACHMENTS:

one application for each tax year for the same qualified

The taxpayer must provide a copy of the qualified military

military veteran may be approved.

veteran’s DD Form 214, Certificate of Release or Discharge

•

For multiple claims received for the same qualified mili-

from Active Duty , or other evidence acceptable to the Depart-

tary veteran, the dates of employment will be compared

ment. The document must show the date the military veteran

to ensure that a credit is allowed for only one full year

was honorably discharged from a branch of the United States

of employment.

military. Evidence other than the qualified military veteran’s

DD Form 214, should be approved through the Department

before submitting the application. The Department may re-

HOW TO CLAIM THIS TAX CREDIT:

quest additional information establishing that the employee

Once approved, you may claim the credit against your per-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4