Instructions For Rct-143 Return

ADVERTISEMENT

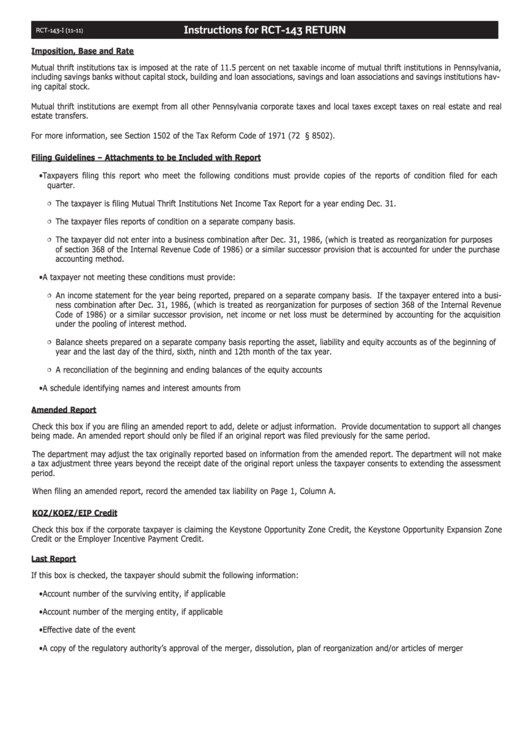

Instructions for RCT-143 RETURN

RCT-143-I (11-11

)

Imposition, Base and Rate

Mutual thrift institutions tax is imposed at the rate of 11.5 percent on net taxable income of mutual thrift institutions in Pennsylvania,

including savings banks without capital stock, building and loan associations, savings and loan associations and savings institutions hav-

ing capital stock.

Mutual thrift institutions are exempt from all other Pennsylvania corporate taxes and local taxes except taxes on real estate and real

estate transfers.

For more information, see Section 1502 of the Tax Reform Code of 1971 (72 P.S. § 8502).

Filing Guidelines – Attachments to be Included with Report

• Taxpayers filing this report who meet the following conditions must provide copies of the reports of condition filed for each

quarter.

The taxpayer is filing Mutual Thrift Institutions Net Income Tax Report for a year ending Dec. 31.

¶

¶

The taxpayer files reports of condition on a separate company basis.

The taxpayer did not enter into a business combination after Dec. 31, 1986, (which is treated as reorganization for purposes

¶

of section 368 of the Internal Revenue Code of 1986) or a similar successor provision that is accounted for under the purchase

accounting method.

• A taxpayer not meeting these conditions must provide:

An income statement for the year being reported, prepared on a separate company basis. If the taxpayer entered into a busi-

¶

ness combination after Dec. 31, 1986, (which is treated as reorganization for purposes of section 368 of the Internal Revenue

Code of 1986) or a similar successor provision, net income or net loss must be determined by accounting for the acquisition

under the pooling of interest method.

Balance sheets prepared on a separate company basis reporting the asset, liability and equity accounts as of the beginning of

¶

year and the last day of the third, sixth, ninth and 12th month of the tax year.

A reconciliation of the beginning and ending balances of the equity accounts

¶

• A schedule identifying names and interest amounts from U.S. and Pennsylvania obligations must accompany the report.

Amended Report

Check this box if you are filing an amended report to add, delete or adjust information. Provide documentation to support all changes

being made. An amended report should only be filed if an original report was filed previously for the same period.

The department may adjust the tax originally reported based on information from the amended report. The department will not make

a tax adjustment three years beyond the receipt date of the original report unless the taxpayer consents to extending the assessment

period.

When filing an amended report, record the amended tax liability on Page 1, Column A.

KOZ/KOEZ/EIP Credit

Check this box if the corporate taxpayer is claiming the Keystone Opportunity Zone Credit, the Keystone Opportunity Expansion Zone

Credit or the Employer Incentive Payment Credit.

Last Report

If this box is checked, the taxpayer should submit the following information:

• Account number of the surviving entity, if applicable

• Account number of the merging entity, if applicable

• Effective date of the event

• A copy of the regulatory authority’s approval of the merger, dissolution, plan of reorganization and/or articles of merger

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5