Instructions For Rct-121 Return

ADVERTISEMENT

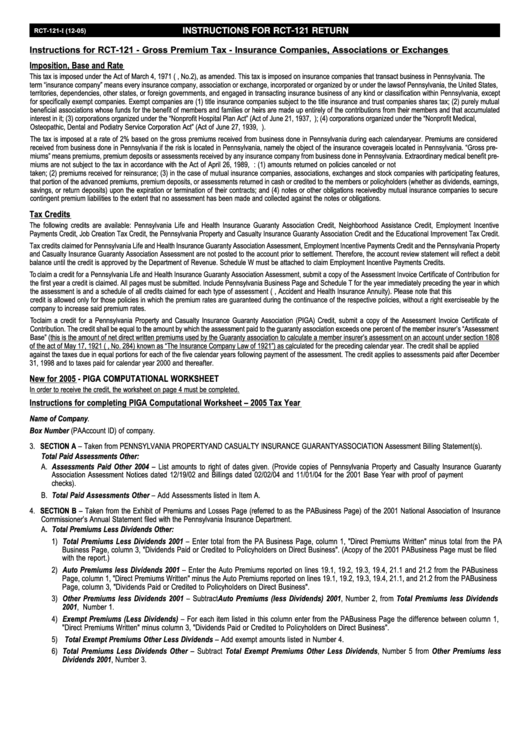

INSTRUCTIONS FOR RCT-121 RETURN

RCT-121-I (12-05)

Instructions for RCT-121 - Gross Premium Tax - Insurance Companies, Associations or Exchanges

Imposition, Base and Rate

This tax is imposed under the Act of March 4, 1971 (P.L. 6, No.2), as amended. This tax is imposed on insurance companies that transact business in Pennsylvania. The

term “insurance company” means every insurance company, association or exchange, incorporated or organized by or under the laws of Pennsylvania, the United States,

territories, dependencies, other states, or foreign governments, and engaged in transacting insurance business of any kind or classification within Pennsylvania, except

for specifically exempt companies. Exempt companies are (1) title insurance companies subject to the title insurance and trust companies shares tax; (2) purely mutual

beneficial associations whose funds for the benefit of members and families or heirs are made up entirely of the contributions from their members and that accumulated

interest in it; (3) corporations organized under the “Nonprofit Hospital Plan Act” (Act of June 21, 1937, P.L. 1948); (4) corporations organized under the “Nonprofit Medical,

Osteopathic, Dental and Podiatry Service Corporation Act” (Act of June 27, 1939, P.L. 1125).

The tax is imposed at a rate of 2% based on the gross premiums received from business done in Pennsylvania during each calendar year. Premiums are considered

received from business done in Pennsylvania if the risk is located in Pennsylvania, namely the object of the insurance coverage is located in Pennsylvania. “Gross pre-

miums” means premiums, premium deposits or assessments received by any insurance company from business done in Pennsylvania. Extraordinary medical benefit pre-

miums are not subject to the tax in accordance with the Act of April 26, 1989, P.L. 6. Amounts that can be deducted: (1) amounts returned on policies canceled or not

taken; (2) premiums received for reinsurance; (3) in the case of mutual insurance companies, associations, exchanges and stock companies with participating features,

that portion of the advanced premiums, premium deposits, or assessments returned in cash or credited to the members or policyholders (whether as dividends, earnings,

savings, or return deposits) upon the expiration or termination of their contracts; and (4) notes or other obligations received by mutual insurance companies to secure

contingent premium liabilities to the extent that no assessment has been made and collected against the notes or obligations.

Tax Credits

The following credits are available: Pennsylvania Life and Health Insurance Guaranty Association Credit, Neighborhood Assistance Credit, Employment Incentive

Payments Credit, Job Creation Tax Credit, the Pennsylvania Property and Casualty Insurance Guaranty Association Credit and the Educational Improvement Tax Credit.

Tax credits claimed for Pennsylvania Life and Health Insurance Guaranty Association Assessment, Employment Incentive Payments Credit and the Pennsylvania Property

and Casualty Insurance Guaranty Association Assessment are not posted to the account prior to settlement. Therefore, the account review statement will reflect a debit

balance until the credit is approved by the Department of Revenue. Schedule W must be attached to claim Employment Incentive Payments Credits.

To claim a credit for a Pennsylvania Life and Health Insurance Guaranty Association Assessment, submit a copy of the Assessment Invoice Certificate of Contribution for

the first year a credit is claimed. All pages must be submitted. Include Pennsylvania Business Page and Schedule T for the year immediately preceding the year in which

the assessment is and a schedule of all credits claimed for each type of assessment (i.e. Life Insurance, Accident and Health Insurance Annuity). Please note that this

credit is allowed only for those policies in which the premium rates are guaranteed during the continuance of the respective policies, without a right exerciseable by the

company to increase said premium rates.

To claim a credit for a Pennsylvania Property and Casualty Insurance Guaranty Association (PIGA) Credit, submit a copy of the Assessment Invoice Certificate of

Contribution. The credit shall be equal to the amount by which the assessment paid to the guaranty association exceeds one percent of the member insurer’s “Assessment

Base” (this is the amount of net direct written premiums used by the Guaranty association to calculate a member insurer’s assessment on an account under section 1808

of the act of May 17, 1921 (P.L. 682, No. 284) known as “The Insurance Company Law of 1921”) as calculated for the preceding calendar year. The credit shall be applied

against the taxes due in equal portions for each of the five calendar years following payment of the assessment. The credit applies to assessments paid after December

31, 1998 and to taxes paid for calendar year 2000 and thereafter.

New for 2005 - PIGA COMPUTATIONAL WORKSHEET

In order to receive the credit, the worksheet on page 4 must be completed.

Instructions for completing PIGA Computational Worksheet – 2005 Tax Year

1. Print Name of Company.

2. Enter Box Number (PA Account ID) of company.

3. SECTION A – Taken from PENNSYLVANIA PROPERTY AND CASUALTY INSURANCE GUARANTY ASSOCIATION Assessment Billing Statement(s).

Total Paid Assessments Other:

A. Assessments Paid Other 2004 – List amounts to right of dates given. (Provide copies of Pennsylvania Property and Casualty Insurance Guaranty

Association Assessment Notices dated 12/19/02 and Billings dated 02/02/04 and 11/01/04 for the 2001 Base Year with proof of payment i.e. canceled

checks).

B. Total Paid Assessments Other – Add Assessments listed in Item A.

4. SECTION B – Taken from the Exhibit of Premiums and Losses Page (referred to as the PA Business Page) of the 2001 National Association of Insurance

Commissioner’s Annual Statement filed with the Pennsylvania Insurance Department.

A. Total Premiums Less Dividends Other:

1) Total Premiums Less Dividends 2001 – Enter total from the PA Business Page, column 1, "Direct Premiums Written" minus total from the PA

Business Page, column 3, "Dividends Paid or Credited to Policyholders on Direct Business". (A copy of the 2001 PA Business Page must be filed

with the report.)

2) Auto Premiums less Dividends 2001 – Enter the Auto Premiums reported on lines 19.1, 19.2, 19.3, 19.4, 21.1 and 21.2 from the PA Business

Page, column 1, "Direct Premiums Written" minus the Auto Premiums reported on lines 19.1, 19.2, 19.3, 19.4, 21.1, and 21.2 from the PA Business

Page, column 3, "Dividends Paid or Credited to Policyholders on Direct Business".

3) Other Premiums less Dividends 2001 – Subtract Auto Premiums (less Dividends) 2001, Number 2, from Total Premiums less Dividends

2001, Number 1.

4) Exempt Premiums (Less Dividends) – For each item listed in this column enter from the PA Business Page the difference between column 1,

"Direct Premiums Written" minus column 3, "Dividends Paid or Credited to Policyholders on Direct Business".

5) Total Exempt Premiums Other Less Dividends – Add exempt amounts listed in Number 4.

6) Total Premiums Less Dividends Other – Subtract Total Exempt Premiums Other Less Dividends, Number 5 from Other Premiums less

Dividends 2001, Number 3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3