Instructions For Rct-125 Return

ADVERTISEMENT

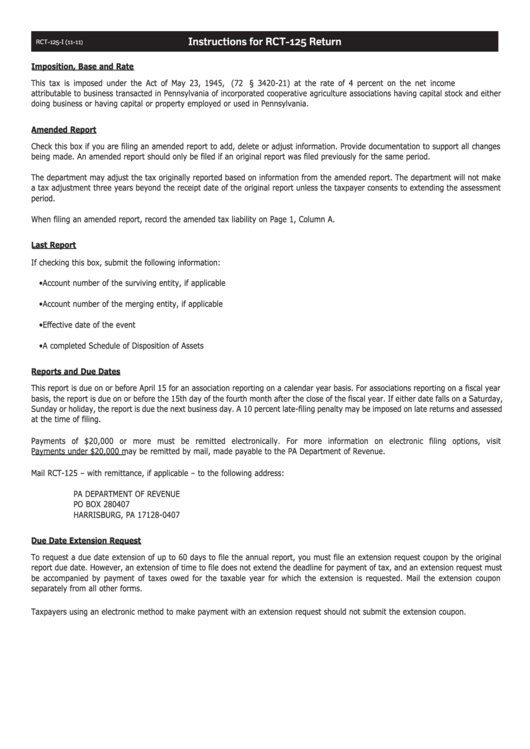

Instructions for RCT-125 Return

RCT-125-I (11-11

)

Imposition, Base and Rate

This tax is imposed under the Act of May 23, 1945, P.L. 893 (72 P.S. § 3420-21) at the rate of 4 percent on the net income

attributable to business transacted in Pennsylvania of incorporated cooperative agriculture associations having capital stock and either

doing business or having capital or property employed or used in Pennsylvania.

Amended Report

Check this box if you are filing an amended report to add, delete or adjust information. Provide documentation to support all changes

being made. An amended report should only be filed if an original report was filed previously for the same period.

The department may adjust the tax originally reported based on information from the amended report. The department will not make

a tax adjustment three years beyond the receipt date of the original report unless the taxpayer consents to extending the assessment

period.

When filing an amended report, record the amended tax liability on Page 1, Column A.

Last Report

If checking this box, submit the following information:

• Account number of the surviving entity, if applicable

• Account number of the merging entity, if applicable

• Effective date of the event

• A completed Schedule of Disposition of Assets

Reports and Due Dates

This report is due on or before April 15 for an association reporting on a calendar year basis. For associations reporting on a fiscal year

basis, the report is due on or before the 15th day of the fourth month after the close of the fiscal year. If either date falls on a Saturday,

Sunday or holiday, the report is due the next business day. A 10 percent late-filing penalty may be imposed on late returns and assessed

at the time of filing.

Payments of $20,000 or more must be remitted electronically. For more information on electronic filing options, visit

Payments under $20,000 may be remitted by mail, made payable to the PA Department of Revenue.

Mail RCT-125 – with remittance, if applicable – to the following address:

PA DEPARTMENT OF REVENUE

PO BOX 280407

HARRISBURG, PA 17128-0407

Due Date Extension Request

To request a due date extension of up to 60 days to file the annual report, you must file an extension request coupon by the original

report due date. However, an extension of time to file does not extend the deadline for payment of tax, and an extension request must

be accompanied by payment of taxes owed for the taxable year for which the extension is requested. Mail the extension coupon

separately from all other forms.

Taxpayers using an electronic method to make payment with an extension request should not submit the extension coupon.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2