AP-193-2

(Rev.8-11/13)

Additional Information

Each Retail Permit Holder –

• must keep the permit on public display at the place of business for which the permit was issued.

• who has a permit assigned to a vehicle shall post the permit in a conspicuous place on the vehicle.

• who operates a cigarette vending machine shall place a retailer's permit (decal) on the applicable machine.

• must also have an active sales tax permit for each commercial business location from which cigarette/tobacco

products are sold. This includes owners of coin-operated cigarette/tobacco products vending machines and/or

vehicles from which cigarettes, cigars and/or tobacco products are sold and any person who sells cigarettes on

the Internet or by telephone or mail order.

Records –

• Retailers must buy cigarettes and tobacco products from Texas permitted distributors and wholesalers and NOT

from other retailers.

• Retailers must collect, report, and remit sales tax on all sales of cigarettes, cigars and tobacco products monthly,

quarterly or yearly depending on the volume of sales.

Your permit MUST be prominently displayed in your place of business.

Retailer Permits

• Retailer permits are non-transferable and non-assignable.

• New retailer permits are valid from the date of issuance through May 31 of each even numbered year.

• Renewals are valid for two years, beginning June 1 of each even numbered year and expiring on May 31 of each even

numbered year.

Allow a minimum of 16 business days for processing the application.

Permit Fee

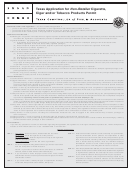

• The $180 permit fee for the retailer permit is prorated over a two year permit period.

(Example: June 1, 2006 - May 31, 2008; June 1, 2008 - May 31, 2010, etc.)

• During the last three months of the permit period, the Comptroller may collect the prorated permit fee for the current

permit period and the fee for the next permit period.

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

EVEN

YEAR

$202.50* $195.00*

187.50* $180.00

$172.50

$165.00

$157.50

$150.00

$142.50

$135.00

*PRORATED

*PRORATED *PRORATED

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

ODD

YEAR

$127.50

$120.00

$112.50

$105.00

$97.50

$90.00

$82.50

$75.00

$67.50

$60.00

$52.50

$45.00

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

EVEN

YEAR

$37.50

$30.00

$22.50*

$15.00*

$7.50*

• If you have been selling without a permit, a $50 late fee will be assessed on each existing location, vending machine

and/or vehicle that is not in compliance with permit requirements. Operating without a valid permit is a Class A

misdemeanor and is punishable by a fine of not more than $2,000 per day.

For Assistance

Contact the Comptroller's office at (800) 862-2260 or (512) 463-3731, or visit the Comptroller's website at

if you have questions regarding cigarette, cigar and/or tobacco products tax. Receive tax help

via e-mail at tax.help@cpa.state.tx.us. You can also visit a tax specialist at a local field office near you.

All information provided on this form may be disclosed to the public, upon request, under

the Texas Public Information Act, Government Code, Chapter 552.

You have certain rights under Chapters 552 and 559, Texas Government Code, to review, request and correct information we

have on file about you. Contact us at the address or telephone numbers listed on this form.

Mail your completed application with the required permit fee to:

Make check payable to:

Comptroller of Public Accounts

State Comptroller

111 E. 17th St.

Austin, TX 78774-0100

1

1 2

2 3

3 4

4