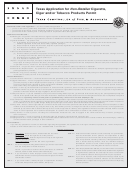

Texas Application for

AP-193-4

(Rev.8-11/13)

Retailer Cigarette, Cigar and/or

Tobacco Products Taxes Permit

• Type or print.

Page 2

Name (same as Item 2)

Taxpayer number (same as Item 1)

17. Will you be selling cigarettes, cigars and/or tobacco products from vending machine(s) that you own? ...................................

YES

NO

If you answered "YES," in Item 17, skip to Item 19. If you answered "NO," in Item 17, proceed to Item 18.

18. If you do not own the vending machine(s), list the machine owner's name and mailing address. (Include street and number, P.O. Box or rural route

and box number, city, state and ZIP code.)

19. Do you own the cigarettes, cigars and/or tobacco products displayed for sale in the vending machine(s)? ..............................

YES

NO

20. Will you sell or store cigarettes, cigars and/or tobacco products other than through the vending machine(s)? .........................

YES

NO

21. Will you sell or store cigarettes, cigars and/or tobacco products at the location where the records will be kept? ......................

YES

NO

22. If you are selling cigarettes, cigars and/or tobacco products from a vending machine, where will the business records for the machines be kept?

MUST be a commercial business location.

(Use street address or directions, city, state and ZIP code – NOT P.O. Box, rural route or public storage facility.)

23. Enter the following information for each vending machine (Use additional sheets or complete Form 69-119 to add additional vending

machines, if necessary.)

MAKE OR MANUFACTURER

MODEL

SERIAL NUMBER

INVENTORY NUMBER

IN-SERVICE DATE

LOCATION NAME:

LOCATION ADDRESS:

(Include street, city and ZIP code.)

PHYSICAL PLACEMENT OF

MACHINE WITHIN LOCATION:

MAKE OR MANUFACTURER

MODEL

SERIAL NUMBER

INVENTORY NUMBER

IN-SERVICE DATE

LOCATION NAME:

LOCATION ADDRESS:

(Include street, city and ZIP code.)

PHYSICAL PLACEMENT OF

MACHINE WITHIN LOCATION:

24. Will you be selling cigarettes, cigars and/or tobacco products from a motor vehicle? ................................................................

YES

NO

25. Enter the following information for each vehicle (Use additional sheets or complete Form 69-122 to add additional vehicles, if necessary.)

YEAR

MAKE

MODEL

LICENSE PLATE NO.

STATE

MOTOR VEHICLE ID NO.

IN-SERVICE DATE

26. If you are selling cigarettes, cigars and/or tobacco products from a motor vehicle, where will the business records for the vehicle(s) be maintained?

MUST be a commercial location.

(Use street address or directions, city, state and ZIP code – NOT P.O. Box, rural route or public storage facility.)

Date of application

27. I (We) declare that the information in this document and any attachments is true and correct to the best of my (our)

month

day

year

knowledge and belief.

The sole owner, all general partners, corporation president, vice-president, secretary or treasurer, or an authorized

representative must sign this application. Representative must submit a power of attorney with application.

Type or print name and title of sole owner, partner or officer

Sole owner, partner or officer

Type or print name and title of partner or officer

Partner or officer

Type or print name and title of partner or officer

Partner or officer

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity to

conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available online

at You may also want to contact the municipality and county in which you will conduct business to determine

any local governmental requirements.

1

1 2

2 3

3 4

4