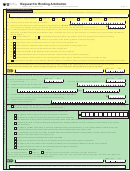

AP-219-2

(Rev.5-13/9)

Specific Instructions

This form is designed for use by property owners or agents, appraisal districts and the Comptroller’s office. Only complete the

part of the form that applies to you.

Arbitrating Contiguous Properties: You may arbitrate more than one property for a single deposit, provided they are

contiguous to one another. Please indicate if you choose to arbitrate contiguous property in box 18 and follow the directions

before filling out the rest of the form.

Properties Valued at More Than $1 Million: To arbitrate a property valued at more than $1 million by the appraisal review

board, the property must qualify as the property owner’s residence homestead under Tax Code Section 11.13.

Any questions that you have about completing the form should be directed to the Comptroller’s office. Please contact us by

calling 1-800-252-9121.

For Property Owners or Agents

Complete the form steps 1 through 24. You must type or print in black ink so that the information can be scanned. All questions

must be answered so that your request can be processed in a timely fashion. Agents must submit a written authorization signed

by the property owner, on the form prescribed by the Comptroller (Form 50-791), that states the specific authority given to

the agent for this request for binding arbitration. An agent’s fiduciary form used for representation at the appraisal district or

appraisal review board will not be accepted.

Any refund to an owner or agent is subject to the provisions of Texas Government Code, §403.055, and related statutory

provisions and rules. Therefore, the Social Security number and/or Tax Identification Number of the individual to whom a refund

payment is requested or authorized in the Request for Binding Arbitration is required.

For Contiguous Arbitration: You must fill out a separate copy of page 2 on each property to be arbitrated. Enter an individual

value you believe is correct for each property to be arbitrated. The Comptroller’s office will calculate the total value of all the

properties that will be used to determine who pays the arbitrator’s fee.

For Appraisal Districts

Complete the first line of the form marked “CAD” on page 1, filling in the deposit amount, your appraisal district

number, the year and the number that your appraisal district is assigning this arbitration request.

Next, complete the portion of the form marked “For Appraisal District Use Only” on page 2. You must provide the value deter-

mined by the appraisal review board for the subject property and the Geographic Identification Number (GEO#) and Record

Identification Number (R#). You must also provide a copy of the order determining protest from the appraisal review board. It

is important that the order indicates the ARB certified appraised or market value of the subject property pursuant to Tax Code

Section 41.41(a)(1) or (2). Any other determination cannot be the subject of an arbitration proceeding.

Check the applicable boxes concerning the request for binding arbitration. By checking the boxes, you are certifying the validity

of the inquiries; therefore, care must be taken in the responses. The chief appraiser or designated appraisal district employee

must sign the form in order to finalize the certification required by law.

For Contiguous Arbitration: You must fill out a separate copy of page 2 on each property to be arbitrated. Enter in the

individual ARB value for each property to be arbitrated. Submit an ARB order for each property. The Comptroller’s office will

calculate the total value of all the properties that will be used to determine who pays the arbitrator’s fee.

Property Owner or Agent Checklist

The property owner or agent has signed the request for arbitration.

The request was filed with the appraisal district not later than the 45th day after the date the property owner received the

appraisal review board order determining the protest.

A deposit in the form of a check issued and guaranteed by a banking institution (such as a cashier’s or teller’s check) or by

a money order is attached.

If an agent is submitting the request, a written authorization (Form 50-791) signed by the property owner is attached,

expressly authorizing the agent to sign and file the request.

The request for arbitration concerns the appraised or market value of $1 million or less for the property for which an appraisal

review board order was issued, or qualifies as the owner’s residence homestead under Tax Code Section 11.13.

The appeal does not involve any matter in dispute other than the determination of the appraised or market value of the property

pursuant to Tax Code Section 41.41(a)(1) or (2).

All parts of the request for arbitration have been completed.

Taxes are not delinquent at this time on the property that is the subject of this request for arbitration.

The property that is the subject of this request for arbitration is not the subject of litigation for the tax year in question.

Please retain a copy of this form and the deposit for your records.

1

1 2

2 3

3 4

4