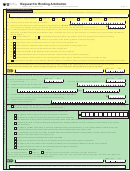

Request for Binding Arbitration

AP-219-3

PRINT FORM

CLEAR FORM

(Rev.5-13/9)

Page 1

• Type or print in black ink.

• Do not write in shaded areas.

ARBITRATION NUMBER (Appraisal District Only)

0 6 8

9 9 1 0 0

. 0 0

TP

POSTMARK DATE

T-CODE

DEPOSIT CODE

PAYMENT AMOUNT

CAD No.

Year

CAD Assigned No.

PROPERTY OWNER INFORMATION - INDIVIDUAL

1. Owner’s name (Last name, first name, middle initial, suffix (i.e, Jr., III, etc.))

Last name

First name

M.I.

Suffix

3. Taxpayer number for reporting any Texas tax OR Texas Identification

2. Owner’s Social Security number*

* Your Social Security number is not subject to

Number if you now have or

public disclosure according to Section 552.147,

have ever had one.

Tex. Govt. Code.

-- Non company owners skip to Item 7 --

PROPERTY OWNER INFORMATION - COMPANY

4. Corporation or partnership or estate name

Contact Name

5. Taxpayer number for reporting any Texas tax OR Texas Identification Number if you now have or have ever had one

6. Federal Employer Identification Number (FEIN) assigned by the Internal Revenue Service ...................................................

7. Mailing address, city, state, ZIP code with extension

Street number, P.O. Box, or rural route and box number

City

State/province

ZIP code

County (or country, if outside the U.S.)

8. Physical location

Street number or rural route and box number

City

State/province

ZIP code

County (or country, if outside the U.S.)

Phone number (Mandatory)

FAX number (Optional)

9. Daytime phone (mandatory) and FAX number (optional) ...................

10. Email address* ........................

*Your email address is confidential according to Section 552.137, Tex. Govt. Code; however, by including the email address on this form, you are affirmatively consenting to its release under

the Public Information Act.

-- If you are not using an agent, skip to Item 18a --

PROPERTY AGENT INFORMATION

11. Individual’s name (Last name, first name, middle initial, suffix (i.e, Jr., III, etc.)) [Note: Agent must be an individual.]

Last name

First name

M.I.

Suffix

Social Security number

Texas Identification Number

12. Agent’s Social Security number*, Texas Identification Number or FEIN ...........

*Your Social Security number is not subject to public disclosure according to Section 552.147, Tex. Govt. Code.

FEIN

The number provided must be assigned to the individual agent.

13. Agent’s mailing address, city, state, ZIP code with extension

Street number or rural route and box number

City

State/province

ZIP code

County (or country, if outside the U.S.)

Phone number (Mandatory)

FAX number (Optional)

14. Daytime phone (mandatory) and FAX number (optional) ...................

15. Email address* ..........................

*Your email address is confidential according to Section 552.137, Tex. Govt. Code; however, by including the email address on this form, you are affirmatively consenting to its release under

the Public Information Act.

16. If the owner will be represented by an agent, please indicate the applicable agent’s designation required to represent an owner in binding arbitration:

An attorney licensed by the state of Texas ......................................................................................................State Bar No.

A real estate broker or salesperson licensed under Chapter 1101, Occupations Code .......................................License No.

A real estate appraiser licensed or certified under Chapter 1103, Occupations Code ................... License No.

-

-

T X

P R O P T C

A property tax consultant registered under Chapter 1152, Occupations Code ............. Registration No.

A certified public accountant licensed or certified under Chapter 901, Occupations Code .........................................License No.

17. If the owner has designated an agent, attach the written authorization to this form.

(Party receiving refund will also receive all

correspondence from Comptroller.)

Indicate if agent is given authority to receive a refund:

Yes

No

PROPERTY INFORMATION

18a. Are you requesting arbitration for contiguous properties?

Yes

No

If “No,” skip to Item 18b.

Important: If you are requesting arbitration for contiguous properties, you must make copies of

Page 2 and fill out and submit a separate Page 2 for each property being appealed.

1

1 2

2 3

3 4

4