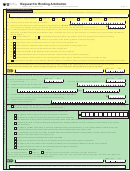

Request for Binding Arbitration

AP-219-4

(Rev.5-13/9)

Page 2

• Type or print in black ink.

• Do not write in shaded areas.

PROPERTY INFORMATION

18b. Address or location of the property requested for arbitration as shown on order of determination, and account number:

19. Type of property being appealed:

Residential

Land

Commercial

Minerals

Agricultural

Business personal property

20. Primary county in which the property is located .........................................

21. Value that owner believes is accurate market or appraised value (WHOLE DOLLARS ONLY):

$

(For contiguous properties, enter in value for the individual property in line 18b. Do NOT enter per acre value.) .................

22. I would be willing to accept an arbitrator that would hear this case (Check all that apply. Note: Unless the appraisal district agrees to arbitration by

submission of written documents, the arbitration will be conducted in person or by teleconference. An arbitrator may require that the arbitration be

done in person.):

By teleconference

B

By written documents submitted by the property owner and appraisal district without a meeting

A

23. I am appealing the market or appraised value of my property for the following reasons (Check all that apply):

The property could not sell for the amount of value shown on the appraisal roll.

A

B

The property has hidden damages or flaws that were not considered in the appraised value.

The methodology used by the appraisal district was inappropriate.

C

Evidence presented to the appraisal review board was not fully considered.

D

The appraisal district did not correctly calculate the value limitation for residence homesteads.

E

The productivity value of the land or the special appraisal of the property allowed by law was not calculated correctly.

F

24.

I hereby request Arbitration. I have attached a MONEY ORDER or CASHIER’S CHECK payable to the Texas Comptroller of Public Accounts for $500.

This form and the required deposit must be hand delivered or mailed certified to the appraisal district for which the ARB order was issued.

I understand that sending this request and deposit directly to the Comptroller will jeopardize my right to arbitrate.

Month

Day

Year

Owner or agent signature

Date

FOR APPRAISAL DISTRICT USE ONLY -- for contiguous properties, fill out each page for every contiguous property being appealed.

Month

Day

Year

Month

Day

Year

25. Date of postmark or hand delivery

of request to CAD .....................................

25a. Date ARB order received by owner ............

25b. Certified tracking number for ARB order .....................................................................

26. Appraisal District Property Identification Number

AND

GEOGRAPHIC IDENTIFICATION NUMBER (GEO#) IF APPLICABLE

RECORD IDENTIFICATION NUMBER (R#) IF APPLICABLE

27. Value determined by the Appraisal Review Board order (WHOLE DOLLARS ONLY):

$

(For contiguous properties, enter in value for the individual property.) ..................................................................................

28. Cashier’s check or money order

number of attached deposit ...................................

29.

If an agent is submitting the request, a written authorization signed by the property owner is attached that expressly authorizes the agent to sign

and file the request. (An attorney does not require authorization.)

ARBITRATION NUMBER

30. The Appraisal District has examined the documentation and certifies that:

The property owner or agent has signed the request for arbitration.

CAD No.

Year

CAD Assigned No.

The request was filed with the appraisal district not later than the 45th day

after the date the property owner received the appraisal review board order determining the protest.

A deposit in the form of a check issued and guaranteed by a banking institution (such as a cashier’s or teller’s check) or by a money

order is attached.

The property qualifies as the owner’s residence homestead under Tax Code Section 11.13 or the appraised or market value of the

property as determined by the appraisal review board order of determination is $1 million or less.

The appeal does not involve any matter in dispute other than the determination of the appraised or market value of the property

pursuant to Tax Code Section 41.41(a)(1) or (2).

All parts of the request for arbitration have been completed.

Taxes are not delinquent at this time on the property that is the subject of this request for arbitration.

The property that is the subject of this request for arbitration is not the subject of litigation for the tax year in question.

The properties that are subject to this request qualify for contiguous arbitration.

31. Fill out ARBITRATION NUMBER at the top of Page 1.

32. The appraisal district

DOES or

DOES NOT consent to arbitrate by submission of written documents.

I further certify that the request for binding arbitration and deposit, along with a copy of the order determining protest, have been submitted to the

Comptroller of Public Accounts on the date indicated below:

Month

Day

Year

Chief appraiser or CAD employee signature

Date

For assistance, contact the Texas Comptroller’s office at 1-800-252-9121 or 512-305-9999, or by email at ptad.arb@cpa.state.tx.us.

1

1 2

2 3

3 4

4