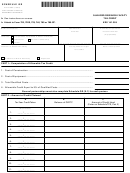

Schedule K-53 - Research And Development Credit Page 2

ADVERTISEMENT

INSTRUCTIONS FOR SCHEDULE K-53

GENERAL INFORMATION

PART B-COMPUTATION OF ALLOWED CREDIT

FOR THIS YEAR’S EXPENDITURES

A credit may be deducted from a taxpayer’s Kansas income tax

liability if the taxpayer had qualifying expenditures in research

LINE 10 — Enter amount of your Kansas tax liability for this year.

and development activities conducted within Kansas (K.S.A.

LINE 11 – Enter the lesser of line 9 or line 10. This is the credit

79-32,182b). Qualifying expenditures are expenditures made for

allowed for expenditures made during this tax year.

research and development purposes (other than expenditures of

monies made available to the taxpayer pursuant to federal or

PART C - COMPUTATION OF CARRY FORWARD CREDIT

state law), which are expenses allowable for deduction under the

provisions of the federal Internal Revenue Code of 1986 and

LINE 12 – Multiply line 6 by the proportionate share percentage

amendments thereto.

(line 8), then subtract line 11. This is the amount of credit to

The allowable credit is 6.5% of the amount by which the

be carried forward.

amount expended for the activities in the taxable year exceeds

the taxpayer’s average of the actual expenditures. This is for the

PART D-COMPUTATION OF CREDITS FROM PRIOR YEARS

activities made in the taxable year and the two immediate

preceding taxable years.

If additional columns are necessary, please enclose an additional

schedule. You will need copies of your Schedule

The amount of credit allowable in any one taxable year is

K-53 forms from prior years to complete this section.

limited to 25% of the total amount of the credit plus any applicable

carry forward. The amount of any remaining unused credit may

LINE 13 – Enter the year end date of the original Schedule

be carried forward until the total amount of the credit is used.

K-53 for which you are claiming a carry forward credit.

Keep an itemized schedule of the expenditures for the

LINE 14 – Enter the amount of carry forward from the original

amounts claimed on lines 1, 2a and 2b. KDOR (Kansas

schedule K-53 for the year shown on line 13.

Department of Revenue) reserves the right to request additional

information as necessary.

LINE 15 – Enter the total amount of line 14 which you have

previously claimed as a credit.

SPECIFIC LINE INSTRUCTIONS

LINE 16 – Enter the years you previously claimed the credit.

Enter the taxpayer’s name and Social Security number or

LINE 17 – Subtract line 15 from line 14. This is the amount of carry

federal Employer Identification Number (EIN) in the space

forward remaining from the prior K-53 Schedules.

provided. If the person claiming this credit is a partner or

shareholder in a partnership, LLC, S Corporation, etc., enter the

LINE 18 – Enter the maximum credit allowable in any one

name and EIN of that entity.

year from the original Schedule K-53 for the year shown on

line 13.

PART A – COMPUTATION OF MAXIMUM ALLOWABLE CREDIT

FOR THIS YEAR’S EXPENDITURES

LINE 19 – Enter the lesser of line 17 or line 18. This is the amount

of carry forward available to this return from each year shown

LINE 1 – Mark the box that best describes your research and

on line 13.

development expenditures for the current year.

LINE 20 – Add line 19, columns (A) through (D) (plus additional

LINE 2a – Enter the total allowable research and development

columns if applicable) and enter the result. This is the total

expenditures for activities conducted within Kansas for the

amount of carry forward credit available to this tax year.

first tax year preceding the current taxable year.

LINE 21 – Enter total Kansas tax liability for the current tax year

LINE 2b – Enter the total allowable research and development

after all previously claimed credits.

expenditures for activities conducted within Kansas for the

second tax year preceding the current taxable year.

PART E – COMPUTATION OF TOTAL CREDIT CLAIMED

THIS TAX YEAR

LINE 3 – Add lines 1, 2a, and 2b and enter the result on line 3.

LINE 22 – Enter the lesser of the sum of lines 11 and 20 or line

LINE 4 – Divide line 3 by three (3). This is the amount of average

21. Enter this amount on the appropriate line of Form K-40,

expenditures.

Form K-41, or Form K-120.

LINE 5 – Subtract line 4 from line 1. This is the amount of

expenditures eligible for the credit. If line 1 is less than or

TAXPAYER ASSISTANCE

equal to line 4, enter zero on line 5.

For assistance in completing this schedule contact KDOR:

LINE 6 – Multiply line 5 by 6.5% (.065). This is the total credit.

Tax Operations

LINE 7 – Multiply line 6 by 25% (.25). This is the maximum credit

Docking State Office Building, 1st fl.

allowed in any one tax year.

915 SW Harrison St.

LINE 8 – Partners, shareholders or members: Enter the percentage

Topeka, KS 66625-2007

that represents your proportionate share in the partnership, S

Phone: (785) 368-8222

corporation, LLC or LLP. All other taxpayers: Enter 100%.

Fax: (785) 291-3614

LINE 9– Multiply line 7 by line 8 and enter the result.

Web site:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2