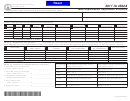

2011 IA 6251 Instructions

WHO MUST FILE IA 6251

pay Iowa minimum tax only on the percentage of adjustments

and tax preferences which are Iowa source. Lines 29-32 in Part

All individuals, estates, and trusts that had one or more of the

IV must be completed to calculate the Iowa minimum tax

adjustments or preferences in Part I must complete form IA

liability for nonresidents and part-year residents only if one has

6251 to see if they owe Iowa minimum tax. Taxpayers may

Iowa source adjustments or preferences.

have an Iowa minimum tax liability even if they owed no

federal minimum tax. Nonresidents who have a liability for

Line 29.

Iowa minimum tax are required to file an Iowa return even if

Add Iowa net income from line 26, IA 126, plus the total of

they have no regular Iowa income tax liability.

those adjustments and tax preferences on line 13 of the IA 6251

Married filing separate filers: Each spouse needs to complete

that are from Iowa sources.

an IA 6251.

Line 30.

PART I: ADJUSTMENTS AND PREFERENCES

Add total net income from line 27, IA 126, plus the total of

all adjustments and tax preferences on line 13 of the IA 6251.

If you did not itemize on the federal level, lines 1-6 of the IA

6251 will refer to the Iowa Schedule A.

Line 31.

Note: The federal tax preferences for percentage depletion of

Divide line 29 by line 30 and enter the result to three decimal

an oil, gas, or geothermal well and intangible drilling costs

places (Example: .786).

from lines 9 and 26 of federal form 6251 are not tax

Line 32.

preferences but are additions to income on line 14 of IA 1040.

Multiply line 28 by line 31. The result is the Iowa minimum

RELATED ADJUSTMENTS

tax and is to be entered on line 45, IA 1040, or on line 25, IA

1041. See the instructions below relating to minimum tax

Line 12-m.

limited to net worth.

Include related adjustments from line 27 of the federal 6251

only to the extent the adjustments are ones that affect the

MINIMUM TAX LIMITED TO NET WORTH

computation of net income. An adjustment related to tax-

Taxpayers who meet all qualifications for a distressed sale, but

exempt interest from private activity bonds would not be

have a debt to asset ratio of 75% or less, are not subject to the

included, since this is not an Iowa tax preference or adjustment.

minimum tax in an amount greater than the taxpayer’s net

worth. In situations where a taxpayer has multiple transactions

ALTERNATIVE NET OPERATING LOSS DEDUCTION

(forfeitures, transfers, sales, or exchanges), minimum tax is

Line 18.

limited to net worth prior to the last transaction in the tax year.

A net operating loss can be carried back or carried forward to

For additional information on what constitutes a “distressed

reduce a taxpayer’s alternative minimum taxable income.

sale,” contact the Taxpayer Services Section. If calling from

However, before the net operating loss can be deducted, it must

the Des Moines area or from out of state, call (515) 281-3114.

be reduced by any adjustments and tax preferences used in

Elsewhere in Iowa or from the Rock Island, Moline, or Omaha

computing the net operating loss. A net operating loss that is

areas, call 1-800-367-3388 (toll free). E-mail:idr@iowa.gov

carried to the current tax year on line 18 cannot exceed 90%

ALTERNATIVE MINIMUM TAX CARRYFORWARD

of the amount on line 17. Any portion of the net operating loss

CREDIT

which cannot be used can be carried over to the next tax year.

An alternative minimum tax credit is available that may reduce

Line 27.

the regular tax of an individual for minimum tax paid in a prior

Enter the amount from IA 1040, line 43, less line 49; or enter

year on deferral items of tax preference. The Iowa credit is

the amount from IA 1041, line 23, less line 27. If less than zero,

computed similarly to the federal credit but on form IA 8801.

enter zero.

The IA 8801 and the IA 148 Tax Credits Schedule must be

NONRESIDENTS AND PART-YEAR RESIDENTS

attached to the IA 1040 if this credit is claimed.

Nonresidents and part-year residents of Iowa are required to

41-131b (09/19/11)

1

1 2

2