Instructions For Form Rv-2 - Periodic Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return Page 2

ADVERTISEMENT

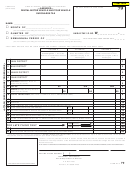

fig. 2.1

STEP 4 - Place an “X” in the appropriate box to indicate

for each district. If filing quarterly or semiannually, multiply

the filing period (Month, Quarter, or Semiannual Period) for

the number of tour vehicles by the number of months in the

which the tax return is being filed and enter the filing period

period.

information with the appropriate numeric (two digit) month

In Column C, line 1, BTK has entered “1” for the

and year end for the last month of the filing period (e.g.,

number of tour vehicles for Oahu.

Month of January 2013 = 01/13; Quarterly period of January

STEP 8a. - Add the number of Rental Motor Vehicle Days

through March 2013 = 03/13; Semiannual period of January

from Column A for all districts (lines 1 through 4).

through June 2013 = 06/13).

BTK files monthly returns, so an “X” was placed in the

In Column A, line 5, BTK has entered 790 rental vehicle

box labeled “MONTH” and BTK entered 01/13 for the

days for the month of January.

numeric month and year end for the month of the filing

STEP 8b. - Add the number of tour vehicles from Column B

period.

for all districts (lines 1 through 4).

fig. 2.1)

COMPUTING THE TAXES

(

In Column B, line 5, BTK has entered 2 tour vehicles

for the month of January.

STEP 5 - Column A, lines 1 through 4. Enter the number of

days that your rental motor vehicles were rented during the

STEP 8c. - Add the number of tour vehicles from Column C

period. If filing quarterly or semiannually, add the Rental

for all districts (lines 1 through 4).

Motor Vehicle days for each month during the period, and

In Column C, line 5, BTK has entered 1 tour vehicle for

enter the totals on the appropriate lines.

the month of January.

For example, if you have five cars on Oahu and they were

STEP 9a - In Column A, multiply the number entered on line

each rented for thirty days during the period, enter “150” (5 x

5 by the tax rate of $3 (line 6), and enter the result on line 7.

30) in Column A, line 1.

All activities must be allocated to their proper district(s). If

BTK has multiplied 790 (the number of vehicle days

you enter an amount on the “TOTALS” line (line 5) of any

entered on line 5) by $3 (the tax rate listed on line 6) to

column, you must enter amount(s) which equal that total on

get $2,370, which is entered in Column A, line 7 (790 x

$3 = $2,370).

the district allocation lines (lines 1 through 4) of that column,

or we will not be able to correctly process your tax return.

STEP 9b - In Column B, multiply the number entered on

line 5 by the tax rate of $15 (line 6) and enter the result on

For Column A, line 1 (Rental Motor Vehicle days on

Oahu), BTK has entered the net rental days of “520.”

Column B, line 7.

For Column A, line 2, (Rental Motor Vehicle days on

Maui) BTK has entered the net rental days of “270.”

BTK has multiplied 2 (the number of tour vehicles in

use during the month on line 5) by $15 (the tax rate

STEP 6 - Column B, lines 1 through 4. Enter the number

listed on line 6) to get $30, which is entered in Column

B, line 7 (2 x $15 = $30).

of tour vehicles (8-25 passengers) used during the period

for each District. If filing quarterly or semiannually, multiply

STEP 9c - In Column C, multiply the number entered on line

the number of tour vehicles by the number of months in the

5 by the tax rate of $65 (line 6), and enter the result on line

period.

7.

In Column B, line 1, BTK has entered “2” for the

BTK has multiplied 1 (the number of tour vehicles in

number of tour vehicles for Oahu.

use during the month on line 5) by $65 (the tax rate on

line 6) to get $65, which is entered in Column C, line 7

STEP 7 - Column C, lines 1 through 4. Enter the number of

(1 x $65 = $65).

tour vehicles (26 or more passengers) used during the period

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4