Instructions For Form Rv-2 - Periodic Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return Page 4

ADVERTISEMENT

INSTRUCTIONS FOR FILING AN AMENDED FORM RV-2

6. If line 10 is MORE THAN line 11, subtract line 11 from

If you file your Form RV-2 and later become aware of any

line 10 and enter the result on line 13, “ADDITIONAL

changes you must make to the reported number of rental

TAXES DUE”.

motor vehicle days and/or the number of tour vehicle-months,

you may file an amended return on Form RV-2 to change the

7. If the amended Form RV-2 is being filed after the

Form RV-2 you already filed. (Note: the Amended Rental

due date of the original Form RV-2, and if there is

Motor Vehicle and Tour Vehicle Surcharge Tax, Form RV-5,

an amount entered on line 13, enter on line 14 the

has been made obsolete.)

amount of any penalty and/or interest now due. On

a timely filed original Form RV-2, a penalty of 20%

Do NOT file an amended Form RV-2 if the Rental Motor

of the tax due will be assessed if any tax remains

Vehicle and Tour Vehicle Surcharge Tax Annual Return &

unpaid after 60 days from the prescribed due date

Reconciliation, Form RV-3, has already been filed for the tax

of the original Form RV-2. The 60-day period is

year.

calculated beginning with the prescribed due date,

Complete your amended Form RV-2 as follows:

even if the prescribed due date falls on a Saturday,

Sunday, or legal holiday. This penalty is applicable

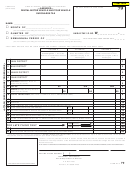

1. Check the box at the top of the Form RV-2 to

to amended Form RV-2s for timely filed original

designate that this is an amended return (see fig.

Form RV-2s. Interest at the rate of 2/3 of 1% per

2.0).

month or part of a month shall be assessed on

unpaid taxes and penalties assessed beginning with

2. Enter the correct number of rental motor vehicle

the first calendar day after the date prescribed for

days and/or the number of tour vehicle-months,

payment, whether or not that first calendar day falls

and amounts of taxes due which should have been

on Saturday, Sunday, or legal holiday.

reported on the original Form RV-2. Follow Steps

1 through 10 above used to complete your original

8. Add lines 13 and 14 and enter the total on line 15,

return. (Note: Entries which were correctly reported

“TOTAL AMOUNT DUE AND PAYABLE”.

on the original Form RV-2 also must be entered on

the appropriate line(s). Failure to do so will result

9. Enter on line 16 the amount of any payment being

in a change from the correct amount to -0-.)

made with the amended Form RV-2. If the amended

Form RV-2 is being filed after the due date of the

3. As of the date the amended return is filed, enter

original Form RV-2, include any additional penalty

on line 9 the amounts of penalty and/or interest

and interest in your payment. Attach your check

assessed for the period. Penalty and interest are

or money order for this amount payable to “Hawaii

generally assessed because the original return was

State Tax Collector” in U.S. dollars drawn on any

filed after the filing deadline or because the taxes

U.S. bank where indicated on the amended Form

due were not paid in full by the filing deadline.

RV-2. Write “RV”, the filing period, your Hawaii Tax

I.D. No., and your daytime phone number on your

4. Enter on line 11 the total amount of taxes, additional

check or money order.

DO NOT SEND CASH.

assessments, and penalty and/or interest paid

less any refunds received for the period. Include

Send your check or money order and the amended

payments made with the original periodic return,

Form RV-2 to:

as well as any supplemental payments made after

the original periodic return was filed. REMINDER:

Hawaii Department of Taxation

Payments are applied first to recover costs incurred

P.O. Box 2430

by the Department, then to any interest due, then to

Honolulu, HI 96804-2430

penalties, and finally, to taxes.

10. Sign your name and write your title, the date, and

5. If line 10 is LESS THAN line 11, subtract line 10 from

a daytime contact phone number in the spaces

line 11 and enter the result on line 12, “CREDIT TO

provided at the bottom of the amended Form RV-2

BE REFUNDED”.

(see fig. 2.2).

If you have questions, please contact the customer service representative at:

Voice: 808-587-4242

Mail: Taxpayer Services Branch

Telephone for the Hearing Impaired:

1-800-222-3229 (Toll-Free)

P.O. Box 259

808-587-1418

Fax: (808) 587-1488

Honolulu, HI 96809-0259

1-800-887-8974 (Toll-Free)

E-mail: Taxpayer.Services@hawaii.gov

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4