Form 104 - Colorado Individual Income Tax - 2011 Page 9

ADVERTISEMENT

Page 9

calculated by Revenue Online. Full-year residents

LINE

Estimated Tax

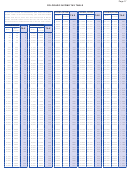

should refer to the tax table at the back of this booklet.

22

Enter the sum of all estimated payments and credits

Determine the tax by the amount listed on line 14.

allocated to this tax period. Amounts can include

Part-year residents and nonresidents should transfer

estimated tax credits carried forward from the previous

the apportioned tax amount from line 36 of Form

tax year, quarterly estimated payments remitted, any

104PN. For Revenue Online, click the red ERROR

extension payment remitted, amounts withheld from

button to jump to the 104PN.

Colorado real estate sales by nonresidents on the

DR 1079, nonresident beneficiary withholdings

LINE

Alternative Minimum Tax

remitted with the DR 0104BEP, and amounts paid

16

Enter the amount of any alternative minimum tax by

on behalf of nonresident partners or shareholders

clicking the EDIT button on Revenue Online, or by

on the DR 0108. We recommend that you read FYI

entering the amount on your paper filing. Generally,

Publication—Income 51 if this applies to you.

if you pay alternative minimum tax on your federal

income tax return you will pay the same for your

LINE

Refundable Credits

Colorado return. We recommend that you read FYI

23

Complete Form 104CR to claim various refundable

Publication—Income 14 if this applies to you.

credits. For Revenue Online, click the EDIT button

to complete Form 104CR. Or, if filing a paper return,

LINE

Recapture of Prior Year Credits

transfer the amount from line 9 of Form 104CR to

17

Enter any historic property preservation credit,

this line.

health care professional credit, low income housing

credit or other credit claimed in prior years that must

Submit any additional documentation as specified

be recaptured.

for the credit(s) claimed electronically on Revenue

Online, the DR 1778, or, if filing on paper, attach to

LINE

Subtotal

your return.

18

This line is automatically calculated by Revenue

Online, or enter the sum of lines 15, 16 and 17.

LINE

Subtotal

24

This line is automatically calculated by Revenue

Tax Credits

Online, or enter the sum of lines 21, 22 and 23.

LINE

Nonrefundable Credits

LINE

Federal Adjusted Gross Income

19

Complete Form 104CR to claim various non-

25

Refer to your federal income tax return to complete

refundable credits. For Revenue Online, click the

this line:

EDIT button to complete Form 104CR. Or, if filing

• 1040EZ Form use line 4

a paper return, transfer the amount from line 49 of

• 1040 Form use line 37

Form 104CR to this line.

• 1040A Form use line 21

Scan and submit any required documentation

If your federal adjusted gross income is a negative amount, or

through Revenue Online, E-Filer Attachment. Or,

less than zero, be sure to enter the amount on your Colorado

file paper documentation with the DR 1778 E-Filer

return (in brackets if filing a paper return).

Attachment form.

COMPARE LINES 20 AND 24—IF LINE 24 IS GREATER,

LINE

Net Tax

GO TO LINE 26. IF LINE 20 IS GREATER, GO TO LINE 45

20

This line is automatically calculated by Revenue

(or to make a donation go to line 28)

Online, or subtract line 19 from line 18

LINE

Overpayment

LINE

Colorado Income Tax Withheld

26

This amount is automatically calculated by Revenue

21

If using Revenue Online, the sum of step 2 is

Online, if applicable. Paper filers should calculate this

automatically transferred to this line. Or, for paper

line by subtracting line 20 from line 24.

returns, enter the sum of all Colorado income tax

withheld as reported on W-2, W-2G or various 1099

LINE

Estimated Tax Carryforward

statements.

27

Enter the amount, if any, you would like to be available

for 2012 estimated tax.

Include only statements with Colorado withholding

with your return. If filing on paper, staple these

LINES

Voluntary Contributions

statements where indicated on the form.

28-42

If you would like to donate money to one of the

organizations available as part of Checkoff Colorado,

Do NOT include withholdings for federal income tax,

enter the desired amount here. See the back page of

income tax from another state, or local governments.

this booklet for more information about each of these

Be certain to exclude amounts withheld from

charitable organizations.

Colorado real estate sales by nonresidents,

LINE

Subtotal

nonresident beneficiary withholdings, or Colorado

43

This line is automatically calculated by Revenue

partnership or S Corporation income withholdings

Online, or enter the sum of lines 27 through 42.

for nonresidents as these specified amounts should

be listed on line 22.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24