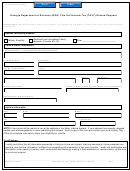

Form Dr 1094 - Colorado Department Of Revenue W-2 Wage Withholding Tax Return Page 2

ADVERTISEMENT

Instructions for Completing

W-2 Wage Withholding Tax Return

The DR 1094 is used by employers to report Colorado W-2 income

ACCOUNT NUMBER: List the Colorado business account number

taxes that have been withheld from employee pay. Review publication

from your withholding certificate or sales tax license. This number is 8

FYI Withholding 5, Colorado Wage Withholding Tax Requirements for

digits. Do not list your FEIN or EFT number here.

detailed information about filing requirements and frequencies.

FILING PERIOD: List here the filing period for this return. Be sure you

After completing payroll and withholding Colorado income taxes as

are using the correct period end date for your defined filing frequency.

defined by the Colorado Income Tax Withholding Tables for Employers

Line 1 Enter the amount of Colorado income tax withheld for the period.

(DR 1098), report here the total tax collected for the filing period. This

If the tax is zero, file a zero return through Revenue Online at

is the Colorado withholding tax that will be reported at the end of the

year on federal form W-2-Wage and Tax Statement.

Line 2 If a previous period IN THE CURRENT TAX YEAR was

You may pay tax through Revenue Online,

overstated and paid, complete the worksheet below and

RevenueOnline by echeck or credit card. Or, you may sign up for

calculate the overpayment for the tax period. Transfer the

Electronic Funds Transfer (EFT). Visit and look

overpayment amount to line 2 of the DR 1094.

for Business Services under the Online Services heading. DO NOT

Line 3 Calculate the net amount due by subtracting line 2 from line 1.

FILE A PAPER DR 1094 IF YOU REMITTED THE WITHHOLDING

Line 4 Complete only if return is being filed after the due date. Penalty

TAXES VIA EFT.

is calculated by determining how far past the due date the return

To prevent being billed by the Department when no taxes were

is being filed. If the return is filed within the first month after the

withheld during the filing period, file a zero return. A paper zero return

due date, calculate the penalty at 5% (.05) of the tax due, or $5,

may be mailed, or for fast and simple filing of a zero return access

whichever is greater. For each additional month thereafter the

and file electronically.

return is delinquent, add one-half of 1% (.005), up to a maximum

AMENDING WITHHOLDING TAXES

of 12%.

If you overpaid for a period, you may take a credit on a future return

Line 5 Complete only if return is being filed after the due date. Refer

in the current calendar year. The credit may be taken on a return/

to publication FYI General 11, Colorado Civil Tax Penalties and

payment filed at or a subsequent

Interest to calculate late payment interest. Enter the calculated

paper form W-2 Wage Withholding Tax Return (DR 1094). If you

interest amount on line 5.

are unable to claim the credit on a subsequent DR 1094 within the

Line 6 Add together the amounts listed on lines 3, 4 and 5. This is the

calendar year, you should claim a refund on your Annual Transmittal of

amount that is due. Make check or money order payable to the

State W-2 Forms (DR 1093) for the appropriate year.

Colorado Department of Revenue. Use the memo to clearly list

If additional tax is owed, file another return for the period the tax is

“ W-2 WTH,” your account number, and tax period.

due reporting only the additional amount owed at

MAIL TO AND MAKE CHECKS PAYABLE TO:

RevenueOnline If you cannot file electronically, file a paper DR 1094

Colorado Department of Revenue

reporting only the additional tax due for the period.

Denver CO 80261-0009

Refunds will be issued from a DR 1093 filed at the end of February

following the end of the calendar year. For additional information or

questions, refer to publication FYI Withholding 5, Colorado Wage

Withholding Tax Requirements at

All FYI publications, forms, and answers to frequently asked questions

are available at , the official Taxation Web site.

Or, you may call (303) 238-7378 to speak with a representative.

SEE BELOW FOR YOUR RECORDS

W-2 WAGE WITHHOLDING TAX

:

ORIGINAL FILING PERIOD

ADJUSTED FILING PERIOD

(if overpayment)

OVERPAYMENT

UNDERPAYMENT

AS ORIGINALLY FILED

AS AMENDED

1. Colorado tax withheld

A. AS FILED

$

$

$

$

2. Overpayment

(current

B. AS CORRECTED $

$

$

$

year only)

3. Total 1 minus 2

C. DIFFERENCE

$

$

$

$

4. Penalty

Overpayment – You may take a credit on a future return in the current calendar year

$

$

only. See instructions above. If overpayment is claimed in a subsequent filing for the

5. Interest

$

$

current calendar year, note in the box Adjusted Filing Period the period date the credit

was claimed.

6. Total Paid

$

$

Underpayment – Calculate the difference above. Report only the difference for the

DATE PAID

$

$

period the additional tax is due per the instructions above. Penalty and interest due

will be calculated after the additional payment for the period has been received.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2