Form Ft-Aft - Floor Tax For Alcoholic Beverage Tax Page 2

ADVERTISEMENT

Schedule A Instructions

The inventory must include all alcoholic beverages possessed, in

The brand name of the product held in inventory is not required.

transit, owned, or stored in a back room, warehouse, or other location

Only the total number of bottles (or barrels) for the common sizes

whether or not pledged as collateral, in inventory on July 1, 2011.

listed is required. This total is then multiplied by the listed wine

gallon multiplier to arrive at the total number of gallons subject

Invoices for any products ordered by a retailer prior to July 1, 2011,

to the alcohol beverages inventory (fl oor) tax. Additionally, each

and delivered by a wholesale distributor from July 1, 2011, through

section allows for other sizes if needed. To identify wine gallon

July 8, 2011, will include the statement “Alcohol Floor Tax Due on

multipliers for other sizes, see Form FT-22-S, Alcohol Beverages

These Products” in bold red lettering.

Conversion Table for Other Sizes, Page 4.

Preparation of Prescribed Forms

How to Report “Opened Bar Stock”

Retailers may use their own method for taking inventory. However,

The standard method for taking an itemized inventory uses the

this detailed inventory must be converted onto Form FT-22-S,

quantity contained in an open bottle in multiples of tenths of a bottle.

Summary of Alcoholic Beverages Floor Tax Inventory Report on

For example, a bottle half full would be .50 and would be added to

Floor Stock of Alcoholic Beverages.

your total quantity of bottles when completing Form FT-22-S.

Form FT-22-S is broken into inventory sections as follows:

Failure to File Form FT-AFT

1.

Still Wine not in excess of 21% alcohol by volume;

Failure to fi le this form and pay the tax due will be suffi cient reason

2.

Still Wines produced by small wineries (producers of 55,000

to revoke any state license or permit issued by DRS to that person.

gallons or less per year) not in excess of 21% alcohol by volume;

Additionally, if any person fails to fi le this report, DRS will estimate

the amounts of alcoholic beverages held by that person based upon

3.

Fortifi ed Wines in excess of 21% alcohol by volume and

any information in the possession of the Commissioner of Revenue

Sparkling Wines;

Services. Even if you possess no alcoholic beverages in inventory

4.

Beer and Other Malt Liquors for draught barrels only;

on July 1, 2011, you must fi le this form.

5.

Beer and Other Malt Liquors for other size containers;

Additional Information

6.

Distilled Liquors (such as whiskey, gin, rum, vodka, brandy,

If you need additional information or assistance call the Excise Taxes

liqueurs, cordials, cocktails and similar compounds containing

Unit at 860-541-3224, Monday through Friday, 8:30 a.m. to 4:30 p.m.

distilled spirits);

7.

Liquor Coolers not more than 7% of alcohol by volume; and

8.

Alcohol in excess of 100 proof.

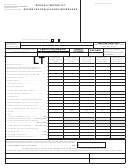

Schedule A

Retailers of Alcoholic Beverages Inventory - Computation of Tax

Column A

Column B

Column C

Column D

Beverage Classifi cation

Quantity

Tax Rate

Amount of Tax

$0.12

1. Still Wines - Not in Excess of 21% Alcohol by Volume

Per Wine

In Column B, enter the amount from Form FT-22-S, Line 1, Column 4.

Gallon

2. Still Wines Produced by Small Wineries

(producers of 55,000

$0.03

- Not in Excess of 21% Alcohol by Volume

gallons or less per year)

Per Wine

In Column B, enter the amount from Form FT-22-S, Line 2, Column 4.

Gallon

3. Fortifi ed Wines in Excess of 21% Alcohol by Volume and

$0.30

Sparkling Wines

Per Wine

In Column B, enter the amount from Form FT-22-S, Line 3, Column 4.

Gallon

$1.20

4. Beer and Other Malt Liquors - Draught Barrels Only

Per

In Column B, enter the amount from Form FT-22-S, Line 4, Column 4.

Barrel

$0.04

5. Beer and Other Malt Liquors - Other Containers

Per Wine

In Column B, enter the amount from Form FT-22-S, Line 5, Column 4.

Gallon

$0.90

6. Distilled Liquors

Per Wine

In Column B, enter the amount from Form FT-22-S, Line 6, Column 4.

Gallon

$0.41

7. Liquor Coolers - Not More Than 7% of Alcohol by Volume

Per Wine

In Column B, enter the amount from Form FT-22-S, Line 7, Column 4.

Gallon

$0.90

8. Alcohol - In Excess of 100 Proof

Per Proof

In Column B, enter the amount from Form FT-22-S, Line 8, Column F.

Gallon

9. Total Tax Due

............................. 9.

Total of Lines 1 through 8. Enter amount here and on Form FT-AFT, Line 1 on front page.

Form FT-AFT Back (New 06/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2