1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

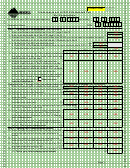

3

3

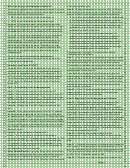

Annualized Income and Adjusted Seasonal Installment Method Worksheet (Continued)

4

4

5

5

A

B

C

D

6

6

Period

7

7

8

8

First 4 months First 6 months First 9 months

Entire year

9

9

20. Divide the amount in each column on line 15c by

10

10

the amount in column D on line 17c and enter the

11

11

890

900

910

920

result .......................................................................20.

12

12

930

940

950

21. Add lines 18 through 20 and enter the result..........21.

960

13

13

22. Divide line 21 by 3 and enter the result ..................22.

970

980

990

1000

14

14

23. Divide line 16 by line 22 and enter the result..........23.

1010

1020

15

1030

1040

15

24. Multiply line 23 by your tax rate ..............................24.

16

16

1050

1060

1070

1080

25. Divide the amount on line 17a by the amount in

17

17

1090

1100

1110

column D on line 17a and enter the result ..............25.

18

18

26. Divide the amount on line 17b by the amount in

19

19

1120

1130

1140

column D on line 17b and enter the result ..............26.

20

20

21

27. Divide the amount on line 17c by the amount in

21

22

column D on line 17c and enter the result ..............27.

22

1150

1160

1170

23

23

28. Add lines 25 through 27 and enter the result..........28.

1180

1190

1200

24

24

29. Divide line 28 by 3 and enter the result. This

25

25

is your base period percentage for months

1210

1220

1230

26

26

through and including your filing month. ..........29.

100%

1240

1250

1260

27

1270

27

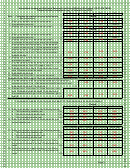

30. In each column multiply the amount on line 24 by

28

28

the amount on line 29. ............................................30.

29

29

31. For each period, enter the amount of any tax credits

1280

1290

1300

1310

30

30

being claimed on Form CIT, page 4, line 13 ...........31.

31

31

32. Total tax after credits. Subtract line 31 from line 30

1320

1330

1340

1350

32

32

and enter the result. If less than zero, enter zero ...32.

1360

1370

1380

33

1390

33

33. Multiply line 32 by 80% and enter the result ...........33.

34

34

Complete lines 36 through 41 for one column before completing lines 34 and 35 of the next column.

35

35

34. Add together all previous columns of line 41 and enter the result

36

36

(for example, add the amounts in columns A and B on line 41, and

1400

1410

1420

37

37

enter the result in column C) ...........................................................34.

38

38

35. Subtract line 34 from line 33. If less than zero, enter

1430

1440

39

1450

1460

39

zero.........................................................................35.

40

40

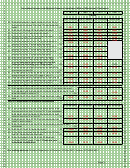

Part III Computation of Required Installments

41

41

42

42

1st installment 2nd installment 3rd installment 4th installment

43

43

36. If you completed only one of the above parts, enter

44

44

the amounts from line 14 or line 35. If you completed

45

45

both parts, enter the lesser of the amounts in each

46

46

1470

1480

1490

1500

column from line 14 or line 35 ................................36.

47

47

1510

1520

1530

1540

37. Divide line 4c, Form CIT-UT, by four and enter the

48

48

result in each column..............................................37.

49

49

38. Enter the amount from line 40 in the preceding column of this

50

50

1550

1560

1570

worksheet ........................................................................................38.

51

51

1580

39. Add lines 37 and 38; enter the result ......................39.

1590

1600

1610

52

52

40. If line 39 is more than line 36, subtract line 36 from

1620

1630

1640

1650

53

53

line 39. Cannot be less than zero ...........................40.

54

54

41. Enter the lesser of line 36 or line 39 here and

55

55

on Form CIT-UT, page 1, line 6. These are your

56

56

1660

1670

1680

1690

calculated installments. .......................................41.

57

57

58

58

59

59

our mailing address: Montana Department of Revenue, PO Box 8021, Helena, MT 59604-8021

60

60

61

61

62

62

63

63

64

64

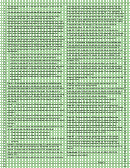

Page 3

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3 4

4 5

5