1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

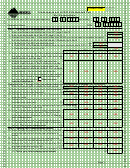

Who has to pay underpayment interest?

of the short taxable year.

4

4

Line 6 – Multiply the amount on line 4c by 25% (0.25) and

You are only subject to the underpayment interest if your tax

5

5

enter this amount in each column, A through D. This is the

liability is $5,000 or more during the current year. You should

6

6

amount of each of your quarterly estimated installments.

have paid the lesser of these amounts:

7

7

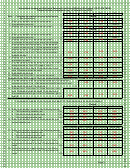

• If you use the annualized income installment method and/

1. 80% of your tax liability for the current year, or

8

8

or the adjusted seasonal installment method, mark the

2. 100% of your tax liability for the previous year.

9

9

box on this line, complete the worksheet on pages 2 and

10

10

However, if the previous year’s return did not show a tax

3 of these instructions to determine the amounts of your

11

11

liability, if that return did not cover a full 12 months, or if you

installments, and enter the amounts from line 41 of the

12

12

are filing your initial return this year, your installments must

worksheet on line 6 of this form.

13

13

be based upon 80% of your tax liability for the current year.

• If your income varied during the year because, for

14

14

If you did not pay enough estimated tax by any installment

example, your business was operated on a seasonal

15

15

due date, you may owe underpayment interest for that

basis, you may want to use the annualized income

16

16

estimate period. The interest is calculated separately for

installment method and/or seasonal installment method.

17

17

each installment due date, even if you are requesting a

Using these methods may reduce the amount of your

18

18

refund on your Montana tax return. Therefore, you may

required installments. See the instructions on this page

19

19

owe underpayment interest for an earlier installment due

for more information about this calculation.

20

20

date, even if you paid enough tax later to make up the

21

21

Complete lines 7 through 14 in each column before

underpayment.

22

22

completing the next column.

If you do not want to calculate the underpayment

23

23

Line 7 – Enter the amount of estimated tax payments made

interest, we will calculate it and send you a notice of the

24

24

on or before the due date on line 5 for this particular column,

underpayment interest due.

25

25

and after the due date on line 5 for the previous column.

26

26

How do I use Form CIT-UT?

For example, a calendar year corporation will enter on line

27

27

7, column B, the amount of estimated tax payments made

Complete Part I of this form to determine if you have an

28

28

between April 15 and June 15.

underpayment for any of the four installment due dates. If

29

29

you have an underpayment on line 13 in columns A, B, C,

If you have an overpayment from the previous year, you

30

30

or D, go to Part II to calculate your underpayment interest.

should apply the installment to column A. If you have mineral

31

31

If you have to pay underpayment interest, include Form

royalty tax (line 12d of the CIT) and/or tax on pass-through

32

32

CIT-UT with your Montana Corporate Income Tax Return

entities (line 12e of the CIT) withheld on your behalf, divide

33

33

(Form CIT).

the total of these amounts by four and apply the result to

34

34

each quarterly installment.

35

35

Part I: Calculating Your Underpayment

Line 13 – If line 13 shows an underpayment in any column,

36

36

Line 1 – Enter the tax from line 10 of your Form CIT.

please complete Part II to calculate the underpayment

37

37

Line 2 – Enter the tax credits from line 13 of your Form CIT.

interest that you owe for this tax year.

38

38

Line 3 – Subtract line 2 from line 1. If the result is less than

39

39

Part II: Figuring Your Underpayment Interest

$5,000, stop here. You do not need to complete this form. If

40

40

Line 15 – Enter the date of the estimated payment that

the result is $5,000 or greater, enter the result here.

41

41

covers the installment in each column. A payment of

42

42

Line 4a – Multiply line 3 by 80%. Enter the result on this

estimated tax is applied against underpayment of required

43

43

line.

installments in the order that those installments are required

44

44

Line 4b – From your previous year’s Form CLT-4, subtract

to be paid. For example, after the first installment due date

45

45

the tax credits you reported on line 13 from your Montana

(April 15th), there is an underpayment of $1,000 and the

46

46

tax liability on line 10 (line 10 minus line 13). Enter the result

second installment requires a payment of $2,000. A payment

47

47

on this line. However, if your previous year’s return covered

of $2,000 is made on June 10, with $1,000 of this payment

48

48

a period of less than 12 months, it did not show a tax liability,

being applied to the underpayment of the first installment.

49

49

or if you are filing your initial return this year, do not use this

The interest on the first installment will be calculated from

50

50

line. Instead, enter the amount from line 4a on line 4c and

April 15 through June 10 (56 days). The second installment

51

51

then go to line 5.

will now be underpaid by $1,000.

52

52

Line 4c – Enter the lesser of line 4a or 4b.

Line 16 – Calculate the number of days that the

53

53

Line 5 – Enter the quarterly installment due dates in

underpayment is late. This is the number of days from the

54

54

columns A through D. The installment due dates are the 15th

55

installment due date until the payment for the installment is

55

day of the 4th, 6th, 9th, and 12th months of your tax year.

56

paid.

56

For example, if your tax year ends on December 31, your

57

57

Line 17 – Calculate the amount of underpayment interest for

installment due dates are April 15, June 15, September 15,

58

58

each period. The interest rate on the underpayment is 12%

and December 15 of your tax year.

59

59

per year, calculated daily. Multiply the underpayment on line

60

60

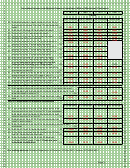

Short Period Returns: If you are filing a short period return,

13 by the number of days late on line 16. Multiply this result

61

61

payments of estimated tax are to be made at the times and

by 12% (0.12). Divide this result by 365.

62

62

in the amounts required for regular tax years, except all

Line 18 – Calculate your total underpayment interest. Add

63

63

installments must be made by the 15th day of the last month

64

64

Page 4

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3 4

4 5

5