1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

all amounts on line 17, columns A through D, and enter the

tax return here. Enter the amount in each column that you

4

4

result here.

are entitled to use because of events that occurred during

5

5

the months shown in the column headings. For example, if

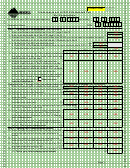

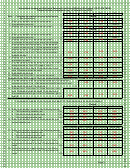

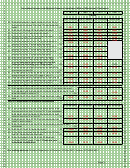

Instructions for Annualized/Seasonal Worksheet

6

6

you used the amount from line 3 on line 7, you will base your

7

If you can establish that you did not earn income evenly

7

credit allocation on the periods listed above line 1 to allocate

throughout the year, you can use this worksheet to

8

8

the credit. If you used the amount from line 6 on line 7, you

determine your quarterly installments of estimated tax. Use

9

9

will use the periods listed above line 4 to allocate the credit.

10

the worksheet to calculate each of your estimated payments

10

Complete lines 36 through 41 for one column before

under the annualized and/or seasonal methods. Calculating

11

11

completing lines 13 and 14 of the next column.

your installments using the annualized or seasonal method

12

12

Line 13 – Add the amounts from line 41 in all previous

13

may lower the amount of one or more required installments.

13

columns and enter the result here. For example, for Column

If so, your underpayment interest could be reduced or

14

14

D, you add together the amounts from line 41 in columns A

15

eliminated for one or more installment periods. Please note

15

through C and enter the result on line 13, Column D.

you must use the same method of determining your required

16

16

installments for each quarter. If you use the worksheets to

17

17

Part II: Calculate Adjusted Seasonal Installments

18

determine your estimated installments, include the federal

18

The adjusted seasonal installment method for calculating

Form 2220, Underpayment of Estimated Tax by Corporation,

19

19

estimated tax payments can be used if your business is

to your Montana return along with Form CIT-UT and this

20

20

seasonal. For example, a ski shop that receives most of its

21

worksheet.

21

income each year during the winter months might benefit

22

22

• If you are using only the annualized income installment

from using this method. In order to use this method, your

23

23

method, complete Parts I and III of the worksheet.

base percentage for any six consecutive months has to be

24

24

• If you are using only the adjusted seasonal installment

at least 70%.

25

25

method, complete Parts II and III of the worksheet.

To calculate the base period percentage, you need to

26

26

• If you are using both the annualized income and adjusted

compare your taxable income for six-month corresponding

27

27

seasonal methods, complete the entire worksheet. To

periods for the last three taxable years, to the total taxable

28

28

arrive at the amount of each required installment, select

income for the last three taxable years. This comparison is

29

29

the smallest of the annualized income installment,

done on lines 15 through 30.

30

30

adjusted seasonal installment (if applicable), or regular

31

Lines 15 through 30 – Prepare the calculations as directed

31

installment.

on each line.

32

32

33

33

Part I: Calculate Annualized Income Installments

Line 22 – This is your base period percentage for the

34

34

months before your filing month.

The annualized income installment method for calculating

35

35

Line 31 – Enter the tax credits from line 13 on your Montana

estimated tax payments may benefit you if your income was

36

36

tax return here. Enter the amount in each column that you

not received evenly throughout the year. For example, a

37

37

are entitled to use because of events that occurred during

company may liquidate a large portion of its inventory during

38

38

the months shown in the column headings.

the last quarter of the year, making the earlier installments

39

39

smaller than they would have been if the regular method

Complete lines 36 through 41 for one column before

40

40

was used.

completing lines 34 and 35 of the next column.

41

41

Line 1 – Enter the amount of Montana taxable income from

42

Line 34 – Add the amounts from line 41 in all previous

42

line 7 of Form CIT in each column based on the amount

columns and enter the result here. For example, for Column

43

43

earned for each period that is indicated above line 1 for each

D, you add together the amounts from line 41 in columns A

44

44

column.

45

through C and enter the result on line 34, Column D.

45

46

46

Line 4 – Enter the amount of Montana taxable income from

Part III: Computation of Required Installments

47

47

line 7 of Form CIT in each column based on the amount

Line 36 – If you only completed Part I, enter the amounts

48

48

earned for each period that is indicated above line 4 for each

from each column on line 14 of the worksheet in each

49

49

column.

column here. If you only completed Part II, enter the

50

50

Line 7 – You have three annualization period options to use

amounts from each column on line 35 in each column here.

51

51

to calculate your installment amounts on this line:

If you completed both Parts I and II, enter the lesser of the

52

52

1. Use the amounts on line 3 in all columns

amounts in each column on line 14 or 35.

53

53

2. Use the amounts on line 6 in all columns

54

54

Line 41 – In each column enter the lesser of the same

55

55

3. Use the lesser of the amounts on line 3 or line 6 for each

column on line 36 or line 39. These are your calculated

56

56

column

installments of estimated tax based on the annualized

57

57

income and/or seasonal methods. Enter on line 6 of the

Line 8 – Multiply the amounts on line 7 in each column by

58

58

Form CIT-UT the amount from each column A through D of

the tax rate used to calculate your Montana income tax

59

59

line 41.

return. The tax rate in Montana is 6.75% unless you are

60

60

filing under the water’s edge method, in which case the tax

Questions? Please call us toll free at (866) 859-2254

61

61

rate is 7%.

(in Helena, 444-6900).

62

62

Line 9 – Enter the tax credits from line 13 on your Montana

63

63

64

64

Page 5

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3 4

4 5

5