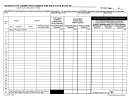

Return to Form

A rent certificate is used to verify the rent paid to occupy a Wisconsin “homestead” in 2013 . A homestead could be a room,

apartment, mobile or manufactured home, house, farm, or nursing home room .

Instructions for Renter (Claimant)

Complete all fields except the social security number . Then give to your landlord to complete and sign . A separate rent certificate

must be completed for each homestead used to compute your credit .

If your landlord won’t sign, place a checkmark in the designated area . Complete the fields above line 1 and lines 1 to 5, and

attach a copy of each canceled check or bank money order you have to verify your rent . Any portion not verified will not be allowed .

After your landlord returns the completed rent certificate, enter your social security number and then fill in the allowable amounts

from lines 2b and 5a on Schedule H or H-EZ, as appropriate .

Attach all rent certificates to one Schedule H or H-EZ. If you claim less than 12 months of rent and/or property taxes, also attach a

note explaining where you lived for the balance of 2013 .

Instructions for Landlord/Authorized Representative

Complete a separate rent certificate for each renter (claimant) requesting one . If blank, fill in the renter’s name . Then fill in the

fields above line 1 and lines 1 to 5, sign and print your name, and return to the renter . Note: You may not charge a fee for filling

in a rent certificate .

Lines 1a and 1b If you checked “No” on line 1a, do not complete the rent certificate unless line 1b applies .

Line 3a Fill in the rent you actually collected per month for this rental unit (apartment, room, one-half of a duplex, etc .) for 2013, for

the time this renter occupied it in 2013 . Include any separate amounts the renter paid to you for items such as parking, a garage,

utilities, appliances, or furnishings . Do not include rent for a prior year or amounts you received directly from a governmental

agency through a subsidy, voucher, grant, etc ., for the unit (except amounts an agency paid as a claimant’s representative payee) .

If the monthly rent for this unit changed in 2013, use the extra columns to fill in each rate separately .

Line 3b Fill in the number of months (or partial months) each rate from line 3a applied to this renter . For partial months, fill in the

number of days rather than a fraction or a decimal .

Line 3c Fill in the total rent collected for this unit for the time occupied by this renter in 2013 (generally, multiply line 3a by 3b) .

Example: You rented a unit for $300 per month for 7 months and $325 per month for 5 months . Fill in lines 3a - 3c as follows:

300

.00

325

.00

.00

a Rent collected per month for this rental unit for 2013 . . . . . . . . . . 3a

7

5

b Number of months this rental unit was rented to this renter in 2013 . .

3,725

.00

c Total rent collected for this rental unit for 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3c

Line 3d Fill in the total number of occupants in this rental unit during the rental period . Note: Do not count the renter’s spouse or

children under age 18 as of December 31, 2013 .

Line 3e Fill in this renter’s share of the total rent from line 3c . Do not include rent paid for other renters .

Line 4 Fill in this renter’s share of the value of food and personal services (medical, laundry, transportation, counseling, grooming,

recreational, therapeutic, etc .) you provided for this rental unit . If none were provided, fill in 0 . Note: Do not include utilities,

furnishings, or appliances .

Signature Review the rent certificate to be sure that all applicable fields and lines have an entry . Sign (by hand) and date, print

your name, and return the rent certificate to the renter . Only an original signature is acceptable .

Renter Instructions for Shared Living Expenses Schedule

Complete this schedule if line 3d shows 2 or more occupants and each did not pay an equal share of the rent . You may claim only

the portion of rent that reflects the percentage of shared living expenses you paid .

Example: You paid shared living expenses as shown

Your allowable rent for occupancy only is $3,300, computed as

below . Services provided to you of $300 are filled in on

follows:

line 4 .

.00

$ 4,800

1 Total rent paid (line 1a) . . . . . . . . . . . . . . . . 1

2 Shared living expenses

$ 6,000

.00

Shared Living

Total Paid by

Amount

you paid (line 5b) . . . . . . . . 2

Expenses

All Occupants

You Paid

3 Total shared living

$ 4,800

.00

$ 4,800

.00

Rent

1a)

1b)

$ 8,000

.00

expenses (line 5a) . . . . . . . 3

2,400

.00

1,200

.00

Food

2a)

2b)

4 Divide line 2 by line 3 . Fill

75

in decimal amount . . . . . . . . . . . . . . . . . . . . 4

x .

600

.00

-0-

.00

Utilities

3a)

3b)

$ 3,600

.00

5 Multiply line 1 by line 4 . . . . . . . . . . . . . . . . . 5

200

.00

-0-

.00

Other

4a)

4b)

6 Value of food and services provided by

$ 8,000

.00

$ 6,000

.00

Total

5a)

5b)

$ 300

.00

landlord (line 4 above) . . . . . . . . . . . . . . . . . 6

7 Subtract line 6 from line 5 . This is your allowable

rent . Fill in here and on line 14a or 14c of

$ 3,300

.00

Schedule H (line 9a or 9c of Schedule H-EZ) 7

Return to Form

1

1 2

2 3

3