Reset Form

FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

8821A

Tax Information Authorization

(REV. 10/05)

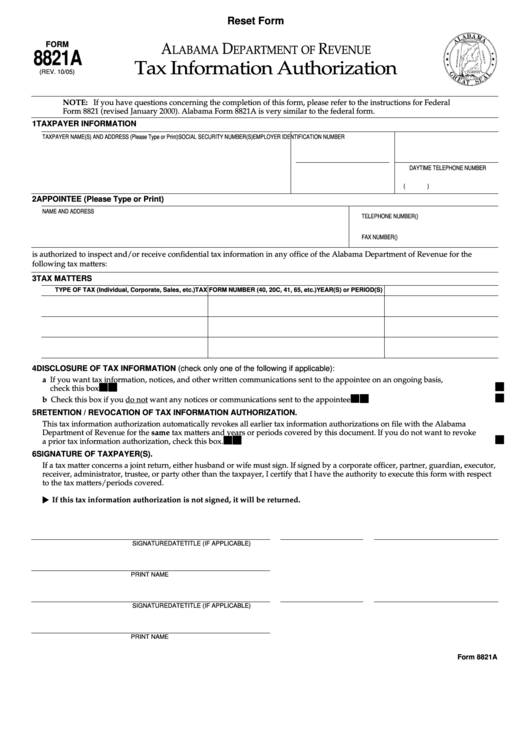

NOTE: If you have questions concerning the completion of this form, please refer to the instructions for Federal

Form 8821 (revised January 2000). Alabama Form 8821A is very similar to the federal form.

1 TAXPAYER INFORMATION

TAXPAYER NAME(S) AND ADDRESS (Please Type or Print)

SOCIAL SECURITY NUMBER(S)

EMPLOYER IDENTIFICATION NUMBER

DAYTIME TELEPHONE NUMBER

(

)

2 APPOINTEE (Please Type or Print)

NAME AND ADDRESS

TELEPHONE NUMBER

(

)

FAX NUMBER

(

)

is authorized to inspect and/or receive confidential tax information in any office of the Alabama Department of Revenue for the

following tax matters:

3 TAX MATTERS

TYPE OF TAX (Individual, Corporate, Sales, etc.)

TAX FORM NUMBER (40, 20C, 41, 65, etc.)

YEAR(S) or PERIOD(S)

4 DISCLOSURE OF TAX INFORMATION (check only one of the following if applicable):

a If you want tax information, notices, and other written communications sent to the appointee on an ongoing basis,

check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Check this box if you do not want any notices or communications sent to the appointee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 RETENTION / REVOCATION OF TAX INFORMATION AUTHORIZATION.

This tax information authorization automatically revokes all earlier tax information authorizations on file with the Alabama

Department of Revenue for the same tax matters and years or periods covered by this document. If you do not want to revoke

a prior tax information authorization, check this box. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 SIGNATURE OF TAXPAYER(S).

If a tax matter concerns a joint return, either husband or wife must sign. If signed by a corporate officer, partner, guardian, executor,

receiver, administrator, trustee, or party other than the taxpayer, I certify that I have the authority to execute this form with respect

to the tax matters/periods covered.

If this tax information authorization is not signed, it will be returned.

SIGNATURE

DATE

TITLE (IF APPLICABLE)

PRINT NAME

SIGNATURE

DATE

TITLE (IF APPLICABLE)

PRINT NAME

Form 8821A

1

1