RESET

PRINT

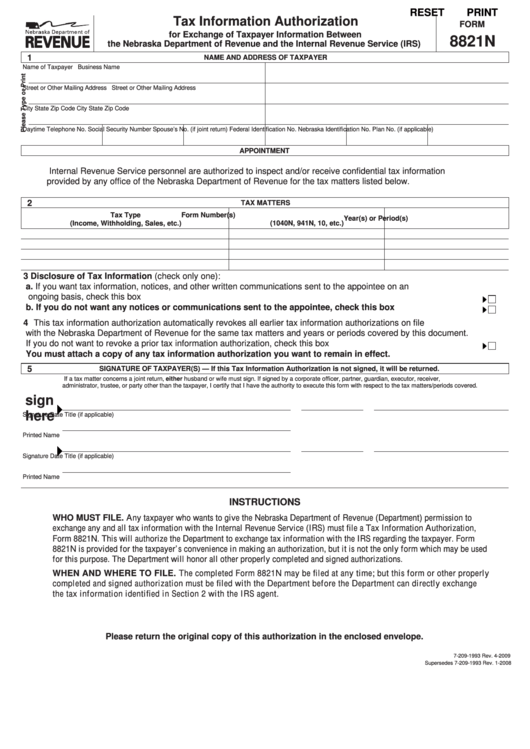

Tax Information Authorization

FORM

for Exchange of Taxpayer Information Between

8821N

the Nebraska Department of Revenue and the Internal Revenue Service (IRS)

1

NAME AND ADDRESS OF TAXPAYER

Name of Taxpayer

Business Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Daytime Telephone No.

Social Security Number

Spouse’s No. (if joint return)

Federal Identification No.

Nebraska Identification No.

Plan No. (if applicable)

APPOINTMENT

Internal Revenue Service personnel are authorized to inspect and/or receive confidential tax information

provided by any office of the Nebraska Department of Revenue for the tax matters listed below.

2

TAX MATTERS

Tax Type

Form Number(s)

Year(s) or Period(s)

(Income, Withholding, Sales, etc.)

(1040N, 941N, 10, etc.)

3 Disclosure of Tax Information (check only one):

a.

If you want tax information, notices, and other written communications sent to the appointee on an

ongoing basis, check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b.

If you do not want any notices or communications sent to the appointee, check this box . . . . . . . . . . . . . .

4 This tax information authorization automatically revokes all earlier tax information authorizations on file

with the Nebraska Department of Revenue for the same tax matters and years or periods covered by this document.

If you do not want to revoke a prior tax information authorization, check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

You must attach a copy of any tax information authorization you want to remain in effect.

5

SIGNATURE OF TAXPAYER(S) — If this Tax Information Authorization is not signed, it will be returned.

If a tax matter concerns a joint return, either husband or wife must sign. If signed by a corporate officer, partner, guardian, executor, receiver,

administrator, trustee, or party other than the taxpayer, I certify that I have the authority to execute this form with respect to the tax matters/periods covered.

sign

here

Signature

Date

Title (if applicable)

Printed Name

Signature

Date

Title (if applicable)

Printed Name

INSTRUCTIONS

WHO MUST FILE. Any taxpayer who wants to give the Nebraska Department of Revenue (Department) permission to

exchange any and all tax information with the Internal Revenue Service (IRS) must file a Tax Information Authorization,

Form 8821N. This will authorize the Department to exchange tax information with the IRS regarding the taxpayer. Form

8821N is provided for the taxpayer’s convenience in making an authorization, but it is not the only form which may be used

for this purpose. The Department will honor all other properly completed and signed authorizations.

WHEN AND WHERE TO FILE. The completed Form 8821N may be filed at any time; but this form or other properly

completed and signed authorization must be filed with the Department before the Department can directly exchange

the tax information identified in Section 2 with the IRS agent.

Please return the original copy of this authorization in the enclosed envelope.

7-209-1993 Rev. 4-2009

Supersedes 7-209-1993 Rev. 1-2008

1

1 2

2