Virginia Schedule Cr Instructions - For Use With Forms 760, 760py, 763 And 765 General Information - 2012

ADVERTISEMENT

To obtain forms, call 804-440-2541;

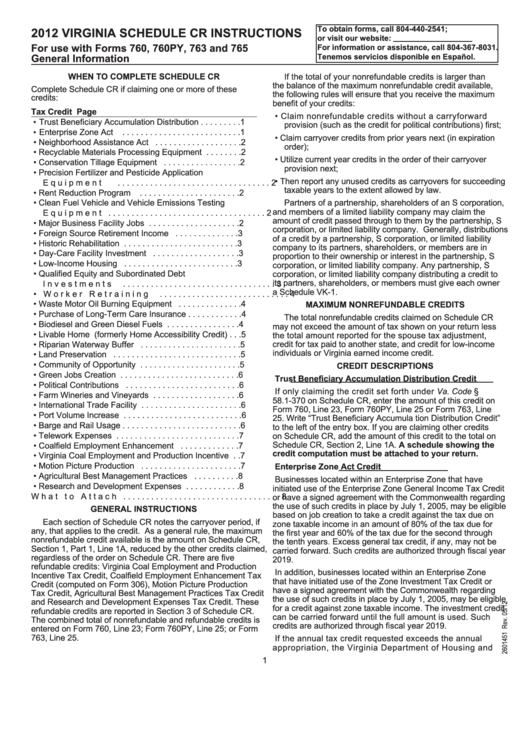

2012 VIRGINIA SCHEDULE CR INSTRUCTIONS

or visit our website:

For use with Forms 760, 760PY, 763 and 765

For information or assistance, call 804-367-8031.

General Information

Tenemos servicios disponible en Español.

WHEN TO COMPLETE SCHEDULE CR

If the total of your nonrefundable credits is larger than

the balance of the maximum nonrefundable credit available,

Complete Schedule CR if claiming one or more of these

the following rules will ensure that you receive the maximum

credits:

benefit of your credits:

Tax Credit

Page

• Claim nonrefundable credits without a carryforward

• Trust Beneficiary Accumulation Distribution . . . . . . . . . 1

provision (such as the credit for political contributions) first;

• Enterprise Zone Act

. . . . . . . . . . . . . . . . . . . . . . . . . . 1

• Claim carryover credits from prior years next (in expiration

• Neighborhood Assistance Act . . . . . . . . . . . . . . . . . . . 2

order);

• Recyclable Materials Processing Equipment . . . . . . . . 2

• Utilize current year credits in the order of their carryover

• Conservation Tillage Equipment . . . . . . . . . . . . . . . . . 2

provision next;

• Precision Fertilizer and Pesticide Application

• Then report any unused credits as carryovers for succeeding

Equipment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

taxable years to the extent allowed by law .

• Rent Reduction Program

. . . . . . . . . . . . . . . . . . . . . . 2

• Clean Fuel Vehicle and Vehicle Emissions Testing

Partners of a partnership, shareholders of an S corporation,

and members of a limited liability company may claim the

Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

amount of credit passed through to them by the partnership, S

• Major Business Facility Jobs . . . . . . . . . . . . . . . . . . . . 2

corporation, or limited liability company . Generally, distributions

• Foreign Source Retirement Income . . . . . . . . . . . . . . 3

of a credit by a partnership, S corporation, or limited liability

• Historic Rehabilitation . . . . . . . . . . . . . . . . . . . . . . . . . 3

company to its partners, shareholders, or members are in

• Day-Care Facility Investment . . . . . . . . . . . . . . . . . . . 3

proportion to their ownership or interest in the partnership, S

• Low-Income Housing . . . . . . . . . . . . . . . . . . . . . . . . . 3

corporation, or limited liability company . Any partnership, S

• Qualified Equity and Subordinated Debt

corporation, or limited liability company distributing a credit to

its partners, shareholders, or members must give each owner

Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

a Schedule VK-1 .

• Worker Retraining . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

• Waste Motor Oil Burning Equipment . . . . . . . . . . . . . . 4

MAXIMUM NONREFUNDABLE CREDITS

• Purchase of Long-Term Care Insurance . . . . . . . . . . . . 4

The total nonrefundable credits claimed on Schedule CR

• Biodiesel and Green Diesel Fuels . . . . . . . . . . . . . . . . 4

may not exceed the amount of tax shown on your return less

• Livable Home (formerly Home Accessibility Credit) . . . 5

the total amount reported for the spouse tax adjustment,

• Riparian Waterway Buffer . . . . . . . . . . . . . . . . . . . . . . 5

credit for tax paid to another state, and credit for low-income

individuals or Virginia earned income credit .

• Land Preservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

• Community of Opportunity . . . . . . . . . . . . . . . . . . . . . . 5

CREDIT DESCRIPTIONS

• Green Jobs Creation . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Trust Beneficiary Accumulation Distribution Credit

• Political Contributions . . . . . . . . . . . . . . . . . . . . . . . . . 6

If only claiming the credit set forth under Va. Code §

• Farm Wineries and Vineyards . . . . . . . . . . . . . . . . . . . 6

58 .1-370 on Schedule CR, enter the amount of this credit on

• International Trade Facility . . . . . . . . . . . . . . . . . . . . . . 6

Form 760, Line 23, Form 760PY, Line 25 or Form 763, Line

• Port Volume Increase . . . . . . . . . . . . . . . . . . . . . . . . . . 6

25 . Write “Trust Beneficiary Accumula tion Distribution Credit”

• Barge and Rail Usage . . . . . . . . . . . . . . . . . . . . . . . . . . 6

to the left of the entry box . If you are claiming other credits

• Telework Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

on Schedule CR, add the amount of this credit to the total on

Schedule CR, Section 2, Line 1A . A schedule showing the

• Coalfield Employment Enhancement . . . . . . . . . . . . . 7

credit computation must be attached to your return.

• Virginia Coal Employment and Production Incentive . . 7

• Motion Picture Production . . . . . . . . . . . . . . . . . . . . . . 7

Enterprise Zone Act Credit

• Agricultural Best Management Practices . . . . . . . . . . 8

Businesses located within an Enterprise Zone that have

• Research and Development Expenses . . . . . . . . . . . . 8

initiated use of the Enterprise Zone General Income Tax Credit

What to Attach . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

or have a signed agreement with the Commonwealth regarding

the use of such credits in place by July 1, 2005, may be eligible

GENERAL INSTRUCTIONS

based on job creation to take a credit against the tax due on

Each section of Schedule CR notes the carryover period, if

zone taxable income in an amount of 80% of the tax due for

any, that applies to the credit . As a general rule, the maximum

the first year and 60% of the tax due for the second through

nonrefundable credit available is the amount on Schedule CR,

the tenth years . Excess general tax credit, if any, may not be

Section 1, Part 1, Line 1A, reduced by the other credits claimed,

carried forward . Such credits are authorized through fiscal year

regardless of the order on Schedule CR . There are five

2019 .

refundable credits: Virginia Coal Employment and Production

In addition, businesses located within an Enterprise Zone

Incentive Tax Credit, Coalfield Employment Enhancement Tax

that have initiated use of the Zone Investment Tax Credit or

Credit (computed on Form 306), Motion Picture Production

have a signed agreement with the Commonwealth regarding

Tax Credit, Agricultural Best Management Practices Tax Credit

the use of such credits in place by July 1, 2005, may be eligible

and Research and Development Expenses Tax Credit . These

for a credit against zone taxable income . The investment credit

refundable credits are reported in Section 3 of Schedule CR .

can be carried forward until the full amount is used . Such

The combined total of nonrefundable and refundable credits is

credits are authorized through fiscal year 2019 .

entered on Form 760, Line 23; Form 760PY, Line 25; or Form

763, Line 25 .

If the annual tax credit requested exceeds the annual

appropriation, the Virginia Department of Housing and

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8