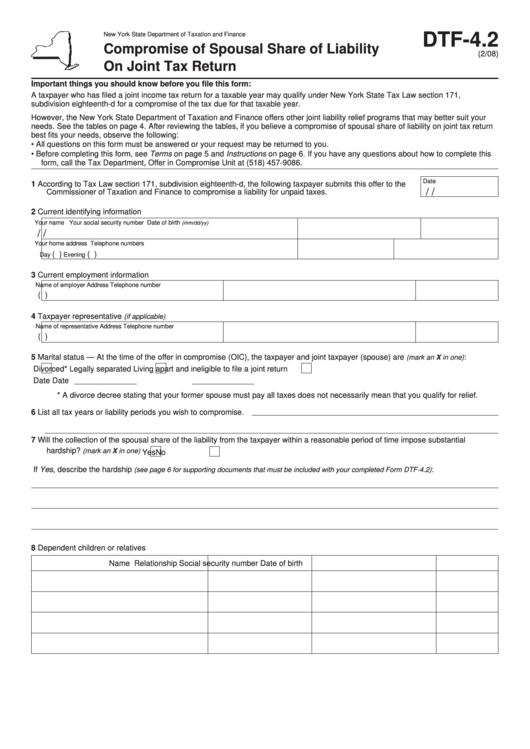

Form Dtf-4.2 - Compromise Of Spousal Share Of Liability On Joint Tax Return

ADVERTISEMENT

New York State Department of Taxation and Finance

DTF-4.2

Compromise of Spousal Share of Liability

(2/08)

On Joint Tax Return

Important things you should know before you file this form:

A taxpayer who has filed a joint income tax return for a taxable year may qualify under New York State Tax Law section 171,

subdivision eighteenth-d for a compromise of the tax due for that taxable year.

However, the New York State Department of Taxation and Finance offers other joint liability relief programs that may better suit your

needs. See the tables on page 4. After reviewing the tables, if you believe a compromise of spousal share of liability on joint tax return

best fits your needs, observe the following:

• All questions on this form must be answered or your request may be returned to you.

• Before completing this form, see Terms on page 5 and Instructions on page 6. If you have any questions about how to complete this

form, call the Tax Department, Offer in Compromise Unit at (518) 457-9086.

Date

1

According to Tax Law section 171, subdivision eighteenth-d, the following taxpayer submits this offer to the

/

/

Commissioner of Taxation and Finance to compromise a liability for unpaid taxes.

2

Current identifying information

Your name

Your social security number

Date of birth

(mm/dd/yy)

/

/

Your home address

Telephone numbers

(

)

(

)

Day

Evening

3

Current employment information

Name of employer

Address

Telephone number

(

)

4

Taxpayer representative

(if applicable)

Name of representative

Address

Telephone number

(

)

5

Marital status — At the time of the offer in compromise (OIC), the taxpayer and joint taxpayer (spouse) are

:

(mark an X in one)

Divorced*

Legally separated

Living apart and ineligible to file a joint return

Date

Date

* A divorce decree stating that your former spouse must pay all taxes does not necessarily mean that you qualify for relief.

6

List all tax years or liability periods you wish to compromise.

7

Will the collection of the spousal share of the liability from the taxpayer within a reasonable period of time impose substantial

hardship?

(mark an X in one)

Yes

No

If Yes, describe the hardship

:

(see page 6 for supporting documents that must be included with your completed Form DTF-4.2)

8

Dependent children or relatives

Name

Relationship

Social security number

Date of birth

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6