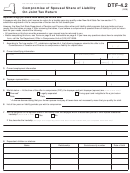

Form Dtf-4.2 - Compromise Of Spousal Share Of Liability On Joint Tax Return Page 4

ADVERTISEMENT

Page 4 of 6 DTF-4.2 (2/08)

For tax years 1999 and after: Types of relief from joint liability available under Tax Law section 654

Factors

Rules for innocent spouse relief

Rules for separation of liability

Rules for equitable relief

Type of liability

You must have filed a joint return that

You must have filed a joint return that

You must have filed a joint return that

has an understatement of tax due to

has an understatement of tax due,

has either an understatement or an

an erroneous item of your spouse.

at least in part, to an item of your

underpayment of tax.

spouse.

Marital Status

May be considered in determining

You must be no longer married (or

May be considered in determining

whether to grant relief.

your spouse is deceased), legally

whether to grant relief.

separated, or have not lived with your

spouse in the same residence for an

entire year before you file for relief.

Knowledge

You must establish that at the

If the Tax Department establishes

May be considered as a factor for

time you signed the joint return

that you actually knew of the item

relief.

you did not know, and had no

giving rise to the understatement,

reason to know, that there was an

then you are not entitled to relief to

understatement of tax or the extent

the extent of the actual knowledge.

of the understatement.

Other qualifications

None.

None.

You do not qualify for innocent

spouse relief or separation of liability.

Unfairness

It must be unfair to hold you liable

Not considered as a factor for relief.

It must be unfair to hold you liable for

for the understatement of tax

the underpayment or understatement

taking into account all the facts and

of tax taking into account all the facts

circumstances.

and circumstances.

Refunds

Your request can generate a refund.

Your request cannot generate a

Your request can generate a refund

refund.

under certain circumstances.

To apply

File Form IT-285 with supporting documentation.

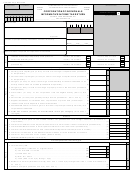

For tax years prior to 1999: Rules for innocent spouse relief under former Tax Law section 651(b)(5)

Type of liability

You must have filed a joint return that has a substantial understatement of tax (an amount over $100) due to a

grossly erroneous item of your spouse. Relief under section 651(b)(5) is not available for tax years beginning on

or after January 1, 1999.

Marital status

Not considered as a factor for relief.

Knowledge

You must establish that at the time you signed the joint return you did not know, and had no reason to know, that

there was a substantial understatement of tax.

Other qualifications

If a substantial understatement is attributable to a New York deduction, exemption, credit, or property basis

for which there is no basis in fact or law, the tax liability must exceed a specified percentage of the innocent

spouse’s New York adjusted gross income for the most recent taxable year ending before the date the deficiency

is mailed. This requirement shall not apply to a substantial understatement attributable to an omission from

New York adjusted gross income.

Unfairness

It must be unfair to hold you liable for the substantial understatement of tax taking into account all the facts and

circumstances

Refunds

Your request can generate a refund.

To apply

File a statement with supporting documentation.

For detailed information, see NYS Publication 89, Innocent Spouse Relief (And Separation of Liability and Equitable Relief), (at ).

For specific details of the offer process, see NYS Publication 220, Offer in Compromise Program.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6