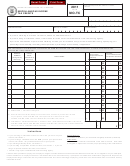

2011 Form 562 - Page 2

Film or Music Project Credit

68 Oklahoma Statutes (OS) Sec. 2357.101

Tax Credit Moratorium

No credit may be claimed for reinvestments occurring during the period of July 1, 2010 through June 30, 2012, for which

the credit would otherwise be allowable. This credit may be claimed for tax year 2012 and subsequent tax years, for rein-

vestments on or after July 1, 2012, of the profit from the investment in an existing Oklahoma film or music project with a

production company for a new Oklahoma film or music project.

Instructions

Prepare a separate Form 562, for each investment in an Oklahoma film or music project, in the tax year in which the profit

is reinvested.

Part One:

Enter information for your investment in an existing Oklahoma film or music project. The investment must have been with

a production company and used to pay for production costs.

Line 1: Enter the date on which you made the investment in an existing Oklahoma film or music project.

Line 2: Enter the name of the Production Company with which the investment was made.

Line 3: Enter the Federal Identification Number of the production company with which the investment was made.

Line 4: Enter the date production of the existing Oklahoma film or music project began.

Line 5: Enter the name and description of the existing Oklahoma film or music project in which you invested with the

production company listed on line 2.

Line 6: Enter the amount of your investment.

Line 7: Enter the profit you received from the project listed on line 5. “Profit” means the amount made by the taxpayer to

be determined as follows:

a) the gross revenues less gross expenses, including direct production, distribution and marketing costs and an

allocation of indirect overhead costs, of the film or music project shall be multiplied by,

b) a ratio, the numerator of which is Oklahoma production costs and the denominator of which is total production

costs which shall be multiplied by,

c) the percent of the taxpayer’s taxable income allocated to Oklahoma in a taxable year, and

d) subtract from the result of the formula calculated from steps a through c of this paragraph the profit made by a

taxpayer from investment in an existing Oklahoma film or music project in previous taxable years. Profit shall

include either a net profit or net loss.

Part Two:

Enter information for your reinvestment of the profits, as shown on Part One, line 7. The reinvestment must be in a new

Oklahoma film or music project with the same production company as listed in Part One, line 2. The investment must be

used to pay for production costs.

Line 1: Enter the date when your profit was reinvested into a new Oklahoma film or music project. The date must be

during this tax year.

Line 2: Enter the name and description of the new Oklahoma film or music project in which you invested your profit.

Line 3: Enter only the portion of your profit you have reinvested in the new Oklahoma film or music project with the

production company listed in Part One, line 2.

Part Three:

The credit is 25% of the profit which has been reinvested on or after July 1, 2012, to pay for the production costs of a new

Oklahoma film or music project.

1

1 2

2 3

3