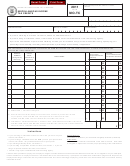

2011 Form 562 - Page 3

Film or Music Project Credit

68 OS Sec. 2357.101

Definitions

“Existing Oklahoma film or music project” means a film or music project produced after July 1, 2005.

“Investment” means costs associated with the original production company. Film or music projects acquired from an

original production company do not qualify as investment.

“Film” means a professional single media, multimedia program or feature, including, but not limited to, national advertising

messages that are broadcast on a national affiliate or cable network, fixed on film or digital video, which can be viewed or

reproduced and which is exhibited in theaters, licensed for exhibition by individual television stations, groups of stations,

networks, cable television stations or other means or licensed for home viewing markets. The term does not include child

pornography as defined in 21 OS Sec. 1024.1(A) or obscene material as defined in 21 OS Sec. 1024.1(B)(1).

“Music project” means a professional recording released on a national or international level, whether via traditional

manufacturing or distributing or electronic distribution, using technology currently in use or future technology including, but

not limited to, music CDs, radio commercials, jingles, cues, or electronic device recordings.

“Production company” means a person who produces a film or music project for exhibition in theaters, on television or

elsewhere.

“Oklahoma production cost” means that portion of total production costs which are incurred with any qualified vendor.

“Total production cost” includes, but is not limited to:

•

wages or salaries of persons who have earned income from working on a film or music project in this state,

including payments to personal services corporations with respect to the services of qualified performing artists,

as determined under Section 62(a) of the Internal Revenue Code,

•

the cost of construction and operations, wardrobe, accessories and related services,

•

the cost of photography, sound synchronization, lighting and related services,

•

the cost of editing and related services,

•

rental of facilities and equipment, and

•

other direct costs of producing a film or music project.

“Qualified vendor” means an Oklahoma entity which provides goods or services to a production company and for which:

•

fifty percent (50%) or more of its employees are Oklahoma residents, and

•

fifty percent (50%) or more of gross wages, as reported on Internal Revenue Service Form W-2 or Form 1099, are

paid to Oklahoma residents.

For purposes of this “Qualified vendor” definition, an employee shall include a self-employed individual reporting income

from a qualified vendor on Federal Form 1040.

Notice

Effective July 1, 2011.

Tax credits transferred or allocated must be reported on Oklahoma Tax Commission Form 569. Failure to file Form 569

will result in the affected credits being denied by the Oklahoma Tax Commission pursuant to 68 OS Sec. 2357.1A-2.

1

1 2

2 3

3